Trading with Focus – What were all the ‘smart’ investors buying this year?

Experts

It’s funny. I keep getting invited to market-related interviews to ‘update’ viewers on the trades that our clients did in previous periods.

Then my poor marketing and PR team cop it for asking me.

I usually go off on the same rant about what a waste of a good interview that would be, I mean who cares what people were trading? Why would we give away our clients’ secrets?

Or are they thinking it’ll help pump up the price if we tell them what people bought last week, like Rene Rivkin used to do (allegedly)?

And retail investors, as a group, are well known for panic buying at the top, and panic selling at the bottom, so… is it just one big joke and will Ashton Kutcher jump out at the end and tell me we’ve been pranked? Do the movements of a specific herd of an online trading company somehow offer an insight that is more valuable than can be gleaned from volume indicators or professional investors?

Smart traders should want to know what to trade now, not what a whole lot of people ‘were’ trading!

Don’t be the herd. Eat the herd.

But all our competitors seem to do it, so I thought it would be a good time to look at a few of the ‘most traded stocks’ using the buy/sell button supplied by the winner of the ‘Highest Spend on Millennial Advertising – Online Share Buying Category’.

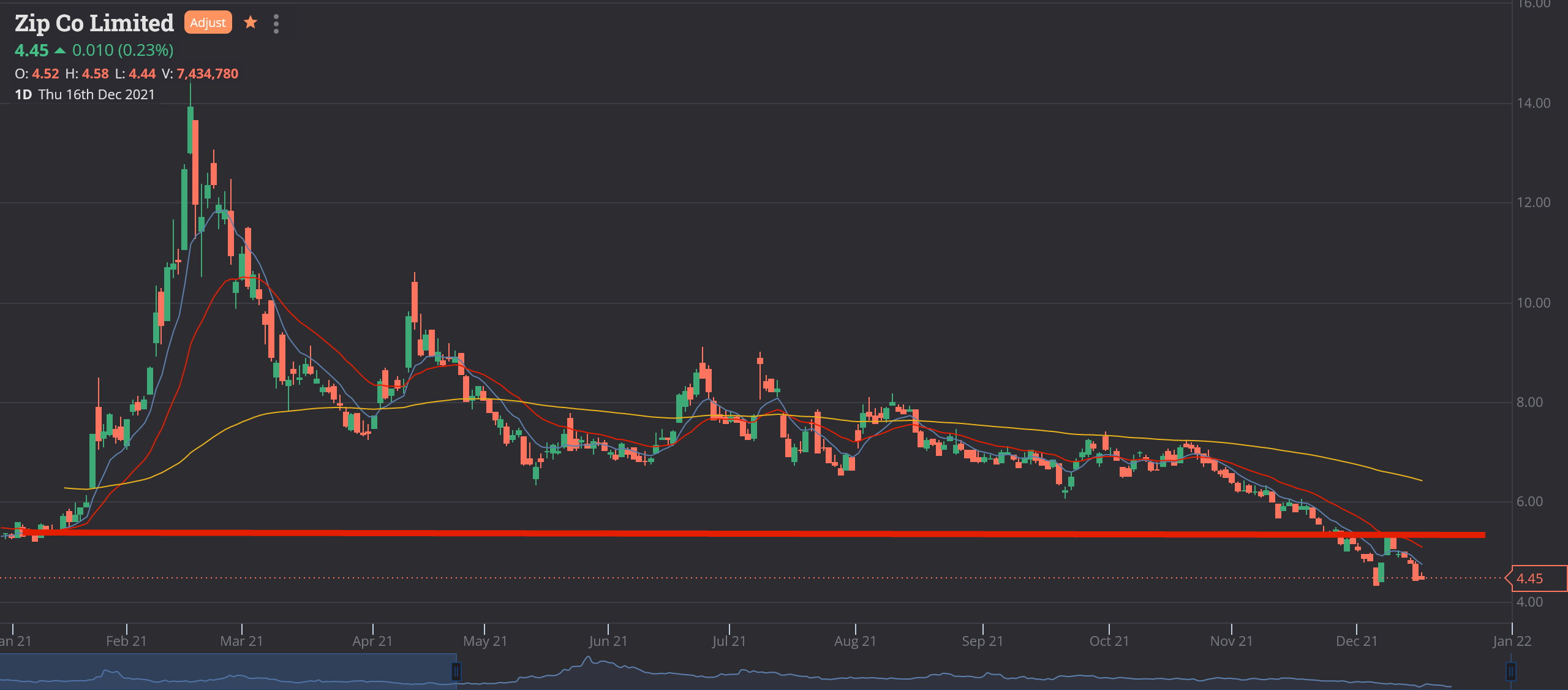

Let’s start with the top of the podium, most traded stock, your favourite and mine, unregulated debt for poor impressionable people – the second biggest BNPL player in Australia, and the one that didn’t get taken over… and now has to prove that it wasn’t just a faddish flash in the pan.

I sure hope all that volume was done buying it on the first day of the year and selling it in the middle of Feb, otherwise as a buy-and-hold stock this sure looks like a good tax loss. But it’s no surprise there was a lot of stock to buy, as there was a lot of founder stock being sold… and who better to buy it?

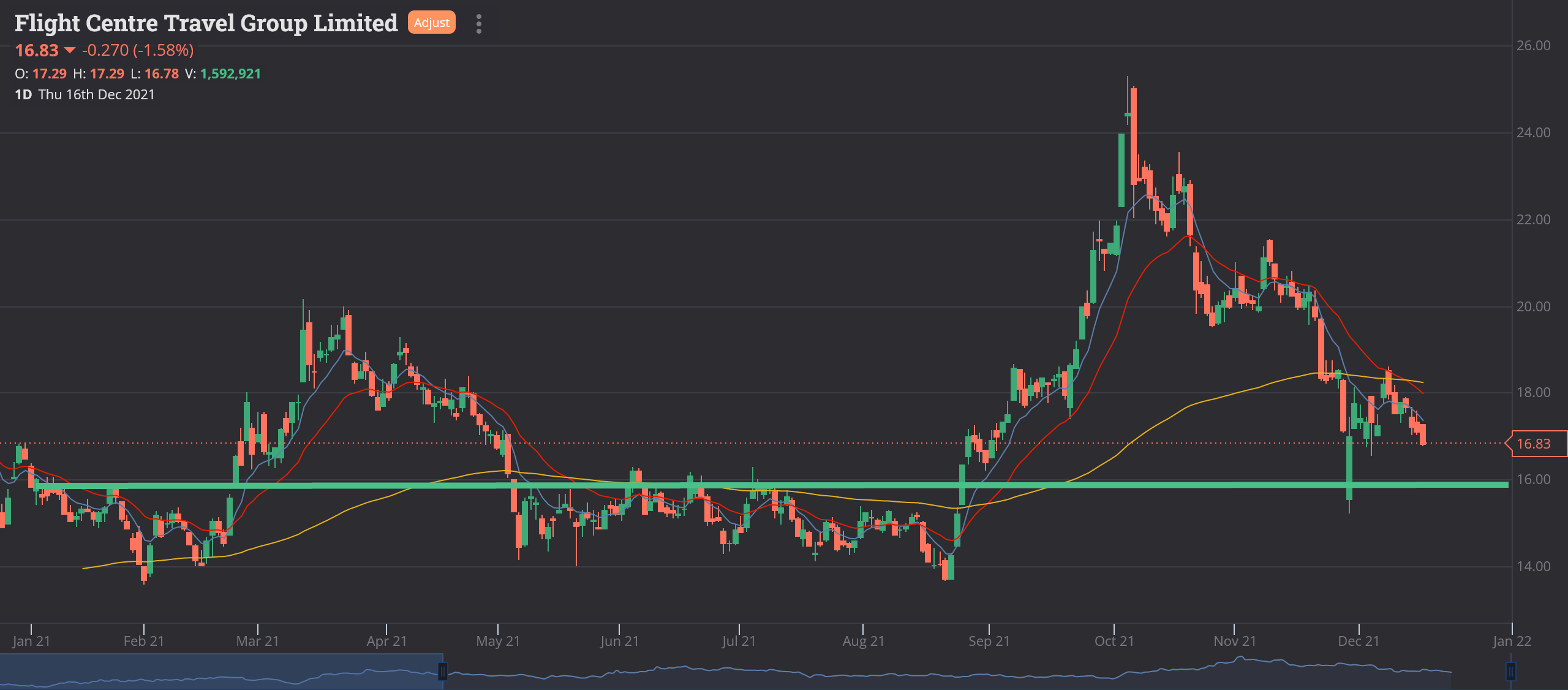

Next up, this little ripper.

