Trading with Focus – are the wheels are falling off the stockmarket?

Experts

I’ve seen a sell-off, but I haven’t seen panic.

One of the world’s leading super-nuclear-powers, with an action movie quality of megalomaniac at the helm, with secret police and a couple of million troops, and with tanks and artillery that would impress Tony Stark is invading one of the countries that broke away from the USSR in 1991. And they want it back.

Everyone is pissed, and European leaders are already taking major steps to stop it, with sanctions likely to bite hard. The Russian stockmarket has crashed, oil has gone through the roof adding extra pressure to an already spiraling inflation problem.

But even, with all of this, on top of the threat of fast rising interest rates and major supply chain issues, I’m still not seeing any panic.

Sure, we’ve seen some investments and stocks ‘get found out’. The BNPLs turned out to be very, very, big speculative shares, only held up by the hype of a retail army that was buying things on the basis of them going up.

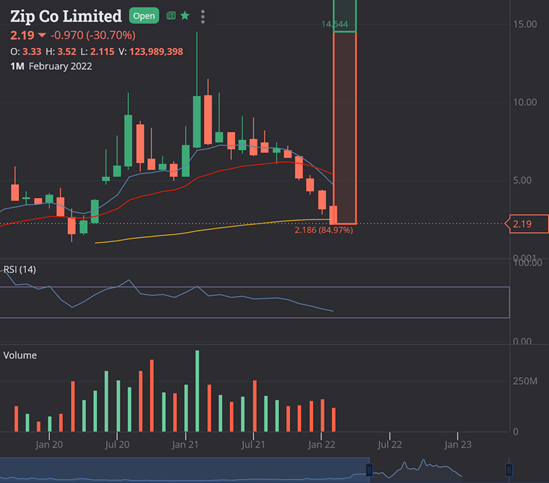

Zippy-zip is down 85% from its highs. Still haven’t seen real panic though. Just a grinding, relentless, day after day descent back to whence they came, pre-Covid, before BNPL were going to destroy the banks.

