Here’s our fortnightly wrap of all the news driving ASX health stocks.

It’s been a largely positive two week in the ASX small and mid-cap healthcare space, with 67 companies gaining ground and 49 losing it. Another 16 companies were flat and we had one debutant that we’ll get to later.

| Code | Company | Price | % return since Feb 3 | %YTD return | % return since 31/12/19 | MktCap |

|---|

| 1AD | Adalta | 18.5 | 48.0 | 119.7 | 48.0 | $47,809,291 |

| 1ST | 1St Group | 3.5 | 16.7 | -39.7 | 2.9 | $15,710,825 |

| 4DX | 4Dmedical | 195 | -5.8 | | -19.8 | $346,105,648 |

| AC8 | Auscann Grp Hlgs | 18 | 0.0 | -33.3 | -7.7 | $58,653,761 |

| ACR | Acrux | 17.5 | -7.9 | 2.9 | 6.1 | $49,407,663 |

| ACW | Actinogen Medical | 2.2 | 4.8 | -27.6 | 4.8 | $35,468,317 |

| ADO | Anteotech | 26 | 40.5 | 815.6 | 147.6 | $523,641,076 |

| ADR | Adherium | 2.2 | 0.0 | -29.0 | -21.4 | $14,271,516 |

| AGH | Althea Group | 53.75 | 14.4 | 45.3 | 23.6 | $140,369,844 |

| AHC | Austco Healthcare | 9.8 | -2.0 | -6.7 | -1.0 | $27,850,517 |

| AHK | Ark Mines | 3.4 | 0.0 | 0.0 | 0.0 | $1,778,920 |

| ALC | Alcidion Group | 21 | -2.3 | -4.5 | 13.5 | $203,092,281 |

| ALT | Analytica | 0.3 | -25.0 | 0.0 | 0.0 | $10,558,837 |

| AMT | Allegra Orthopaedics | 30 | -10.4 | 114.3 | -14.3 | $31,860,057 |

| ANP | Antisense Therapeut. | 19.5 | 5.4 | 174.6 | 50.0 | $114,811,188 |

| APH | AP Hemp | 49 | 8.9 | 276.9 | 44.1 | $27,762,142 |

| ARX | Aroa Biosurgery | 120.5 | -1.2 | | 4.8 | $354,857,169 |

| AT1 | Atomo Diagnostics | 28.5 | -3.4 | | -6.6 | $114,209,294 |

| ATH | Alterity Therap | 4.3 | 19.4 | 152.9 | 38.7 | $89,612,717 |

| ATX | Amplia Therapeutics | 28.5 | 5.6 | 208.1 | 18.8 | $29,084,190 |

| AVE | Avecho Biotech | 2.5 | 0.0 | 614.3 | -13.8 | $41,571,262 |

| BD1 | Bard1 Life Sciences | 325 | 470.2 | 209.5 | 377.9 | $295,325,756 |

| BIT | Biotron | 7.3 | 0.0 | -45.9 | -6.4 | $53,346,886 |

| BNO | Bionomics | 26.5 | 82.8 | 332.5 | 82.8 | $172,783,174 |

| BOT | Botanix Pharma | 13.25 | -22.1 | 47.2 | 6.0 | $131,374,180 |

| BPH | BPH Energy | 20.5 | -2.4 | 2263.7 | 376.7 | $83,001,885 |

| BWX | BWX | 397 | -2.9 | -13.0 | -3.4 | $558,175,992 |

| BXN | Bioxyne | 1.2 | 0.0 | -7.7 | 0.0 | $7,681,745 |

| CAJ | Capitol Health | 28.5 | -1.7 | 7.3 | 3.6 | $292,822,541 |

| CAN | Cann Group | 75 | 15.4 | -33.3 | 27.1 | $209,545,966 |

| CBL | Control Bionics | 73 | -7.6 | | -22.3 | $36,085,450 |

| CDX | Cardiex | 8.7 | 8.8 | 278.3 | 55.4 | $76,722,474 |

| CDY | Cellmid | 9.8 | -2.0 | -48.4 | -10.9 | $12,721,230 |

| CGS | Cogstate | 102.5 | -11.4 | 111.3 | -6.8 | $168,535,948 |

| CHM | Chimeric Therapeutic | 30.5 | 0.0 | | | $56,985,000 |

| CMP | Compumedics | 45.5 | -6.2 | -48.3 | -9.0 | $81,494,956 |

| CP1 | Cannpal Animal | 18 | 0.0 | 44.0 | 5.9 | $17,228,125 |

| CPH | Creso Pharma | 23 | 9.5 | 91.7 | 27.8 | $212,921,938 |

| CTE | Cryosite | 26.5 | -33.8 | 430.0 | -32.9 | $12,183,486 |

| CYC | Cyclopharm | 282 | 2.5 | 152.7 | 12.8 | $257,994,297 |

