Sigma Healthcare shares slide 40pc after Chemist Warehouse break-up

Health & Biotech

Health & Biotech

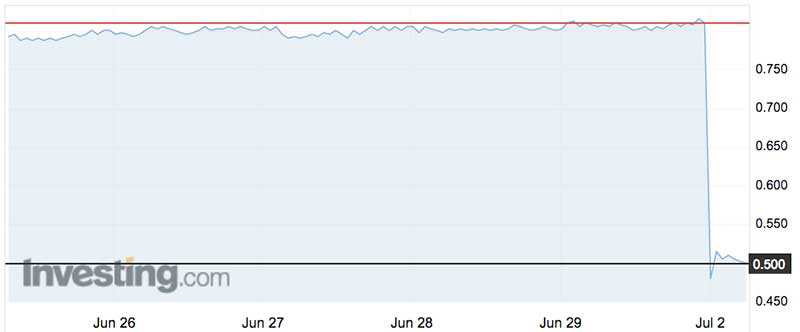

Shares in Sigma Healthcare slid 40 per cent this morning as the company confirmed its My Chemist and Chemist Warehouse contracts would not be extended after negotiations broke down.

Sigma chief executive Mark Hooper told investors the company had previously signposted that it would only continue with the agreements if they “provided an adequate return on invested capital”, which ended up not being the case.

The company will continue its existing agreement to supply My Chemist and Chemist Warehouse until June 30 2019, but after that point will cut ties.

The share price was battered on the news, hitting an intraday low of 44c by 11.30am AEST — a loss of more than 40 per cent and its lowest point in about seven years.

It was one of the most actively-traded stocks on the market for the morning, with 25 million shares worth $12.5 million changing hands by 11.45am.

At 11.45am AEST shares were trading at 50.7c.

Sigma also lowered guidance for the 2018 financial year to earnings before interest and tax of $75 million, down from previous predictions of around $90 million.

The company cited “softer market conditions”, with Mr Hoopper observing May and June had been “particularly weak” and that June PBS adjustments had hit the pharmacy distributor more than anticipated.

Sigma says it will have $300 million cash freed up at the conclusion of the My Chemist and Chemist Warehouse contracts.