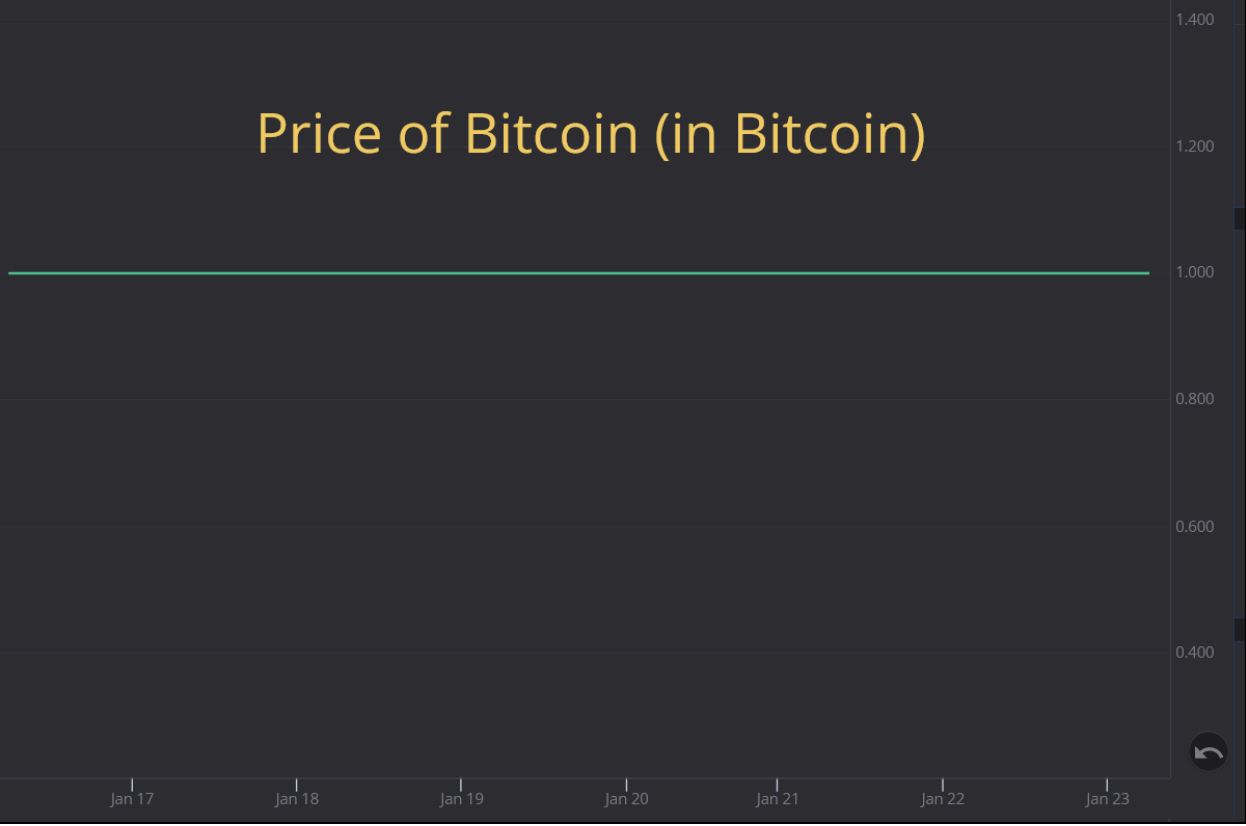

And you’ve got crypto in a similar boat.

I’d take a heavy bet that a thing whose raison d’être is to hide shifty transactions from government oversight, and used to facilitate drug dealing, money laundering and illegal cross-border capital transfers is likely to have been a big hit in Russia.

And last I checked, you can’t buy food with crypto, so the poor folks of the motherland have probably converted a lot of it back to a useable currency in case of a full-blown war.

Funny how crypto only has ‘value’ when compared to a fiat currency. Funny… unless you bought it at its highs, using money.

Is there an opportunity to buy it while it’s down?

Well, it’s certainly a better opportunity than it was when it was at all time highs. But it’s unlikely to get dividend yield support.

There’s no drilling campaign coming up, there’s no human trials, there’s no potential acquisitions that may be earnings accretive, there’s no cost-savings from an independent review, there’s just the hope that someone pays more for it than you did.

Again, I haven’t seen panic though. Real ‘gut wrenching, front-page news bleating that Investing is dead, end of days, potential to collapse the world financial system, fin-fluencers going back to work, ASIC changing legislation, ScoMo calling for calm, government intervention’ kind of panic.

All I’ve seen is a dip.

But you need that sort of panic to call a real bottom opportunity. So this isn’t a bottom of those proportions just yet. Which means there is still a lot of price risk.

You can see it in individual stocks though, all the time. Shareholders calling for blood at AGMs, 249Ds being thrown around like confetti, militant managed funds that take a large stake and muscle their way in, HotCopper looking like an old 1700s military battle with bayonets and more deleted threads than people.

So in my simple opinion, that means one of two things.

Either, this whole sell-off isn’t going to be so bad, and there’s a lot of underlying strength, with a lot of money looking for a home.

Or, we aint seen nothing yet.

Let’s talk about ‘normal profit taking and switching during an ongoing bullmarket’, because we only just had the Covid panic selloff and you remember how that worked. Still feels a bit surreal…

