Iron ore prices lift across the board

Mining

Iron ore spot markets rose across the board on Wednesday, led once again by gains in mid and lower grades.

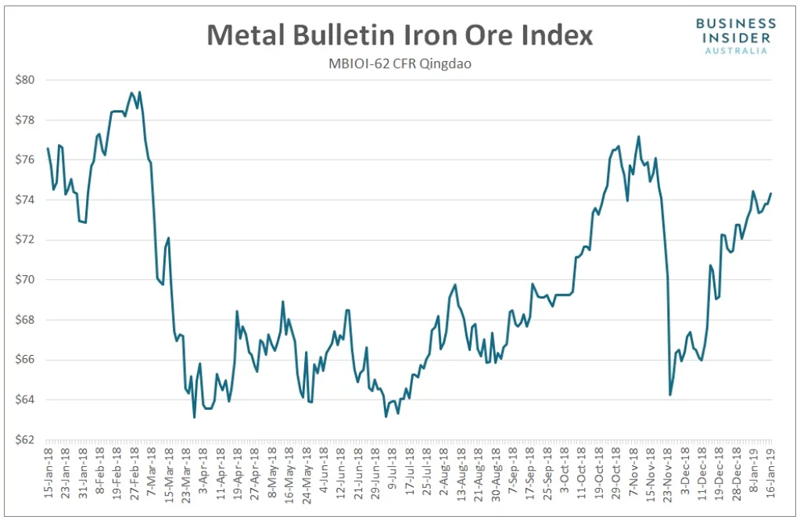

According to Metal Bulletin, the price for benchmark 62% fines rose 0.7% to $74.31 a tonne, leaving it just shy of a two-month high.

From the recent cyclical low of $64.25 a tonne struck on November 26, the benchmark has now rallied 15.7%.

The price for 58% fines also firmed during the session, adding 0.3% to settle at $49.74 a tonne, extending its rally from late November to 25.2%.

As has been the case for several weeks, 65% fines was the relative underachiever, lifting by 0.1% to $88.10 a tonne.

With the price for mid-tier grades rising faster than for high-grade ore, the price premium demanded for 65% fines over the benchmark fell to the lowest level in a year.

“Although the iron ore spot price is still high, China’s steel prices and mill margins have come down. Lower margins are driving steelmakers to a mode of cost cutting, rather than maximising productivity,” said analysts at Morgan Stanley.

“This is evidenced by the narrowing of the high-grade iron ore differential, which has fallen to 18% from its peak of 45% in July 2018.

“We see scope for the low-grade discount to narrow further… since steel makers can achieve further cost savings by lowering the average Fe-grade of the iron ore used.”

Helping to explain the across-the-board gains on Wednesday, Helen Lau, an analyst at Argonaut Securities, told Reuters that both supply and demand factors were at play.

“China’s stimulus measures may boost steel production and that will support iron ore demand,” she said. “The supply disruption in Australia is adding some supply concern and that explains why the price went up.”

On Monday, Rio Tinto said it had declared force majeure on iron ore shipments to some customers following the fire at its Cape Lambert export terminal last week.

Sentiment may have also been helped by news that Chinese new home prices continued to lift in December, increasing by 0.8% following a 0.9% gain in November, according to data released by the China’s NBS. From a year earlier prices rose by 9.7%, the fastest growth since July 2017.

Chinese steel prices also edged higher, helping to underpin bulk commodity markets.

Like spot markets, futures trade has also been subdued this week with all Chinese steel and bulk commodity contracts continuing to hover just below multi-month highs.

Here’s how the scoreboard looked at the conclusion of Wednesday’s night session.

SHFE Hot Rolled Coil ¥3,449 , 0.73%

SHFE Rebar ¥3,557 , 0.88%

DCE Iron Ore ¥512.00 , -0.10%

DCE Coking Coal ¥1,225.50 , -0.45%

DCE Coke ¥2,032.50 , 0.57%

The limited movement suggests spot markets are likely to remain quiet on Thursday.

Trade in Chinese commodity futures will resume at midday AEDT.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.