MoneyTalks: Gold, silver, and tin are poised to star in a new dance number

Experts

Experts

Money Talks is Stockhead’s regular drill down into what stocks investors are looking at right now. We’ll tap our extensive list of experts to hear what’s hot, their top picks, and what they’re looking out for.

Today we hear from Arlington Group Asset Management director Simon Catt.

As Catt considers what lies ahead for the new year – tightening monetary conditions, inflation at 40-year highs, slowing growth, record indebtedness and an oil price shock – he asks: “Will we be surprised if the S+P 500 is not 30% lower than today?”

“The bear market of 2022 and 2023 for equity and bond markets is any case already underway,” he said.

“On January 14, 18 US companies made 52-week highs while 63 companies made 52-week lows.

“Inflation driven by wages, housing and energy prices is rising quicker than interest rates.

“In 2021 we favoured energy particularly coal and remain bullish oil, gas, coal, and uranium but our big call for 2022 is precious metals, especially gold and silver.”

Catt is convinced 2022 will be the year where gold makes it revenge over ‘risky crytpo’ as Bitcoin continues to slide before finishing the year sharply lower.

“Some fear higher interest rates are negative for gold but this misses the point that inflation is increasing faster than interest rates, which means that REAL interest rates are deeply negative and falling fast,” he said.

“Perhaps the first Fed rate hike this cycle expected March 2022 will fire the starting gun for gold price appreciation as it did in 2016.”

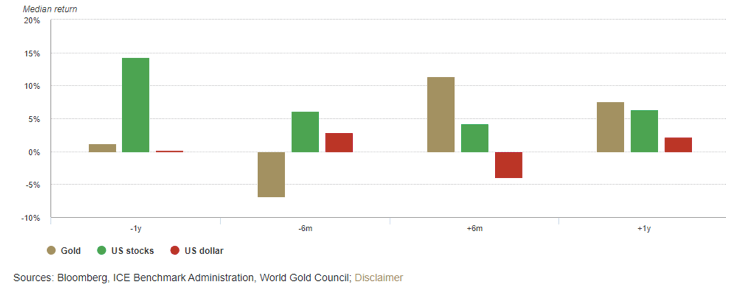

The median returns of gold in the past four tightening cycles is plotted below.

Catt says a sharp slowdown in China seems a significant risk as its government which cares more about control than growth attempts to lock Covid out and fails.

“The US economy is less strong than it looks with consumer confidence at its lowest level in a decade as folk worry about inflation,” he said.

“Hence we are selectively bullish on industrial metals while cautious on the most popular battery metals.

“We see gold heading to $2500/ounce by the end of 2022 and silver $30/ounce.”

FIRST TIN LIMITED

LSE-listed company, First Tin, is Catts’ first pick.

He said along with its plans to list on the ASX by June 2022, First Tin has hired a CEO from top German copper-tin producer Aurubis (Thomas Buenger) and has two significant assets in both Germany and Australia.

“Technical director Tony Truelove will advance the Taronga Mine in Australia and Thomas Buenger will lead the development of the Tellerhauser Mine in Germany,” Catt said.

“First Tin will boast more tin resources than ANY of its listed developer peers with high grades, first world infrastructure and valuable by products with mining permits for both projects.”

WILUNA MINING CORPORATION (ASX:WMC)

“Wiluna will surprise most although not industry observers in 2022 with double production from their gold mine to over 100,000 ounces by mid 2022,” he said.

“We think Wiluna management will deliver and are curious as to what Wiluna’s Russian and German shareholders may have in mind for this future top 10 Aussie gold mine.”

Catt says LEX was both a hero and a villain in 2021, having drilled the ‘Burns’ ‘discovery hole’ in February 2021 of 60m at 5.22gpt gold and 0.38% copper on the edge of Lake Randall.

“Lefroy shares rocketed from $0.20 to $1.50 before quickly retracing to around current levels at $0.30 after failing to follow up the Burns discovery with equally exciting holes,” he said.

“But catalysts for 2022 include following up a number of Burns anomalies underneath Lake Randall with a special ‘lake rig’ drilling ahead now.

“And tier one gold producer Gold Fields are also drilling around 50,000m at the Lefroy joint venture with Lefroy looking for feed for their St Ives gold mine a few kilometres away.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.