| CYP | Cynata Therapeutics | 68 | 2.3 | -36.3 | -0.7 | $98,144,467 |

| DOC | Doctor Care Anywhere | 128 | 0.8 | | 6.7 | $229,169,496 |

| DVL | Dorsavi | 3.5 | 2.9 | 35.6 | -14.6 | $12,594,549 |

| DXB | Dimerix | 29 | 0.0 | 100.0 | 23.4 | $56,394,175 |

| EXL | Elixinol Global | 23 | 15.0 | -54.1 | 31.4 | $73,749,810 |

| EYE | Nova EYE Medical | 34 | 3.0 | -20.3 | -4.2 | $48,853,287 |

| FFC | Farmaforce | 9 | 0.0 | 0.0 | 0.0 | $11,589,388 |

| GLH | Global Health | 40 | -5.9 | 185.7 | -14.9 | $16,839,328 |

| GSS | Genetic Signatures | 173.5 | -6.7 | 48.3 | -13.7 | $257,174,543 |

| GTG | Genetic Technologies | 1.15 | 15.0 | 15.0 | 53.3 | $99,156,494 |

| HCT | Holista CollTech | 7.1 | -1.4 | -54.2 | -1.4 | $19,549,785 |

| HXL | Hexima | 15 | -6.3 | -50.8 | -18.9 | $18,055,861 |

| IBX | Imagion Biosys | 20 | 14.3 | 638.3 | 37.9 | $178,064,289 |

| ICR | Intelicare Holdings | 28.5 | 14.0 | | 18.8 | $9,893,840 |

| ICS | ICSGlobal | 196 | -0.3 | 9.0 | -7.1 | $20,627,077 |

| IDT | IDT Australia | 21 | 5.0 | 50.0 | 13.5 | $50,048,179 |

| IHL | annex Healthcare | 25 | 56.3 | 323.7 | 61.3 | $270,919,222 |

| IMC | Immuron | 25.5 | 24.4 | 82.1 | 10.9 | $55,675,416 |

| IMM | Immutep | 41 | 0.0 | 3.8 | -1.2 | $272,464,620 |

| IMU | Imugene | 11 | 12.2 | 233.3 | 10.0 | $547,183,357 |

| IPD | Impedimed | 14.5 | 20.8 | 43.1 | 16.0 | $182,010,529 |

| IVX | Invion | 1.1 | 22.2 | 10.0 | 10.0 | $55,377,923 |

| JHC | Japara Healthcare Lt | 77.5 | 12.3 | -14.1 | 25.0 | $213,797,862 |

| JHL | Jayex Healthcare | 5 | 25.0 | 127.3 | 28.2 | $9,262,699 |

| KZA | Kazia Therapeutics | 125 | -2.3 | 126.9 | 7.8 | $157,076,999 |

| LBT | LBT Innovations | 11 | 4.8 | -29.0 | -10.2 | $31,079,880 |

| LCT | Living Cell Tech. | 2.1 | 40.0 | 10.5 | 50.0 | $12,571,702 |

| LSH | Lifespot Health | 12.5 | 8.7 | 267.9 | 62.3 | $20,216,035 |

| M7T | Mach7 Tech | 151.5 | 2.4 | 80.2 | 21.2 | $366,315,639 |

| MDC | Medlab Clinical | 32 | 3.2 | 4.9 | 33.3 | $95,089,728 |

| MDR | Medadvisor | 36 | -4.0 | -30.4 | 1.4 | $129,411,780 |

| MEB | Medibio | 1 | 11.1 | 14.4 | 25.0 | $17,268,733 |

| MEM | Memphasys | 11 | 4.8 | 74.6 | 10.0 | $87,373,996 |

| MMJ | MMJ Group Hlds | 14 | 16.7 | 21.7 | 12.0 | $32,193,558 |

| MVF | Monash IVF Group | 77.5 | -1.9 | -13.6 | -1.3 | $305,863,349 |

| MVP | Medical Developments | 627 | -4.3 | -42.6 | -6.1 | $449,680,080 |

| MX1 | Micro-X | 36.5 | 1.4 | 86.0 | 2.8 | $166,188,326 |

| MXC | Mgc Pharmaceuticals | 6.7 | 157.7 | 148.1 | 168.0 | $173,847,048 |

| NC6 | Nanollose | 12.5 | -3.8 | 134.2 | 131.5 | $15,489,382 |

| NEU | Neuren Pharmaceut. | 138 | -7.4 | -49.6 | 7.4 | $160,451,351 |

| NOX | Noxopharm | 83 | 14.5 | 248.1 | 69.4 | $216,827,148 |

| NSB | Neuroscientific | 23.5 | 4.4 | 46.9 | -6.0 | $22,626,208 |

| NTI | Neurotech Intl | 6.7 | 34.0 | 737.5 | 48.9 | $34,223,180 |

| NXS | Next Science | 117.5 | -1.3 | -43.5 | -6.0 | $142,590,482 |

| NYR | Nyrada . | 37.5 | 10.3 | 78.6 | 56.3 | $28,254,965 |

| OCC | Orthocell | 57.5 | 7.5 | 18.6 | 27.8 | $108,535,552 |

