No sour grapes as Murray River Group CEO heads for the exit

Food & Agriculture

Embattled dried fruit grower Murray River Group has lost its chief George Haggar after fewer than five months.

Mr Haggar was brought in on November 9 to turn the company around. That same day Murray River wrote down its inventory by $4.3 million.

Unfortunately the hits continued as the company was forced to issue a profit warning and report a $22.2 million half year loss, all against the backdrop of a major boardroom falling out among the then-directors and the two founders, who were also major shareholders.

In January, Jamie Nemtsas and Erling Sorenson regained control of the company (ASX:MRG) they were ousted from last year, and promptly began selling down their shares.

Mr Haggar will leave the company at the end of this financial year.

“Both parties have taken time since coming together following the outcome of the extraordinary general meeting vote in late January to get to know each other and assess the overall compatibility in leadership and autonomy,” the company said.

“[They] have independently come to the same conclusion that the company is best served by a change of leadership.”

Mr Haggar said his talks with the board were “open, transparent and with the company’s ultimate best interests in mind”.

He said the turnaround strategy was working, with sales gaining momentum and positive initial forecasts for the 2018 dried grape harvest.

Murray River Group’s new chairman Andrew Monk said he was confident the outgoing CEO would “continue to apply himself over the next few months with the same passion, determination and commitment that we have seen from him to date.

“The Board recognises the work George has put towards building and developing a capable team of people, strategically positioning the company to reap the benefits of a promising 2018 harvest,” he said.

The Jamel Family Trust, controlled by Mr Nemtsas’s wife Melanie, is no longer a substantial shareholder. It today further sold down its stake from 5.74 per cent to 4.96 per cent.

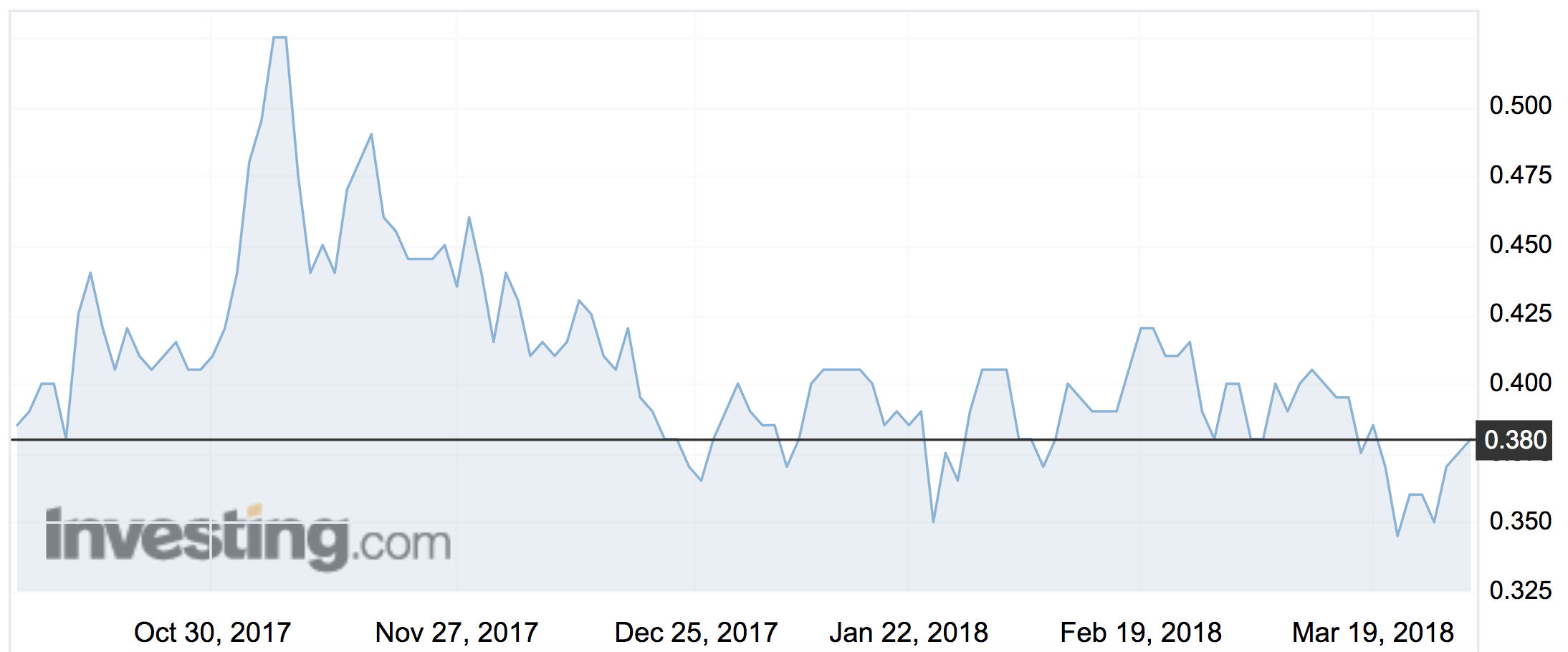

Murray River shares were flat on Tuesday morning at 38c. The company’s 52-week trading range is 26.9c to $1.15.

> Bookmark this link for small cap breaking news

> Discuss small cap news in our Facebook group

> Follow us on Facebook or Twitter

> Subscribe to our daily newsletter