You might be interested in

Health & Biotech

VIP Gloves capitalises on soaring demand for PPE equipment

Health & Biotech

VIP Gloves ramping up to meet demand in a booming global market

Health & Biotech

Health & Biotech

Special Report: Strong conditions in Malaysia have seen share prices for leading glove manufacturers climb to record highs.

As the COVID-19 pandemic extends into August, companies globally are positioning to capitalise on a long-term shift in demand for hygiene products.

Protective glove manufacturer VIP Gloves (ASX:VIP) is one example, and increased investor interest has seen its share price rise from 3.5 cents to 10.5 cents in July – a gain of 200 per cent.

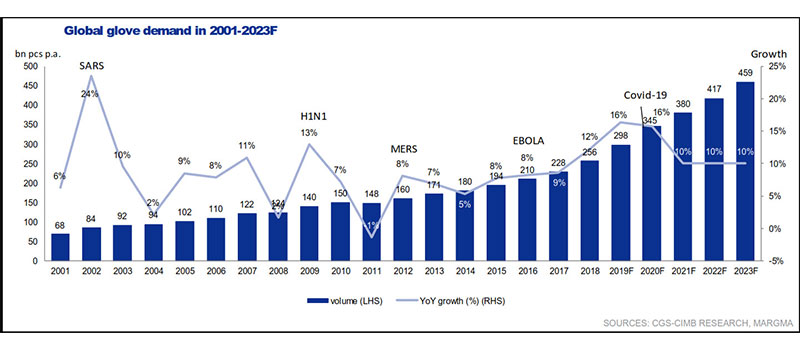

One of the catalysts for VIP’s move has been the surge in global demand for nitrile disposable gloves – widely viewed as a step up from traditional latex gloves with improved longevity and less skin irritation, though the demand for gloves has been increasing even before COVID-19, as seen in the below graph:

Malaysia has established itself as the global manufacturing hub for the sector, and VIP Gloves’ existing operations there have given it a leg up on the competition.

The company is now racing to expand capacity and its existing facilities, as it ramps up production from around 480 million pieces of gloves to a year-end target of 840 million and 1 billion by 1st half 2021

The gains in VIP Gloves can be put into context when measured against other Malaysia-based companies in the space that have benefited from the broader tailwind.

As a case in point, Kuala Lumpur-based company Top Glove Corp — which is listed on the Bursa Malaysia (previously the KL Stock Exchange) — has posted a gain of more than 400 per cent year-to-date.

The increase means Top Glove, which has current production capacity of 78 billion pieces, is now the second largest listed company in Malaysia by market capitalisation, with a market cap of $RM70bn (~$23bn).

As a measure of investor confidence in the space, that valuation now places the company between two listed Malaysian banks – Malayan Banking and Public Bank Corp.

The broader industry sentiment highlights the opportunity for a nimble competitor such as VIP, which currently has a market cap of $61.9m and isn’t facing any capital constraints given it already has production facilities established with further room to easily expand at current site.

With a sales pipeline encompassing a broad range of jurisdictions across Europe, South-East Asia and the US market, VIP is looking to further entrench its competitive advantage from the global tailwinds for hygiene products created by the pandemic.

This story was developed in collaboration with VIP Gloves, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.