IPO Watch: Another explorer debuts with a heady 190% first day gain

IPO Watch

IPO Watch

Two explorers hit the bourse today.

Julimar nearology play Lycaon Resources (ASX:LYN) – which counts stock promoter Next Investors as a major shareholder — did very well out of the gate. It surged to a +200% gain from its IPO price of 20c per share, before settling at a still impressive ~190% by close of play.

Ardea spinout Kalgoorlie Gold Mining (ASX:KAL) did it rough, sinking to 17c from its IPO price of 20c per share.

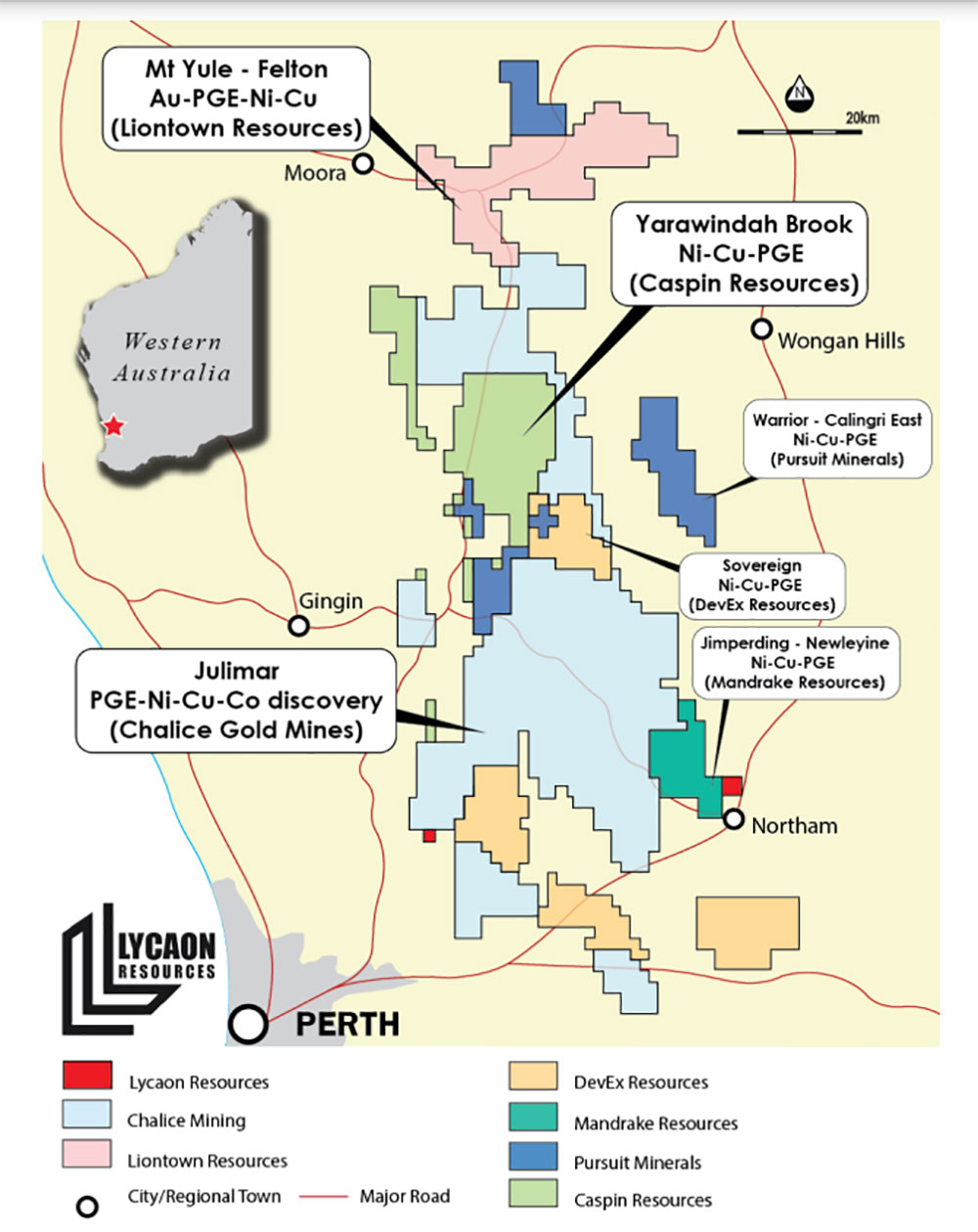

Lycaon holds the rights to acquire three WA exploration projects — ‘Gnewing Bore’ (gold-silver and copper), ‘Rocky Dam’ (gold and base metals) and ‘Julimar’ (nickel, copper, and PGEs).