Now it’s funny. I’m a bit older than the average millennial, but I have never ever been on a cruise. I mean, who uses a travel agent since the internet? Has no-one told the young’uns to ‘buy what you know’, and isn’t this the literal definition of a ‘boomer stock’?

So I guess someone on reddit must have said that it was ‘travel related’, made a meme about it, then all of a sudden – Flight Centre is what, the next Gamestop? (More like the next Blockbuster…if I was to take a view.)

Ok, at least Cruise-I-mean-Flight Centre might end the year in the green. But it’s not really ‘investment grade’ is it? Feels a bit like shorting the ammo manufacturers in 1941, and I doubt the cruise ship industry is the first part of the travel industry that people will flock to. (BTW I’m only assuming that they do cruises, I’ve never set foot in one… another reason I avoid it as an investment.)

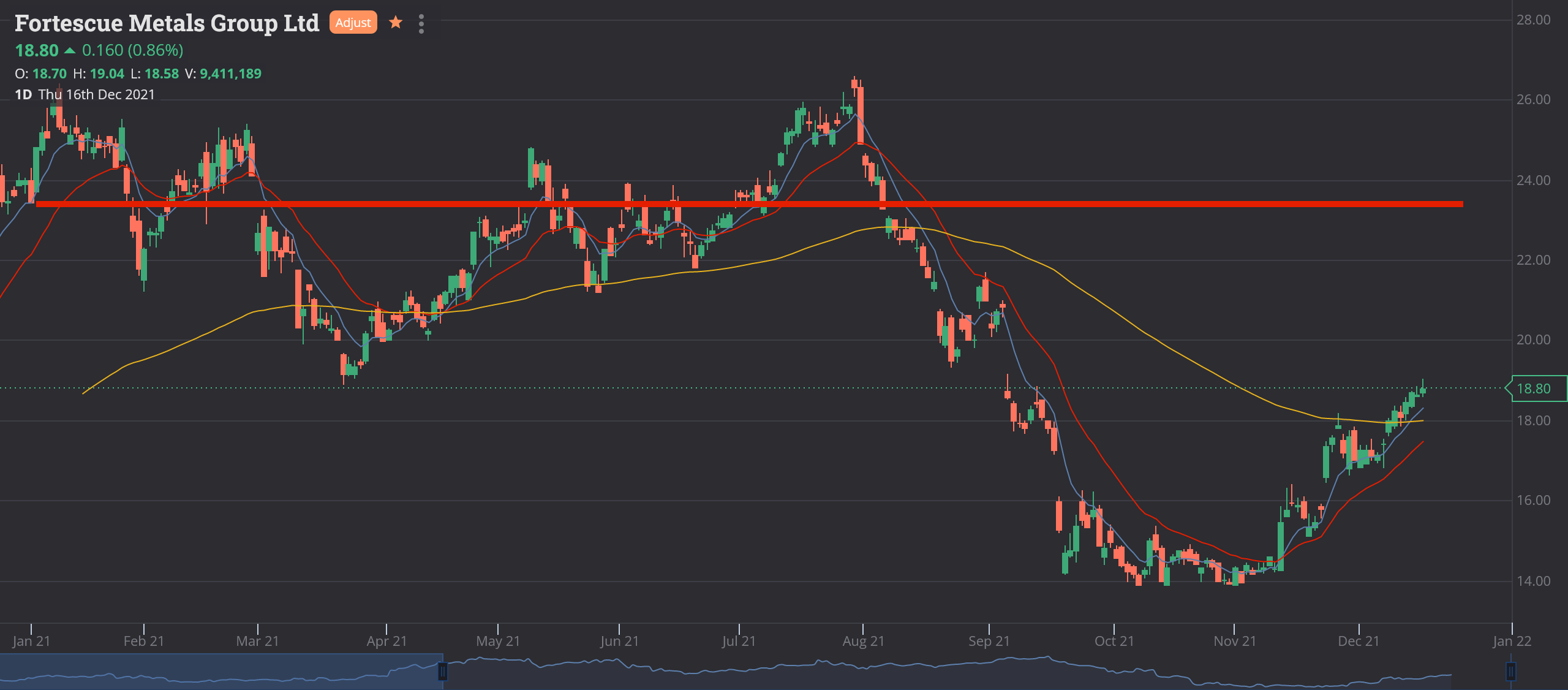

You know what? Even I had a couple of stabs at this next one. Had to average down a LOT after that first collapse and I finally found the bottom, then sold out of the bounce way too soon. But, I gained some grey hair, made a few bucks, and in the end isn’t that what its all about? (Now isn’t that a more valuable insight, than just telling you that I traded them?)

Not a stock I’d hold. But as a trader? It’s a great rollercoaster if you can overcome your burning gut and buy in the absolute panic driven lows and sell in the massive over-optimistic highs. A trait that retail investors are not well known for…

Virtually a single commodity company, at the whim of the Chinese dragon (not known as a friendly animal), and directly linked to global growth that could get sucker-punched at any time, that also relies on shipping and supply lines remaining open and smooth. So one South China Sea incursion or blockade or fuel/ship/container/port access shortage and collapse-o-she-goes.

Nice chunky but most-likely unsustainable dividend, and will also probably end the year heavily in negative territory. Nice bounce trade though, after the panic really set in (probably exacerbated by the retail selling?).

That divvie would have sucked a lot of people in. Literally no-one saw the iron ore price collapsing that quickly, except most of the people I spoke to… who warned me not to trade it. Suckers!