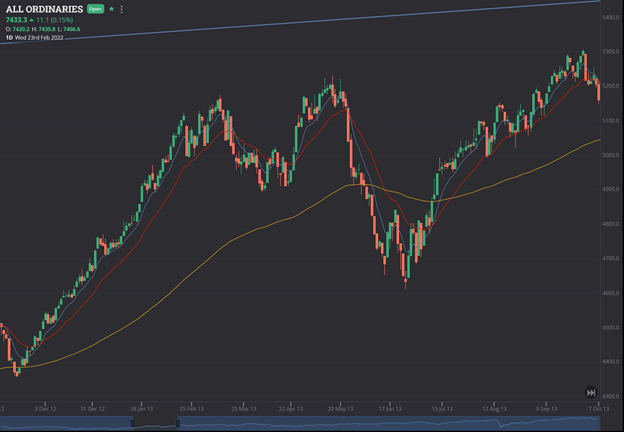

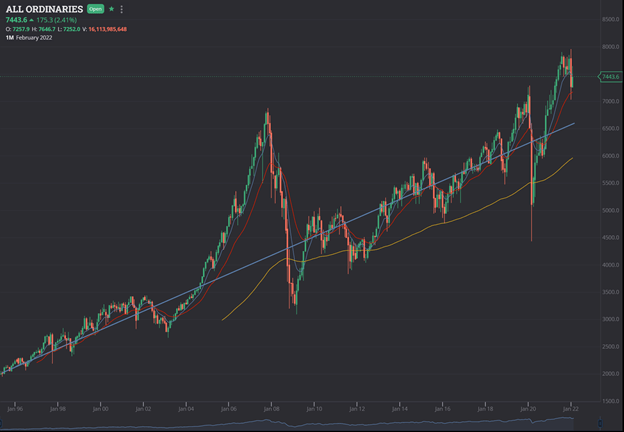

Here’s a couple of sell-offs, using the Marketech proprietary trading and charting platform, only $45 per month with live streaming prices and connected to an Openmarkets trading account with $5/0.02% brokerage on HIN.

That first one was about 5%, the second one was about 10%. This is one of the post-GFC, post-European debt aftershock, normal sell-offs in March to June 2013. A wobble, but then a slap. But also, a solid recovery.

Here’s another one. Also, a wobble, then a slap. From memory this was when the market realised that China was not going to keep growing at an exponential rate, and that sometimes there is oversupply in mining and a slow down in demand.

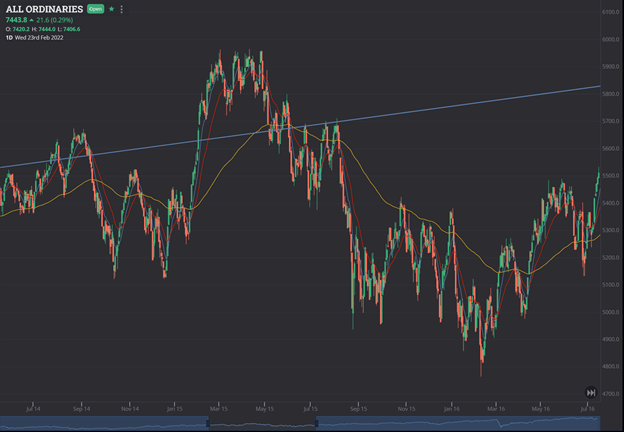

You probably don’t remember, but that blue-line is still on my chart from a few weeks back, when I talked about ‘above the line and below the line’. Note these sell-offs are all firmly below the line…

And here is that line again.

So, as I said back then, in my opinion we are either in some new paradigm of a never-ending bullmarket with a Covid scare in the middle, or we are statistically likely (even with my highly dubious statistical regression) to come back to that line.

Given that we haven’t seen a real panic yet, even though this war in Europe is pretty scary and inflation is also pretty scary, it sort of makes me think that maybe this isn’t the time.

But the ‘big but’ is that IF we were going to see panic, we could still have a long way to fall.

Retail euphoria still hasn’t been destroyed, the media is still positive, people are still talking about what to buy and while all that is still going on we are still not in a true bottom.

This is all just in my humble opinion (to quote the HotCopperites) but a rebound here might just be a reprieve. Whether it is a normal one, in an ongoing bullmarket, or a really scary one, as the beginning of real doom and gloom is yet to be seen.

And that, my friends, is the stockmarket. And, it’s also why you have high level technical charts over multiple timeframes, and stop-losses, and live alerts and live-streaming prices.

This isn’t a time to be winging it with any less.

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC.

You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market, you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

Marketech Focus subscribers also get 2-months free access to the ‘Marcus Today’ newsletter to help you with your investing and trading goals.

For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Online Trading Pty Ltd (ACN 654 674 432), an Authorised Representative (1293528) of Sanlam Private Wealth Pty Ltd (AFSL 337927), and a Stockhead advertiser at the time of publishing.

All information and material contained herein is general in nature and does not consider your financial situation, investment needs or objectives.

The information does not constitute personal financial advice, nor a recommendation or opinion that a security or service is appropriate for you.

You should seek independent and professional tax and financial advice before making any decision based on this information.