Biopharmaceutical company Dimerix (ASX:DXB) makes significant operational advances in the quarter with global support of regulators.

Biopharmaceutical company Dimerix (ASX:DXB) has closed out the June quarter with key support from global regulators, as it advances clinical trials to provide treatments globally for patients with serious and life-threatening diseases during the quarter.

The company today provided the market with its quarterly operational update, which highlighted the significant global progress made across its product development suite.

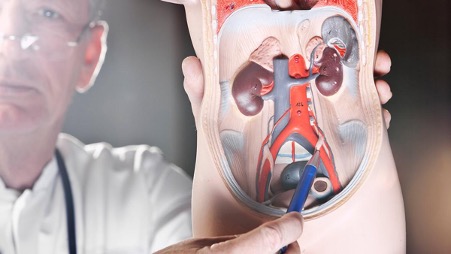

A significant highlight for the quarter was the support extended by the support by the US Food & Drug Administration (FDA), as Dimerix moves towards Phase 3 trials for the use of its patented CCR2-inhibitor DMX-200 drug in the treatment of serious kidney disease FSGS (focal segmental glomerulosclerosis).

The FDA confirmed that Dimerix’s Phase 3 study design (with interim analysis) is appropriate to support the potential for accelerated approval in the US market.

In a further show of support by global regulators, Dimerix received an Innovation Passport for the ILAP (Innovative Licensing and Access Pathway) program from UK regulatory body the MHRA. The decision to reward and ILAP is based on a review of clinical data, providing a pathway to accelerate the development of promising medicines.

The company also confirmed its Phase 3 FSGS study with the European Medicines Agency (EMA) in June.

DMX-200 eligible for accelerated US approval

As the world remains in the grip of the COVID-19 pandemic, Dimerix confirmed it remains eligible for accelerated approval in the US for its CCR2-inhibitator DMX-200 for the treatment of patients.

The company remains involved the CLARITY 2.0 study in India and the REMAP-CAP study in Europe, with Phase 3 trials underway into the effectiveness of DMX-200 when administered together with an angiotensin receptor blocker in COVID-19 positive cases. Multiple patients were recruited to the study in Europe in April.

R&D spend accelerates as overheads remain steady

Dimerix ended Q4 with cash of $5.3 million, with net operating cash outflows for the period of $3.2 million, which was in line with company expectations. Net operating cash inflows in the prior quarter were $1.4 million.

The increase in total operating cash outflow for the quarter is a result of increased clinical and manufacturing expenditure. Whilst increasing R&D spending was significant on the previous year, overheads remain steady, and the company finished the year under budget.

Looking ahead

Dimerix CEO Nina Webster highlighted the strong support of global regulators over the past quarter as a significant milestone for the company.

“Consistent advice on the design of our Phase 3 FSGS study from three different regulatory agencies, being US, Europe and UK, is very encouraging as it means that our single Phase 3 study is appropriate in multiple territories,” Webster told Stockhead.

She said support for the Phase 3 studies in COVID-19 patients remained a company priority.

“Even as vaccination rates increase, it is anticipated that a significant proportion of the population will still be susceptible to COVID-19 because they are resistant to the vaccine or choose not to be vaccinated,” she said.

“It is still a reasonable likelihood that many patients will get infected and will end up in hospital. And with both the UK and the Netherlands removing all restrictions, the REMAP-CAP team are already seeing case numbers and hospitalisations increase significantly.”

“New treatments are desperately needed so we can reduce their risk of getting very severe disease and reduce the impact of long-COVID,” Webster said.

Shares in Dimerix rose by more than 2% in morning trade to 0.25c, with stock price up about 25% since the start of July.

This article was developed in collaboration with Dimerix, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

You might be interested in