Aussie e-tailer Redbubble aims for profit by year’s end

Tech

Tech

Aussie e-tailer Redbubble is aiming to become profitable by the end of this financial year, writes tech expert Tim Knapton of TechVoyage.

Much has been made about the potential carnage in domestic retailing and e-tailing when Amazon physically rolls out its infrastructure in Australia next year.

But one locally founded e-tailer has already been eking out a sizeable slice of markets where Amazon is at its strongest, like US and UK.

Redbubble (ASX:RBL), indeed, is one of the more unique tech plays on the ASX.

Its mission is to build the world’s largest online showcase for independent artists, with a core target of creative millennials.

Redbubble generates over 90 per cent of its revenues outside Australia where it does face some well-funded competition.

But it differentiates itself primarily by the breadth of its range — more than 50 product categories.

Rather than the likes of Amazon and eBay, its closest competitors are niche sites like Society6 and Etsy. It faces more product specific competition from the likes of Minted, Threadless and tee public in tee shirts and wall art.

In some categories it has taken on formidable clicks-and-mortar brands like Ikea, H&M and Typo.

10 million products from 200,000 designers

The Redbubble site carries some 10 million designs across apparel, accessories, stationary and artworks from 200,000 artists and designers.

It also boasts almost 3 million retail customers who it services across more than 20 countries through a network of 24 fulfillers (third party logistics providers).

The site is now generating almost 190 million visits per year. Last financial year its gross transaction value rose by 23 per cent to $175 million. Critically, repeat customers accounted for 40 per cent of that — a ratio that is growing.

As it expands, though, the company’s top line growth is decelerating. Revenues grew by more than 60 per cent in fiscal 2016 and the average order value fell by 8 per cent last year to $48.

However, Red Bubble has a highly experienced executive team underpinned by more than 70 engineers, product managers and data analysts.

Together, they are pursuing a range of growth initiatives based around improving search functionality, boosting customer loyalty, using social media to drive faster new customer acquisition, further broadening product range and migration into new territories and new languages.

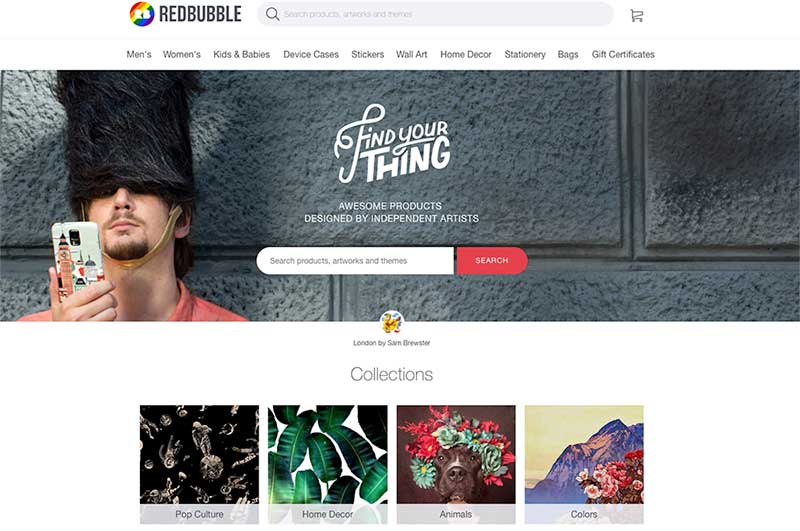

A new Redbubble site feature is Find Your Thing which is designed to help users navigate to the content most relevant to them and also to allow better interfacing with content partners.

The company is deploying its own data science insights to better understand how to convert visitors into customers by analysing how they behave on the site.

Google Shopping and Facebook should continue to be powerful digital channels to mobile shoppers.

Basically, Redbubble retains whatever revenues are not paid in artist margins and tax.

Fulfiller expenses account for over 60 per cent of total costs, with wages, marketing and general op-ex making up the rest.

But there are economies of scale and they are positively impacting the company’s operating leverage — in other words operating expenses are growing more slowly than revenues.

That means that the company can transition into profitability by the end of this financial year.

That could well reverse the decline in the share price of more than 25 per cent over the last three months.

Tim Knapton is the founder and CEO of online tech research and finance marketplace TechVoyage. Its video/financial database and digital broadcast platform provide a more efficient way for investors to appraise listed and unlisted tech companies and for entrepreneurs to finance, acquire and exit them.

Previously Tim was Head of Corporate Broking at Deutsche Australia and before that ran a research department for a leading broking house. Tim has also been a freelance tech/finance journalist for more than 20 years and a columnist with The Australian Financial Review, The Bulletin, BRW, Shares and Australian Business.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.