Director Trades: Who’s on a shopping spree?

Director Trades

Director Trades

Here’s our weekly look at which ASX small cap directors are buying or selling their own stock (week of Oct 12):

There was little selling last week but directors were out in force amassing sizeable stakes in the companies they work for.

Of the notable trades last week 12 directors forked out their own cash, either through on-market or off-market trades or dividend reinvestments.

>> Scroll down for a list of the biggest trades last week

Hongwei Cai at Dongfang Modern Agriculture (ASX:DFM) spent $6m on company stock.

The 31-year-old chairman owns 64 per cent of the company, down from 80 per cent in 2016.

The citrus grower produces and sells all of its fruit in China.

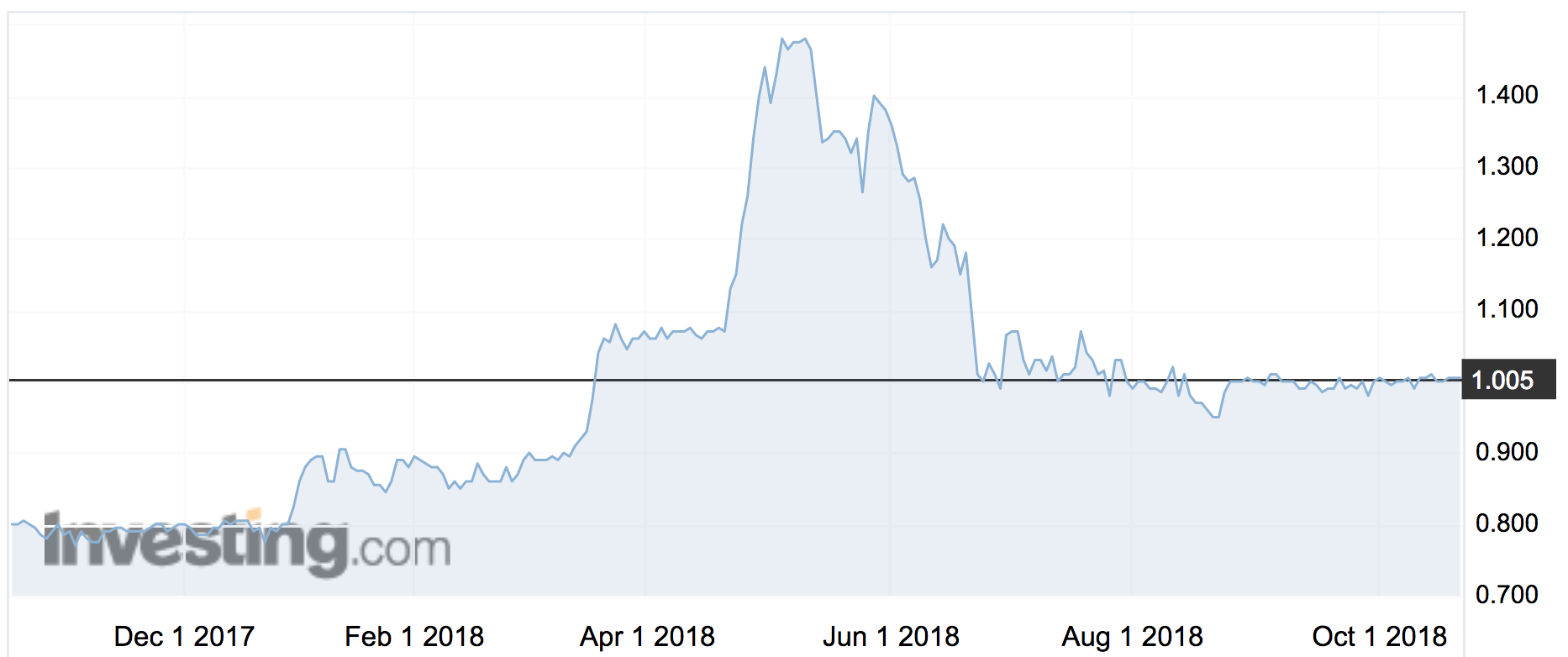

Dongfang shares began a rapid rise at the end of 2017 as the ‘China food’ theme gained traction. It then collapsed and has sat around $1 since June.

He was followed by Metals X (ASX:MLX) chairman Peter Newton — not quite as much of a spring chicken as Mr Cai — who spent $880,000 on market.

Days before Metals X released its quarterly report, saying earnings were up and costs at both the tin and copper operations were down.

