Trading with Focus – We’re kicking off our corporate plays with a nickel/cobalt IPO

Experts

Experts

First we gave you live-streaming ASX data, so that you could bridge the gap between you and the pros from that ’70s style click-to-refresh slideshow, or that delayed crap that you normally use, to try and trade shares with, in the same market as the pros, who all live-stream.

And made it all available on mobile, because you need to go to the toilet sometime.

We gave you high-level technical charts, so you could try and see patterns within patterns like some sort of gypsy-nerd.

We gave you $5 trades, or 0.02%. On HIN. With a high-yielding and secure Macq CMA, because we haven’t had a big pooled trust go bankrupt for a few years running, and you’ll be pissy when it happens again.

We connected Sharesight to help sooth your sometimes volatile relationship with the tax-man.

We gave you access to the NSX, so you could help Australia have its own NASDAQ.

We got you some free research and advice from some of the best in the business – Marcus Today – so you could have a virtual ‘stockbroker in your pocket’ – but one that you could trust, because they aren’t profiting from brokerage on turnover.

All for $45 a month.

But we’re not finished.

We should have all the Chi-X ETFs in play this week, and have it fully blended into the ASX depth early next year (as an option), and if you’re lucky you’ll be able to nominate which market to put your orders in, or even the centrepoint. And multi-screen/multi-chart function should be an early Xmas present.

So we are crushing all the online players, now what about the full-service stockbrokers? What can they possibly offer (that we would need to get for you) to fill out this veritable treasure trove of everything that is ‘serious investing’…?

Of course – access to capital raisings and IPOs!

I was going to pitch ANZ Bank to help them with their capital needs, but after they sold Etrade to CMC for pennies on the pound I thought they might be a bit a bit touchy about it being devalued (by us, probably). And we figured that anyone can access a big bank capital raise; they literally advertise them in newspapers.

So we thought our first one should be ‘boutique’. Hard to get. And we’re from Perth, so it had to be mining. And, let’s face it, it had to be ‘battery metals’.

So, we humbly present, to you, the serious active investors.

Those who presumably know what you’re doing. Who are not getting caught up in the hype and spin of the buy/sell button brigade’s race-to-the-bottom, in price and quality.

The first capital raising via an IPO that our clients can directly participate in and get priority to, through Marketech.

Yes, you better believe it! We are a ‘Joint Lead Manager‘ with Blue Ocean Equities on an Australian Nickel Cobalt play. Rubbin’ shoulders on Day 1 with Sydney corporate royalty!