Gnewing Bore is in the mineral-rich Kimberley region, where major miner IGO (ASX:IGO) continues to amass a large tenement exploration package.

The project is about 40km from Pantoro’s (ASX:PNR) high grade ‘Nicolsons’ mine which currently produces 50,000-55,000 ounces of gold per year.

It isn’t just about gold. The region also hosts Panoramic Resources (ASX:PAN) ‘Savannah’ nickel copper mine and VMS-style base metal deposits at Anglo Australian Resources (ASX:AAR) undeveloped ‘Koongie Park’.

Meanwhile, there’s been limited exploration date at Gnewing Bore, with most work focused on an outcrop which returned rock chip samples up to 5.10 g/t gold and 105g/t silver.

A couple of holes were punched into the target, returning best results of 8m at 0.52g/t gold from 12m.

New drilling of this prospect will be completed in conjunction to other targets identified from an upcoming geophysical, geochemical, and geological review.

Rocky Dam, 60km from Kalgoorlie, surrounds gold producer Northern Star’s (ASX:NST) recent ‘Kurnalpi’ project acquisition and active explorers Riversgold (ASX:RGL) and Black Cat Syndicate (ASX:BC8).

Exploration work to date at Rocky Dam has identified gold at the ‘CRA-North’ prospect, first discovered in the 1990s as a 700m long gold anomaly.

Historical drilling has returned encouraging results which suggests “a mineralised system is present at CRA-North”, LYN says.

Initial exploration will consist of RC and diamond drilling at CRA-North to delineate the strike extent of the oxide (shallow) mineralisation and to test for primary mineralisation at depth.

The postage stamp sized 15sqkm Julimar project tenements are 20km south (E70/5415) and 45km east (E70/5416) of Chalice’s (ASX:CHN) Julimar nickel copper PGE discovery:

Like most of the other projects in the region, LYN’s ground has not historically been explored for copper and nickel mineralisation, however geological mapping has highlighted numerous mafic-ultramafic intrusive bodies in the general area that may be associated with mineralisation.

Geophysical service provider New Resolution Geophysics will complete helicopter electromagnetic survey (HEM).

The company’s primary focus will be on the ‘Bulong Taurus’ project, just 35km east of the City of Kalgoorlie Boulder.

Historically, Ardea’s focus on the Bulong tenements was the high-grade laterite hosted nickel-cobalt mineralisation. There has been minimal gold exploration in recent decades.

And yet the full 18km strike length of the ‘Goddard Fault’ within KAL’s tenure has historic gold shafts, current alluvial gold workings and historic non-JORC compliant mineral resource estimates at the ‘Central and ‘Great Ophir’ prospects.

Historic exploration throughout the area identified significant results, most of which have not been adequately followed up (if at all).

At the Great Ophir mine, 1990s exploration highlighted shallow high-grade intercepts that have not been followed up and are open in all directions, like 5m at 52.1g/t Au from 15m.

Extensive RC and some diamond drilling at Central in the 1990s defined a shallow (non JORC) resource which is being re-evaluated by the company. Best intercepts were 10m at 39.13g/t Au from 128m.

90s drilling at the Trafalgar and Turnpike prospects have likewise identified shallow gold mineralisation that has not been followed up.

The company considers Bulong Taurus to have good development potential, either with a standalone mill or custom milling at one of the multiple local plants centred on Kalgoorlie.

KAL’s plan on listing is to complete a resource drill-out, confirm viable gold extraction through bench-scale metallurgy, prove up a JORC code-compliant resource estimate and complete environmental studies in order to assess development options at Bulong Taurus.