Bad blood: ITL posts lowest revenue since 2005 but its shares are soaring

Health & Biotech

Health & Biotech

ITL Health’s full-year revenue has fallen by 30 per cent, the lowest revenue figure it’s recorded since 2005.

But the medical equipment maker (ASX:ITD) told investors it “expects to release positive results for the financial year to 30 June 2018” — and the shares soared 40 per cent to an intraday high of 24.5c.

ITL Health said revenue for the 2018 financial year was expected at $24.3 million, including $2.9 million from the sale of a division that packaged surgical kits of protective devices.

Merit Medical bought that business, along with the $12 million in revenue it makes.

Chairman Bill Mobbs told Stockhead last year was a particularly disrupted year, and it had taken months to sort out the flow-on effects, like moving office, following the sale of the Australian Custom Pack Business.

Without the drain of a “me too” business that required excessive time and money to keep running, they’re investing more in sales and marketing, and new products.

“Some of our older products in the blood industry are at the end of their patent lives and they’re being wound down. These are some of our stalwarts and we’ve know about this for a while,” he said.

“Weve been certainly feeling the effects of that in this financial year just gone and there will be some flow on in the new year.

“We’re trying to use the year that’s just finished as a clean up year.”

Share price surge

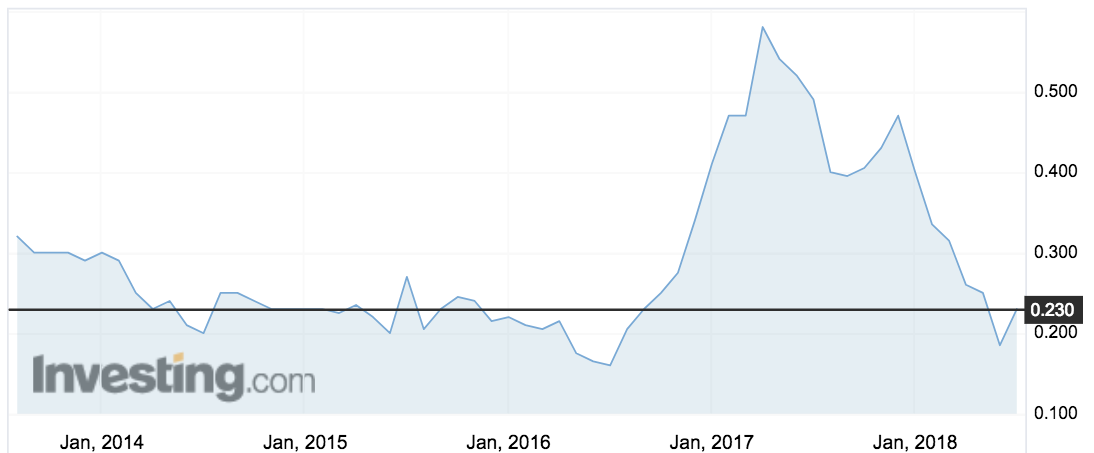

ITL’s share price surged last year to a high of 58c.

Mr Mobbs believes that was due to activity when small cap fund managers jumped on the stock.

He was persuaded to sell 8 per cent of the company to a “specialist small cap fund manager” and a fellow director in late 2016. He says this fund manager is still on the register.

“Then three other fund managers got a whiff and started to drive the price up. They made unbelievable profits quite quickly and sold out, and that started the downhill spiral,” he said.

“It was a feeding frenzy for some small cap fund managers.”

TBF Investment Management became a substantial shareholder in January and sold out in June. Stockhead understands New Zealand investor Pie Fund also got in and out of the company quickly early last year.

Until today’s announcement the company’s shares slid to lows last seen in 2016, at 17.5c, but then bounced 31 per cent to 23c.

Future revenue

The company sells blood-based equipment — things like safety kits for intra-venous (IV) drips — in 55 countries, and have invested heavily in a new home-testing kit called MyHealthTest.

Mr Mobbs says they’ve spent about $3.5 million on the MyHealthTest in 2017 and expect to spend more, although the platform is almost ready to go.

He says revenue is coming from overseas sales in the blood industry, and in Australia it’s divided now into bloodstream infection prevention, and “invasive blood pressure monitoring” where catheters are placed inside the blood.

There are about five players in that field in Australia and Mr Mobbs says they’re number two.