| OIL | Optiscan Imaging | 19 | 72.7 | 475.8 | 81.0 | $95,483,248 |

| ONE | Oneview Healthcare | 9.3 | 14.8 | -21.9 | 106.7 | $38,466,264 |

| ONT | 1300 Smiles | 780 | 14.4 | 28.1 | 15.9 | $166,932,607 |

| OPT | Opthea | 180.75 | -5.4 | -46.8 | -5.9 | $611,172,146 |

| OSL | Oncosil Medical | 11.5 | -8.0 | -33.0 | -4.2 | $92,844,479 |

| OSP | Osprey Med | 1.9 | -9.5 | 18.8 | -13.6 | $32,466,939 |

| OSX | Osteopore | 47.5 | -5.0 | -23.4 | -8.7 | $36,287,577 |

| OVN | Oventus Medical | 21 | -4.5 | -62.8 | -10.6 | $34,817,732 |

| PAA | Pharmaust | 10.5 | 0.0 | 0.0 | 0.0 | $33,256,642 |

| PAB | Patrys | 2.6 | 0.0 | 45.4 | 8.3 | $48,815,343 |

| PAL | Palla Pharma | 54 | -12.2 | -35.7 | -33.3 | $69,901,127 |

| PAR | Paradigm Bio. | 261 | -6.1 | -36.7 | 2.4 | $596,256,007 |

| PBP | Probiotec | 221 | 0.0 | -6.8 | -7.9 | $172,619,493 |

| PCK | Pahek | 7.2 | 4.3 | -40.0 | -6.5 | $78,876,336 |

| PGC | Paragon Care | 27 | 12.5 | 3.8 | 20.0 | $91,229,029 |

| PIQ | Proteomics Int Lab | 106.5 | 43.9 | 222.7 | 34.0 | $110,151,169 |

| PNV | Polynovo | 250 | -4.6 | -18.6 | -35.6 | $1,679,163,632 |

| PSQ | Pacific Smiles Grp | 266 | 1.9 | 42.8 | 4.3 | $400,675,586 |

| PTX | Prescient | 12.5 | 19.0 | 140.4 | 86.6 | $76,866,361 |

| PXS | Pharmaxis | 8.5 | -1.2 | -26.1 | -8.6 | $34,559,340 |

| PYC | PYC Therapeutics | 13.5 | 0.0 | 112.5 | -8.5 | $428,075,024 |

| RAC | Race Oncology | 287 | 34.7 | 720.0 | 64.0 | $380,609,093 |

| RAP | Resapp Health | 6.5 | -4.4 | -72.9 | -23.5 | $51,552,125 |

| RCE | Recce Pharmaceutical | 104.5 | 2.0 | 90.0 | -0.9 | $189,365,237 |

| RGS | Regeneus | 11 | 0.0 | 77.4 | -12.0 | $33,031,282 |

| RHT | Resonance Health | 19.5 | 14.7 | -4.9 | -18.8 | $85,234,376 |

| RHY | Rhythm Biosciences | 138.5 | 14.5 | 1698.7 | 58.3 | $277,159,865 |

| RNO | Rhinomed | 11.5 | -23.3 | -28.1 | -28.1 | $31,726,142 |

| RSH | Respiri | 13.5 | 8.0 | 58.8 | 3.8 | $101,127,711 |

| S66 | Star Combo | 27.5 | -8.3 | -52.6 | -16.7 | $37,045,929 |

| SCU | Stemcell United | 2.7 | 58.8 | 80.0 | 42.1 | $22,688,658 |

| SDI | SDI | 76 | -3.8 | -21.8 | -3.2 | $91,526,458 |

| SHG | Singular Health | 47 | | | | $25,731,750 |

| SOM | SomnoMed | 186 | -2.1 | -34.1 | -11.4 | $158,070,292 |

| SUD | Suda Pharmaceuticals | 4.9 | 8.9 | 3.3 | 22.5 | $18,410,154 |

| SVA | Simavita | 1.6 | -5.9 | -30.4 | 0.0 | $22,279,497 |

| TD1 | Tali Digital | 4.6 | 12.2 | 9.5 | -2.1 | $35,737,550 |

| THC | THC Global Grp | 25.5 | 8.5 | -33.8 | 8.5 | $48,311,522 |

| TLX | Telix Pharmaceutical | 419 | -1.2 | 155.5 | 10.8 | $1,163,682,086 |

| TRU | Truscreen | 9.3 | -19.1 | | | $34,835,160 |

| UBI | Universal Biosensors | 43 | -11.3 | 145.7 | -1.1 | $76,337,987 |

| VBS | Vectus Biosystems | 133.5 | 0.4 | 130.2 | 11.3 | $41,310,289 |

| VHT | Volpara Health Tech | 151.5 | -1.9 | -11.7 | 5.6 | $368,998,049 |

| VLS | Vita Life Sciences.. | 99.5 | 4.7 | 75.0 | -0.5 | $51,648,894 |

| VTI | Vision Tech, | 2 | 17.6 | -48.7 | -20.0 | $19,874,511 |

| ZLD | Zelira Therapeutics | 8 | 2.6 | 37.9 | -13.0 | $94,825,837 |

