Wellard swaps cute calves for big ships but slashes half year loss

Health & Biotech

Live cattle exporter Wellard has once again posted a loss, but investors can take comfort that it’s not quite as big as the last one.

Wellard’s (ASX:WLD) half-year loss shrank by 58 per cent to $7.5 million — a good turnaround from the $17.9 million loss they posted this time last year.

However, the company had fewer cattle to shift and was leasing its ships to other companies in the Mediterranean and South America so revenue was also cut almost in half.

When compared to the first six months of fiscal 2017, revenue was down 41 per cent to $164 million.

The revenue earned from chartering out the company’s ships wasn’t enough to bridge the gap, with chartering earnings up only 9.9 per cent on the same period last year.

The number of cattle shipped fell 46 per cent.

Wellard also said that these financial results actually caused it to breach debt covenants.

It had to categorise $123.2 million in loans as current liabilities.

The company did say however that debt had fallen by 14 per cent, partly thanks to selling one of its ships.

“We improved our gross margin by 167.2 per cent to 15.5 per cent and reduced our operational expenses by 31.3 per cent which improved our operating cashflow and helped to reduce our debt,” said Wellard director of operations Fred Troncone.

“Our costs out program delivered savings of $7.9 million in the first half of the year and we are expecting to exceed our full year target of $10 million in annual overhead savings.”

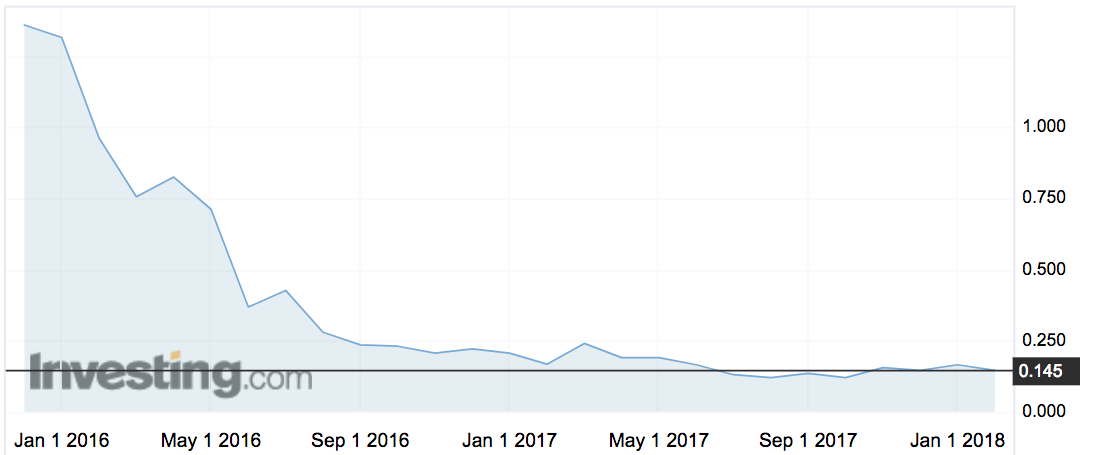

The $77 million company has been recovering slowly since the middle of 2017, but still has a way to go to recover from a fall that happened straight after listing in last 2015.

More demand for fresh meat

Wellard said it’s seeing demand for live cattle grow in the Mediterranean, noting Turkey as a key customer and South America.

Enquiries for live sheep from the Middle East are growing.

But Australian cattle prices are weighing, while opening new markets.

“The company notes that live export from Australia continues to be challenging, however, the price of heavy cattle is trending downward,” Wellard said.

“The eastern young cattle indicator for January 2018 is approximately 15 per cent lower than the corresponding period in 2017.

This improvement has opened opportunities for small shipments of heavy cattle to China, which the company expects will gradually increase as quarantine and processing infrastructure in coastal China develops, and assuming that Australian livestock prices remain attractive.”

Wellard launched live exports to China in November, a deal that was delayed by a year.