Investors’ turnaround prayers may have been answered as Murray River posts less bad results

Food & Agriculture

Food & Agriculture

A year ago Mildura fruit grower Murray River was firmly in the grip of a vicious fight for control over the company, as the now persona-non-grata founders campaigned for and won a boardroom blowup.

Today, a turnaround plan — one that was actively opposed by said founders — is beginning to show signs of working.

Revenue for the six months to December fell by 23 per cent compared to the same period in 2017.

But the loss plunged by 79 per cent, from $22.2m to $4.6m.

The company said the revenue dip was due to not having enough stock on hand before a life-saving $30m capital raising last year — the one the founders objected to and tried to block — and $64m in bank debt.

Costs fell by $2.2m and margins are beginning to improve, in the last half by $1.3m.

It’s these kind of numbers that have induced a handful of institutional investors to take a punt on the flailing farmer.

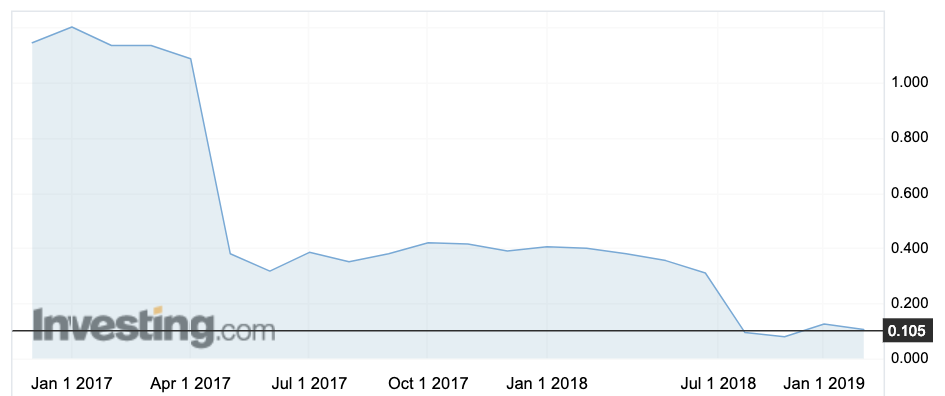

Murray River shares were flat at 10.5c.

The company is forecasting a full year EBITDA (earnings before interest, tax, depreciation and amortisation) loss of $2.8m to $3.2m.

“Progress over the last nine months has been substantial as we have focused on resetting the management team, processes and technical expertise to build a strong operational backbone,” said CEO Valentina Tripp.

“There has also been significant remediation works on the farms, targeting tree health and canopy development in preparation for the 2020 harvest season.”

This is why Murray River is still in its sickbed

Founders Jamie Nemstas and Erling Sorenson listed the company in late 2016.

By May 2017, they had to issue a massive $10m revenue downgrade after storms ravaged crops, and the ASX began asked questions around why shareholders weren’t told earlier.

The founders were forced out, a new CEO was found but the odds were still stacked against the company — more write downs, troublemaking at the AGM by the founders, and a fine for not disclosing the impact of those storms earlier.

Mr Erling and Mr Sorenson won their campaign to replaced the board, which hired a new CEO and set in place the plan that is beginning to reap benefits.