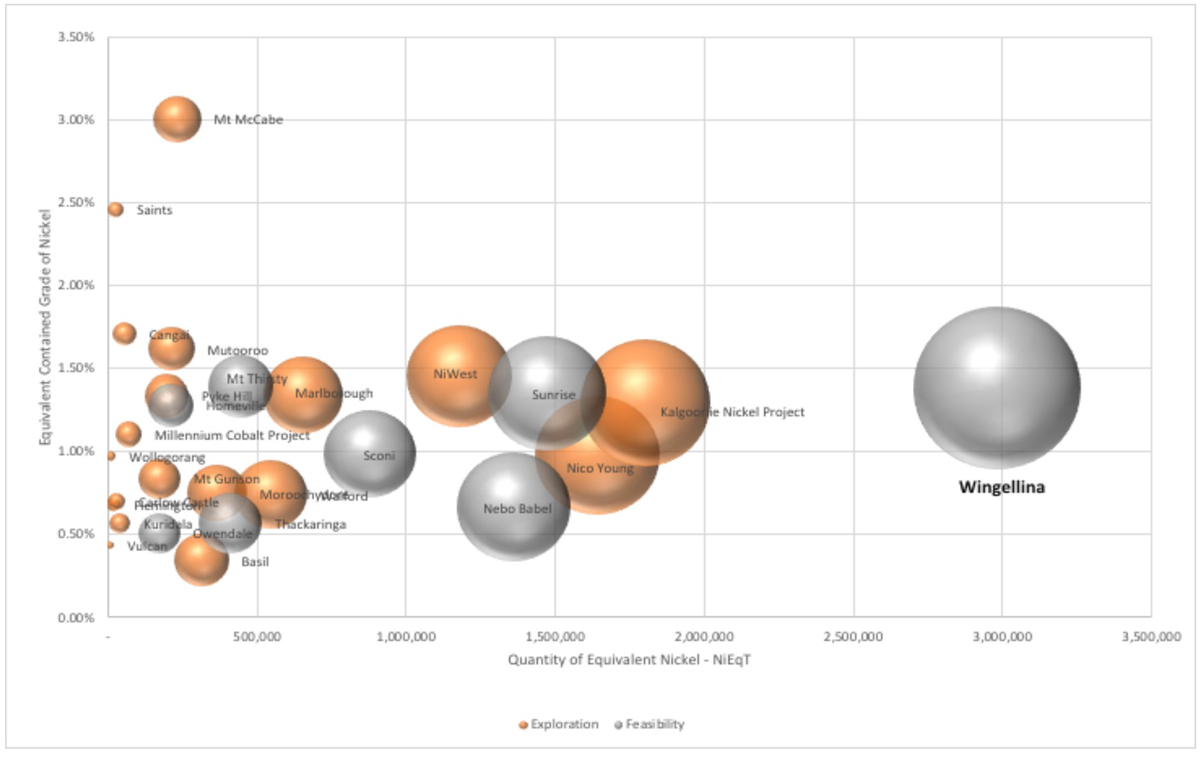

I’m not here to hype it up, that is certainly not my job. But the fact remains, Nico is the spin-out of the Wingellina nickel cobalt deposit from Metals X (MLX.ASX) and it is amongst the biggest nickel cobalt deposits in Australia.

Here’s an old slide from the Metals X days, comparing Australian undeveloped nickel deposits by volume and grade. Don’t take too much from it as it’s old and doesn’t give you the whole story – just that it’s big.

The prospectus lays out the facts and figures, and you can read more about the project on the internet. If you want some then I certainly wish you the best luck in the world, and if your broker can’t get it for you, well… we might be able to do you a solid. As its our job to provide ‘spread’.

But you’ll need to be quick.

You’ll need to have opened a HIN with us and a Macquarie account and have cash in it and a subscription to Marketech Focus within a couple of weeks, or before we fill our allocation. And we don’t control the pace at which Macquarie opens bank accounts; in this new world, filled with money launderers and terrorism-funders…

What I am going to do is explain a few things about this stuff.

We get paid a fee for helping them. Which seems cool, except none of us are paid on commission (so as far as I’m concerned it’s more work for the same amount of money). Like everything we do we’re doing this because we want to give you a trading platform like the pros have, and access to capital raises is a part of that. But you don’t pay the fee, the company does, and it covers costs like staffing and settlement and helps us to fund more features for you!

When listing on the ASX, you need to have what is called ‘market spread’. That means you can’t just have 3 shareholders controlling the distribution and price of the stock as that is called a cartel, not a fair market.

A listing company needs to have a few hundred shareholders with more than a couple of grand’s worth each, so that market forces can determine a fair price. And having it in your name, your super fund, the cat – these all get counted as ‘one’. So we have 300 lots of a minimum $2000 as a priority for our subscribers.

New listings and capital raises aren’t free money. You still have to think a bit deeper than ‘nickel’s so hot right now’…

We’ll have more raises coming our clients’ way, but they don’t get automatic access to all of them. ‘Sophisticated Investors’ are generally thought of as being wealthy enough to take a few hits, so only they can access the really fruity ones for the companies that don’t have time to build a full prospectus.

The theory with a full prospectus is that it’s supposed to have all the info that you need to get up to speed, but they are very expensive and time consuming, so if a company needs money right now they just tap the rich dudes that have bulk cash or bulk income.

It still doesn’t mean it’s free money. It might just mean that they can make a decision with less information, and, in the eyes of financial law, can take the loss and shrug it off.

When you apply, you’re entering a very similar contract to the one that you enter when you buy shares. You have to pay up even if nickel falls out of bed, or you’re breaking a contract.

We get an allocation to distribute, but the company raising the dough ultimately decides who gets it.

Lastly, a super fund isn’t automatically a sophisticated investor, but a sophisticated investor can have a super fund.

Anyways, that was the news for this week – big news, we believe, and now I just need to get Elon on the phone and see if he wants a few.

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC.

You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market, you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

Marketech Focus subscribers also get 2-months free access to the ‘Marcus Today’ newsletter to help you with your investing and trading goals.

For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Online Trading Pty Ltd (ACN 654 674 432), an Authorised Representative (1293528) of Sanlam Private Wealth Pty Ltd (AFSL 337927), and a Stockhead advertiser at the time of publishing.

All information and material contained herein is general in nature and does not consider your financial situation, investment needs or objectives.

The information does not constitute personal financial advice, nor a recommendation or opinion that a security or service is appropriate for you.

You should seek independent and professional tax and financial advice before making any decision based on this information.

Any documents linked or referred to in this article were not selected, modified or otherwise controlled by Stockhead. Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in the documents linked or referred to in this article.