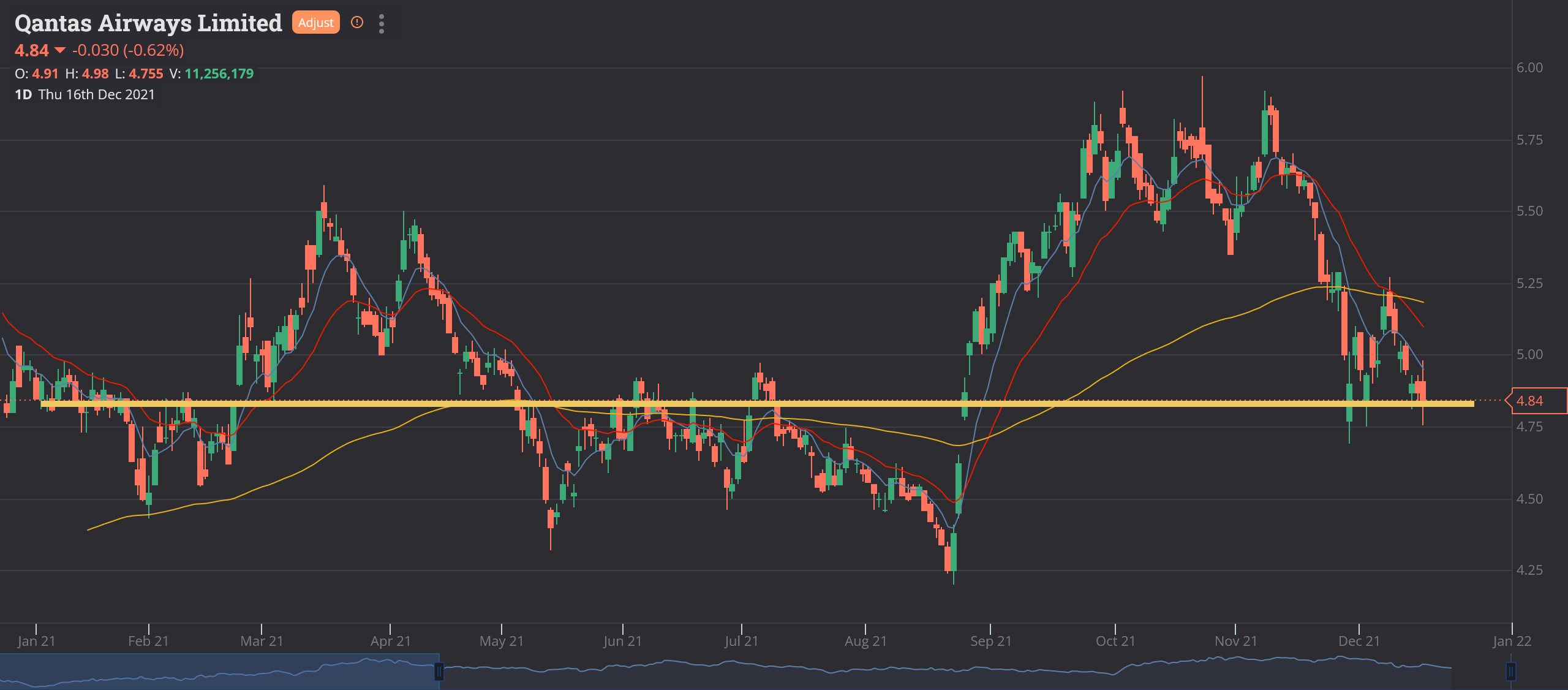

Number 4, just outside the winners’ podium, my favourite wine distributors, the company that gives away frequent flyers points like confetti (could they end up about as useful as Ansetts frequent flyer points are now?)… the Flying Kangaroo!

Once again, a ‘travel stock’, and likely punted on the depth of research that comes with the assumption that everything will return to normal again for travel as soon as they reopen international travel, and the assumption that there was no real damage done to the company in the last two years whilst it was more of a ‘Sitting Kangaroo’.

So it ran up into the borders reopening, then collapsed after. Like speccy stocks do. Buy the rumour…

This one gets a yellow line, as it will end the year virtually unchanged. Again, I sure hope they were buying it in the dark days, and selling it in the optimistic days, and not holding it until after the lockdown ended, because as any seasoned speculative share investor would know… sell the fact!

Optimism and speculation are so much more financially rewarding than truth. After travel starts again we will really find out how damaged these companies are.

Rounding out the Top 5 ‘most traded’ stocks, is none other than… drum-roll… yes, you guessed it, the highest-profile millennial-facing unregulated ‘layby except you get the thing now’ company in Australia.

I think they should also take out the ‘Trump Award’ for Australia, as they somehow convinced the people they are exploiting that they are somehow part of a movement to ‘stick it to the man’. And by the man, I mean the banks, who ironically, these young’uns will want to borrow money from in the future to buy a house, and they won’t be able to, because they were ‘sticking it to them’ by accruing bad debt on worthless consumer products.

