You might be interested in

News

ASX Small Caps Lunch Wrap: Which old timey space adventurer is on its last legs this week?

News

ASX Large Caps: Coles takes lead as iron ore miners struggle; Bitcoin nears US$56k

News

Medtech play G Medical plans to list its Chinese business in Hong Kong, and the proposed valuation has investors buzzing.

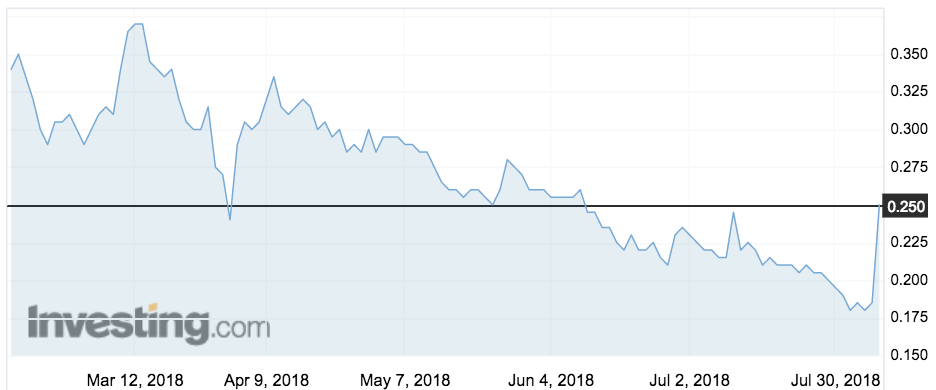

So much so, they pushed the share price up 48 per cent to an intraday high of 27.5c today. The stock was at 25c just after midday.

G Medical makes a medical phone case called Prizma that turns a smartphone into a clinical-grade mobile medical monitor to measure vital signs such as ECG, respiration, oxygen saturation, heart rate, temperature and stress analysis.

The company (ASX:GMV) is proposing to list its Guangzhou Yimei Innovative Medical Science and Technology Co at a valuation of $260 million, within nine months.

It will retain 50 per cent of the company’s stock. It now owns 70 per cent of the Chinese company.

Selling 20 per cent of the company at that valuation would reap $52 million.

The listing assuaged capital raising fears among investors, despite a warning from the company that there were no guarantees an Initial Public Offering would proceed.

Chief Dr Yacov Geva said the deal “delivers an important avenue through which to raise the capital required”.

G Medical financials

At the end of June, G Medical had $3.2 million in the kitty and $3.5 million available as debt, with plans to spend $5 million this quarter.

It took in just $356,000 in customer receipts during the quarter.

In May, Dr Geva stumped up a $3 million loan to keep the company ticking over.

G Medical signed several deals last year for its flagship ‘Prizma’ product.

But it ran into delays waiting on China Food and Drug Association (CFDA) approval which would allow it to start manufacturing the device in China.

It had expected that approval to come by the end of June.

A separate deal with in November with First Channel for India and Taiwan distribution requires the distributor to formalise its “Tier 1” partners.

G Medical has not provided an update on how this is progressing.

Stockhead is seeking comment from G Medical.