Trading with Focus – Is Woolies going to bounce?

Experts

I hate retail shares. It’s such a hard thing to judge.

You have to have a view on global demand shifts, input costs, margins, product lines and competition.

They can also go through long periods of decline, as the stores and the brand can go a bit stale.

But one thing’s for sure. Retail has been smacked. Especially discretionary retail.

It seems that pretty much everyone has a new TV and a new phone and a new coffee machine, a whole new wardrobe and the latest car. And that means they are less likely to need more in the immediate future.

Inflation is also starting to bite. Interest rates might be going up sooner than expected. There are also supplier problems, because you can’t get workers to pick veggies or load trucks from home.

With all of this negativity around the sector it’s not surprising there’s a lot of pain in retail stocks. And where there’s pain there is also opportunity!

Kogan’s down from an all-time high of $25, to $8.50.

Harvey Norman was over $6, now it’s under $5.

JB Hi-fi, $55, down to $45.

But I understand why these guys are down, and they still carry a lot of risk for mine. Interest rate cycles are long, and we are only just starting to talk about it turning back up.

But old man Woolworths. One of the bluest of the blue. If I was to make up a 5-stock portfolio, they’d be in it every time. Great management, great brand, and a virtual duopoly.

(I finally went to an Aldi the other day for the first time. It was OK, but it’s unlikely I’ll drive the extra 500m to go there regularly… And I have a Woolies credit card, so…).

But Woolies are down. They peaked at $42.66 on the 20 August, and now they are down to $36. So that’s a 15% sell-off.

Maybe Xmas sales were off a bit. Maybe we aren’t seeing the same panic sales in toilet paper. Maybe they have a few empty shelves.

It’s probably all Covid-related somehow…

But from what I’m told, Omicron will blast its way through, kill a bunch of people, and leave a whole lot of people behind who will still need bread and milk, and those soft delicious chocolate chip cookies that they make.

So maybe this is just a chance to buy a few on the cheap for a trade, or for the super fund.

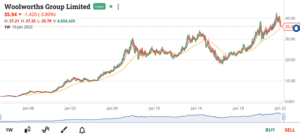

First off, here they are, still, since the dawn of time.

And a bit of oversimplified back-story.

Woolies had a free run at being the best supermarket chain in Australia, right up until Wesfarmers bought Coles in 2007. Coles had been public, and were bought out by some VCs and had various management trying to compete and continually failing for no particularly obvious reason (including one CEO who famously hadn’t even been in a shop for several decades).

But then they gave up and sold it to Wesfarmers.

As with pretty much everything Wesfarmers do, they took their time and then fixed the damn thing. Got it running on all cylinders at the same time that Woollies needed a refresh. So there was a bigger dip in 2015 to 2017 than usual, but history would dictate that every single dip was a buy.

So, if history is a guide in the markets at all, and it sometimes is and sometimes isn’t, then somewhere here Woolies must be good value.

Well, it certainly has bounced after every dip of this magnitude since 2016. Things have obviously changed, sure, but this sell-off was sparked by a trading update in December, and one to which people should not have been too surprised.

Basically, if you skim it, it says “Covid covid covid covid covid covid covid”. Like I thought.

So let’s have a look at a few more indicators.

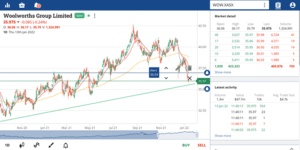

The RSI is certainly showing as oversold.

The stochastics are not as oversold this time around, and this feels a little more like a second and less motivated wave of selling, maybe from the ‘failed bounce shortselling brigade’, but we did also have a massive wave of Covid since then, and another run of empty shelves. So I can’t solely blame traders.

If I was going to put my toe in the water, I would do this.

First, whack on a ‘sensitive news alert’. I don’t want to get caught unawares in case there’s more bad news.

Then, I’d probably buy a few, with the view of averaging down if they keep going down. This isn’t a speculative company, if you end up with a few too many Woolies shares you’ll still be smarter than 98% of people in this market…

Then, so I don’t get caught up watching the least speculative thing in my portfolio, I would put in some price alerts, above and below, and it’ll just ping my mobile.

Some would put in stop-loss orders, but this is Woolies. I’d probably just keep averaging down.

So to finish, I dunno about this article. I was hoping to give you some more insight, but apart from pointing out that Woolies is a blue-chip that’s probably only going through a rough patch…

To me, the worst that can go wrong here in my limited opinion is that I get bored to death.

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC.

You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market, you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

Marketech Focus subscribers also get 2-months free access to the ‘Marcus Today’ newsletter to help you with your investing and trading goals.

For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Online Trading Pty Ltd (ACN 654 674 432), an Authorised Representative (1293528) of Sanlam Private Wealth Pty Ltd (AFSL 337927), and a Stockhead advertiser at the time of publishing.

All information and material contained herein is general in nature and does not consider your financial situation, investment needs or objectives. The information does not constitute personal financial advice, nor a recommendation or opinion that a security or service is appropriate for you. You should seek independent and professional tax and financial advice before making any decision based on this information.