Health: Here’s a gastric stent that could help you lose 10kg in a year, and sleep better

Health & Biotech

Health & Biotech

Positive results are positive.

Gastric device specialists GI Dynamics (ASX: GID) are a happy lot this morning, after the Association of British Clinical Diabetologists green-lit some very promising results from a one-year study of its EndoBarrier device.

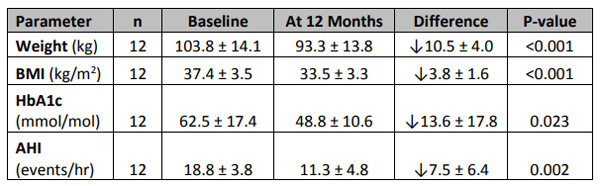

Those results, that showed a significant reduction in weight and body mass index, as well as reduction in obstructive sleep apnea events, were presented at the Diabetes UK Professional Conference 2019.

Of the 12 patients who received 12 months of EndoBarrier treatment, eight had type 2 diabetes and four had pre-diabetes. Result:

Ten kilos in 12 months. That’ll do.

You can probably start with the price of a plane ticket to somewhere that isn’t in the EU or USA, where EndoBarrier is limited to investigational use only.

The device itself is a kind of sleeve delivered via endoscopy, and implanted in the intestine, where is can regulate the body’s hormone delivery.

And operationally, GI Dynamics is still a vehicle used for research and investigation processes only. Widespread commercialisation of a product is still some ways down the track.

As mentioned above, the weight loss also seemed to have a positive effect on obstructive sleep apnea (OSA) events.

The 12 patients were also diagnosed with moderate OSA, which is around 15-29 events per hour, and currently being treated with continuous positive airway pressure (CPAP) – basically having to wear an oxygen mask to sleep.

After 12 months, 10 of those 12 patients could throw away their masks and toss and turn around like the rest of us.

Principal and chief investigator Robert Ryder, MD of Sandwell and West Birmingham Hospitals said the one-year results were “very encouraging.”

“EndoBarrier can provide great benefit to patients who are in need of an alternative treatment.

“Discontinuing the use of CPAP is not only beneficial for patients in terms of significant clinical and lifestyle benefits, but also is financially beneficial for health services.”

Ryder reckons EndoBarrier could fill “a large need for many patients”.

Those results sent the stock up 42 per cent in morning trade.

Remember when OncoSil (ASX: OSL) almost got wiped out four days ago? It shed up to 87 per cent of its share price (nearly $90 million) when its targeted isotope treatment for pancreatic tumours got the thumbs-down from the British Standards Institute (BSI).

The company has been seeking the all-important CE mark approval since 2015, and since the bad news on Monday, now wants to note it has had “constructive dialogue with senior BSI management”.

Now OncoSil “has a better understanding of the issues”, it’s looking forward to its next meeting with the BSI, which “will be held as soon as practicable”.

The other big bust of the week saw Cynata (ASX: CYP) trying to calm panicking shareholders after its Fujifilm deal got delayed for another six months.

It’s trying to get Fujifilm to exercise a licence option to its lead stem cell product, CYP-001, that aims to prevent and treat graft-versus-host disease. Stock crumbled from $1.77 to $1.18.

That sounds disastrous, but a note to clients from Shaw&Partners today has highlighted several reasons why it thinks Cynata’s now a Buy and has set a 12-month price target of $2.50.

Among the reasons, it includes: Fujifilm’s $US900m acquisition of a Danish biologics manufacturing site, which may have put the Cynata deal on the backburner; “indicated intentions” to accelerate development of Cynata’s MSCs; and an ad by Fujifilm in the February editon of Nature magazine that touted its progress in regenerative medicine and ambitions “based on Cynata’s Cymerus tech”.