Next on the list is the managing director of industrial equipment maker Zicom (ASX:ZGL) Giok Sim. He owns 50 per cent of the company now, after buying a little more stock — 6.5m shares — on market.

Scott Didier listed his family’s ‘panel beater of the insurance world’ — aka an emergency building works — in October last year and is the only director to have been quietly buying here and there since.

Mr Didier’s 26 per cent of Johns Lyng Group (ASX:JLG) is on paper worth over $52m. When the company listed, it was worth $60m.

Mr Didier has been branching out into property and accommodation, buying the East Brunswick Hotel in Melbourne in 2017, in order to bring his children into his business empire.

Richard Homsany lifted his stake in Redstone Resources (ASX:RDS) to 11 per cent last week, while Grant Davey was also buying but this time at Superior Lake Resources (ASX:SUP).

Mr Davey has featured among the big dealers of directors trading in the past but for Boss Resources (ASX:BOE) and Matador Mining (ASX:MZZ).

Last week he lifted his interest in the Canada-focused zinc explorer to 7.6 per cent by spending $127,374 on market.

He is also on the boards of Cradle Resources Limited (ASX:CXX) and Graphex Mining Limited (ASX:GPX).

There was one notable sale last week: Anthony Wooles had to sell $310,000 of Imdex (ASX:IMD) shares to settle a tax bill.

Sweat equity

The happiest fellows and single lady were the ones getting their ‘free’ shares last week.

At Dampier Gold (ASX:DAU) chairman Malcolm Carson and and director Hui Guo received 3m incentive shares each, which on Friday were worth $120,000.

The Kalium Lakes (ASX:KLL) boys Brett Hazelden and Philippus van Niekerk received 1.05m and 300,000 shares as part of a performance incentive plan.

Mr Hazelden’s package was worth $399,000 on paper on Friday, while Mr van Neikerk was worth $114,000.

And lastly, the managing director and CEO of Australia’s most intriguingly coded gas company Senex Energy (ASX:SXY), Ian Davies, exercised stock appreciation rights for $2m worth of stock.

Stock appreciation rights are like options and are given to staff and management if a company performs well. But unlike options, the owner doesn’t have to pay anything to exercise them.

| ASX code | Company | Director | Change | Date | Volume | $ | Where | Total holdings controlled |

|---|---|---|---|---|---|---|---|---|

| AGS | Alliance Resources | Ian Gandel | Buy | Oct 10-16 | 3m | 405174 | On market | 29.9m |

| DFM | Dongfang Modern Agriculture Group | Hongwei Cai | Buy | Oct 15 | 6m | 6060000 | Off market | 270m |

| HOM | Homeloans | Warren McLeland | Buy | Oct 12 | 185,505 | 106327 | Dividend reinvestment plan | 12m |

| HOM | Homeloans | Cholmondeley Darvall | Buy | Oct 16 | 300,000 | $186,000 | Off market | 1.7m |

| SUP | Superior Lake Resources | Grant Davey | Buy | Oct 12 | 2.7m | 127374 | On market | 65m |

| SXY | Senex Energy | Ian Davies | Buy | Oct 15 | 4.3m | 0 | Exercise rights | 6.3m |

| DAU | Dampier Gold | Marcolm Carson | Buy | Oct 16 | 3m | 0 | Incentive shares | 3m |

| DAU | Dampier Gold | Hui Guo | Buy | Oct 16 | 3m | 0 | Incentive shares | 3m |

| IMD | Imdex | Anthony Wooles | Sell | Oct 11-16 | 250,000 | 310000 | On market | 1.25m |

| JLG | Johns Lyng Group | Scott Didier | Buy | Oct 12, 15, 16 | 240,000 | 203847 | On market | 58m |

| KLL | Kalium Lakes | Brett Hazelden | Buy | Oct 17 | 1.05m | 0 | Issue of shares under performance plan | 14.7m |

| KLL | Kalium Lakes | Philippus van Neikerk | Buy | Oct 17 | 300,000 | 0 | Issue of shares under performance plan | 1.5m |

| MLX | Metals X | Peter Newton | Buy | Oct 16 | 2m | 880000 | On market | 16.1m |

| PEA | Pacific Energy | James Cullen | Buy | Oct 15 | 300,000 | 161700 | On market | 500,000 |

| ZGL | Zicom Group | Giok Sim | Buy | Oct 17 | 6.5m | 534148 | On market | 108m |

| RDS | Redstone Resources | Richard Homsany | Buy | Oct 9,10,11 | 17.2m | 291528 | On market and entitlement offer | 52m |