Baldness-fighter Cellmid launches hair-raising bid to raise $12m

Health & Biotech

Health & Biotech

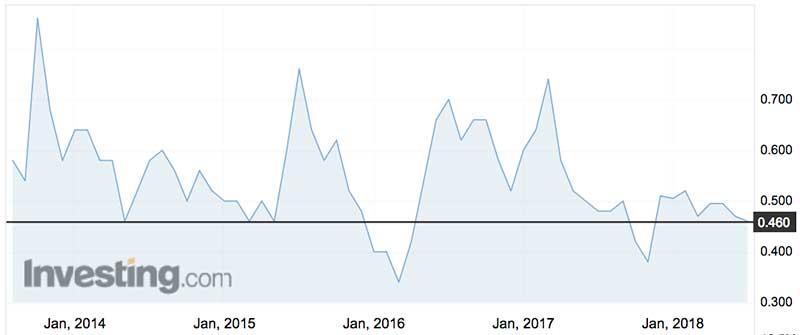

A boost in Cellmid shares — after US department stores Neiman Marcus and Bloomingdales stocked its hair products — has prompted the biotech outfit to pass the hat around.

Cellmid (ASX:CDY) — which makes hair growth tonics as well as developing cancer and heart disease treatments — is aiming to raise $12 million.

Given the entire company is valued at just $26 million in the sharemarket at present, it hasn’t held back in seeking to tap investor appetite for its shares.

The ambitious raising comes as biotech investors have shown a willingness to back promising outfits.

Imugene (ASX:IMU) recently succeeded with a hefty $20 million raising, while Genera Biosystems (ASX:GBI) shares are still suspended as it seeks to raise $11.2 million for a refinancing.

Cellmid has the advantage of selling products that are generating revenue. Its evolis product range claims to reduce hair loss and hair thinning via an anti-aging hair solution.

But it needs extra funds to finance the roll-out of products abroad — which it’s seeking via an issue of new shares priced at 38c — a 17 per cent discount to the market.

Via broker Blue Ocean Equities, Cellmid wants as much as $10 million via a placement (raising an initial $7 million with the right to accept oversubscriptions of another $3 million).

A further $2 million is to be raised from existing shareholders via a share purchase plan, priced also at 38c a share.

Cellmid’s pitch is that it is a global consumer health business with a clinically proven anti-aging product.

Along with Bloomingdales and Niemen Marcus, Cellmid has also signed up Bergdorf Goodman and Soft Surroundings in the big US market, while also getting a foot in the door to sell in China with a deal based on minimum order quantities and a handy upfront payment.

These deals come on top of existing sales in Australia and Japan.

Rapid revenue growth

Helping to encourage investors to back the story is a rapid growth in revenues. The first three quarters of fiscal 2018 already exceed total revenue booked last financial year.

As sales build, Cellmid needs the funds to build inventory to ensure distribution channels have plenty of access to its product line up.

Most of the focus is on its ‘evolis’ product line-up but it also holds exclusive distribution for the Fillerina portfolio of products in Australia and New Zealand.

It’s also continuing to develop a portfolio of midkine drug assets that have potential in a range of diseases from treating some cancers, fibrosis and chronic kidney diseases and some heart conditions.