| ZNO | Zoono Group | 74.5 | -24.7 | -59.9 | -43.3 | $129,649,039 |

Bard1 Life Sciences (ASX:BD1) has been by far the biggest gainer since February 3, with shares in the cancer diagnostic company up 470 per cent through yesterday afternoon to $3.25.

At the beginning of the month, BD1 shares were changing hands for less than 60c – and had been in decline for the past 12 months – but have rocketed higher in recent days after the company released data showing its cancer detection tech works against breast cancer and ovarian cancer.

“Obviously we’ve accomplished a lot in a week,” Bard1 chief executive Dr Learnne Hinch joked to Stockhead.

In reality, not much has changed with the company recently, she added. Staff have been hard at work for months “building the foundations for our success” — developing Bard1’s cancer-detecting blood tests and integrating technology from Sienna Cancer Diagnostics after last year’s merger.

“We think we have been substantially undervalued, and the market is finally recognising our value,” she said.

The company is focused on early cancer detection through simple, cost-effective blood tests that could save lives.

“Our multi-product pipeline covers some of the world’s most common and deadliest cancers in multi-billion dollar markets for ovarian, breast, prostate, and pancreatic cancers,” Dr Hinch wrote in an email.

Bard1 has a number of potential value inflection points coming up, including registering its hTERT cancer blood test in South Korea this quarter, and launching its exosome purification platform next quarter.

“We’ve got a lot going on as a business, it’s going be an exciting year for Bard1 and shareholders,” Dr Hinch said.

MGC, Bionomics, Cryosite

The second spot belongs to MGC Pharmaceuticals (ASX:MXC), whose shares soared after MGC became the first cannabis company to list on the London Stock Exchange.

MGC shares have retreated a bit after touching 8c earlier this week, trading for 6.7c yesterday afternoon, still up 157.7 per cent for the fortnight.

Bionomics (ASX:BNO) was in third with an 82 per cent gain, to 26.5c. The company held a $16 million capital raising last week at 14.5c a share to fund a phase 2b clinical trial of its drug candidate to treat post-traumatic stress disorder (PTSD).

On the flip side, Cryosite (ASX:CTE) shares are down by a third, to 26.5c, over the fortnight.

The clinical trials company has released no news, but ASX documents show that a major shareholder has been selling down its holdings.

Blood and tissue bank Cell Care Australia sold over half a million shares over the period, reducing its stake in Cryosite to 18.6 per cent, from 19.7 per cent.

New entrant

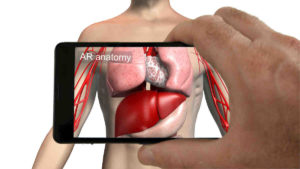

Meanwhile, medical imaging company Singular Health (ASX:SHG) has done well after joining the small-cap healthcare space last Friday after a $6 million IPO at 20c a share.

Its shares closed Wednesday at 45c, and changed hands on Tuesday for as much as 55c.

You might be interested in