It was a solid debut for drug manufacturer Nyrada (ASX:NYR) on the ASX today.

Nyrada raised $8.5m and opened its first session 52.5 per cent higher than its 20c IPO price, hitting an early peak of 30.5c. It closed at 23.5 cents – representing a 17.5 per cent gain.

Nyrada is a spin off of fellow drug developer Noxopharm (ASX:NOX). The company contains all the non-oncology (cancer fighting) assets Noxopharm formerly held.

However, it will apply the same technology as Noxopharm to its own assets. Both companies are working to develop novel small molecule drugs which pertain to underlying pathological processes in the diseases they target.

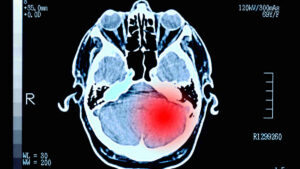

Nyrada has four drug development programs. Its two lead programs are addressing high cholesterol and brain injury.

The other two programs cover inflammation, specifically of peripheral nerves and the immune system.

While many small cap drug companies on the ASX are attempting to bring them to market, Nyrada said in its prospectus it sees its position as primarily for discovery and the early stages of drug development.

Chairman John Moore said later stage development and commercialisation were better left to larger firms.

“If necessary it [Nyrada] is prepared to take the drugs through the clinical development process to marketing approval, but all of the disease markets outlined above are large, making the task of bringing a drug through to market both expensive and lengthy,” he said in the prospectus.

“Nyrada therefore sees its opportunity in identifying and developing new drug opportunities and then passing these opportunities onto other companies with the large infrastructure required to take drug candidates through late-stage development and the regulatory approval process.”

Stockhead has contacted the company for further comment.

This story has been updated since initial publishing to take account of today’s closing price

You might be interested in