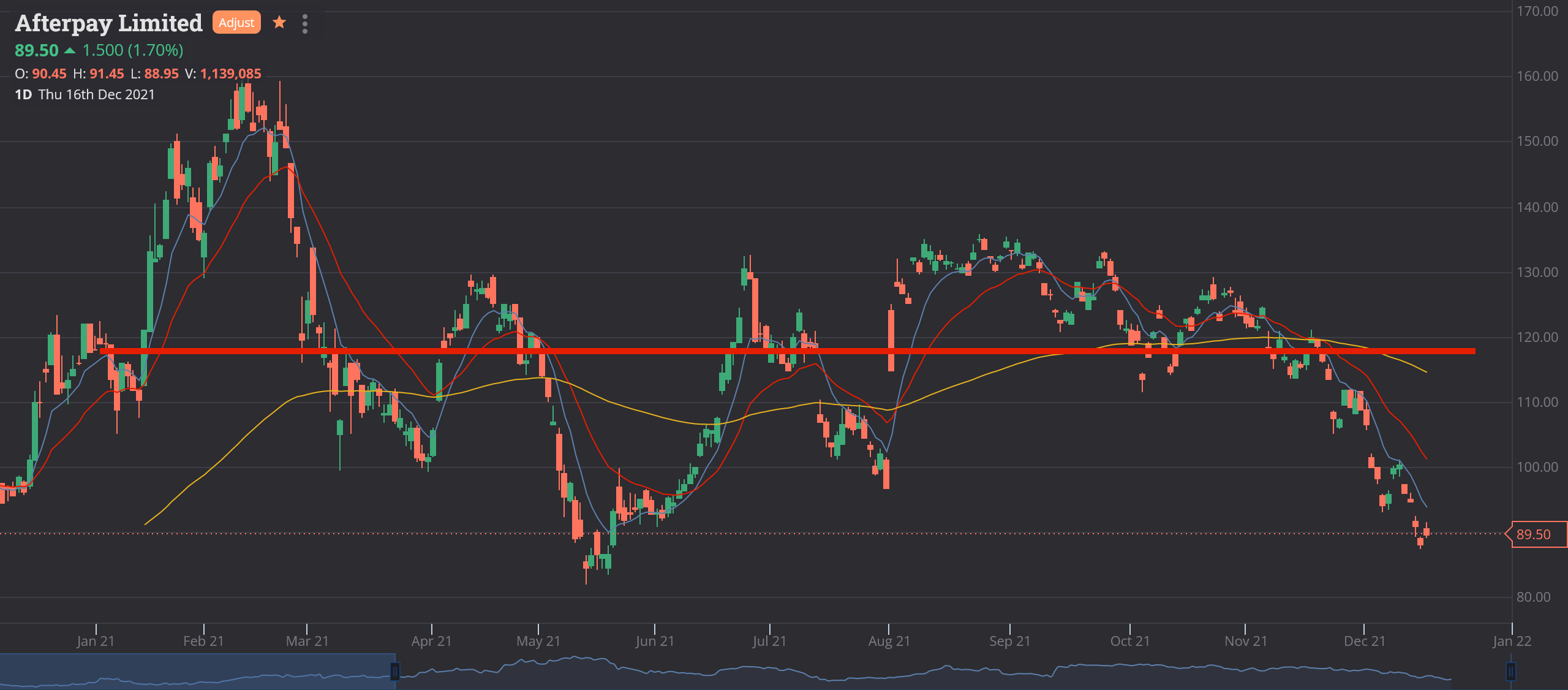

Anyway, here it is, also firmly in the red even though there was a takeover, Mr and Mrs Pay’s little boy, Afterpay.

Now this may also be a complete fluke, but out of the ‘top 5 traded’ using that online buy/sell button, two of the top 5 are major financial backers of the buy/sell button itself, and one of them just announced a massive fly-buys give-away partnership, which just involves swapping cash for points.

So if I were a conspiracy theorist, I would wonder if this was all just another fabulous piece of sponsor placement.

But it is definitely a zero value-add for anyone else. If I want to play ‘what you been trading’ I want to hear about wins, mistakes, ‘should haves’, losses, strategy, reasoning.

Definitely not just ‘volume traded’, or partner product positioning.

So once again, the ‘democratisation’ of the stock market has actually/probably led to small investors – with little to no real-time market data, or advice, or experience, or the capacity to lose large sums of money, at the formative stages of their investment journey – giving their money to the professionals through the stock market. I’ve really got to read the dictionary definition of democracy again!

You should know by now that this is all in jest, much love to all. Just a few friendly jabs. No need for lawyers…

As a trader I actually do benefit from the fact that there is someone out there spending tens of millions in advertising to always find me a new buyer, because when people start getting smart about their investing, specs are dead! Long live the first-time investor! Pity I was so rational about my investing…

And, also, no, I probably won’t do a Marketech Top 5 any time soon. We’re more about ‘value-add’ than ‘copy/paste’. But I sure wish we could do the ‘Rene Rivkin’ again, because even using this, Marketech, the best trading platform in the universe, I’ve still got some toads that need a kiss!

(Don’t forget to come back again next week, I still have to give you all your Xmas presents and you will definitely like these ones!)

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC.

You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market, you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

Marketech Focus subscribers also get 2-months free access to the ‘Marcus Today’ newsletter to help you with your investing and trading goals.

For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Online Trading Pty Ltd (ACN 654 674 432), an Authorised Representative (1293528) of Sanlam Private Wealth Pty Ltd (AFSL 337927), and a Stockhead advertiser at the time of publishing.

All information and material contained herein is general in nature and does not consider your financial situation, investment needs or objectives.

The information does not constitute personal financial advice, nor a recommendation or opinion that a security or service is appropriate for you.

You should seek independent and professional tax and financial advice before making any decision based on this information.