Guy on Rocks: ‘Panic’ could drive gold price to US$3,000oz, and beyond

Experts

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Gold lost 4% over the last two weeks, closing at US$1,752 (four-week low) on the back of a stronger US dollar.

Platinum finished up 2% for the week to US$897/ounce and palladium reached a two-year low of US$1,772.

Copper was also off 4% to US$4.15/lb cents on poor Chinese economic data; the red metal, however, remains in strong contango.

Uranium went against the trend and closed up US$5 for the week to finish at US$44/lb.

Last week, there was a precious metals summit in Beaver Creek Colorado which was attended by Dan Oliver, founder of Myrmikan Capital.

His view is that gold is still good for US$10,000/ounce (at some point) driven by a tanking US$ in conjunction with rampant inflation of 5% (which he considers is really at 10-12%) and finally, a credit collapse.

Apparently, the Fed Reserve Governors have been meeting with various corporations who are all complaining about rising input prices.

The big question is who will be the buyers of US Treasuries once the taper kicks in? Probably nobody!

Add to that negative real wage growth coupled with most small to medium-sized enterprises in the US believing they will be out of business next year.

While crypto currencies are a possible alternative, Oliver considers that they lack the stability of assets such as gold to be a longer-term alternative investment proposition.

He also pointed out the transition from grain, to silver, then gold over thousands of years demonstrating its long history as a currency.

So, what will drive gold from here?

“What would really drive gold up to the next level, the US$3,000 level, would be a panic… and then the Fed shows up and says ‘hey, US$120 trillion, make it US$500 trillion,’ or a billion a month — whatever the next QE is or some other novel policy they didn’t even announce,” he said.

A rough week on the metals markets as China announced it will release more metal reserves to ease supply shortages.

This includes copper, aluminium, and zinc from state reserves, in order “to overcome mismatches between supply and demand”, according to Li Hui from the National Development and Reform Commission.

Government interventions in metals markets have had limited medium to longer-term price impacts so if the Chinese government comes to the end of these reserves there is no stopping metal prices in my view.

Anyway, good on them for trying!

Recent negative sentiment towards metals has also been attributable to weakening construction activity indicators in China and the high likelihood of China credit tightening into this weakness.

There also appears to be a disconnect between metals prices, China PMI and Global PMIs (copper demand weighted and country-by country amplitude adjusted) over the past three months.

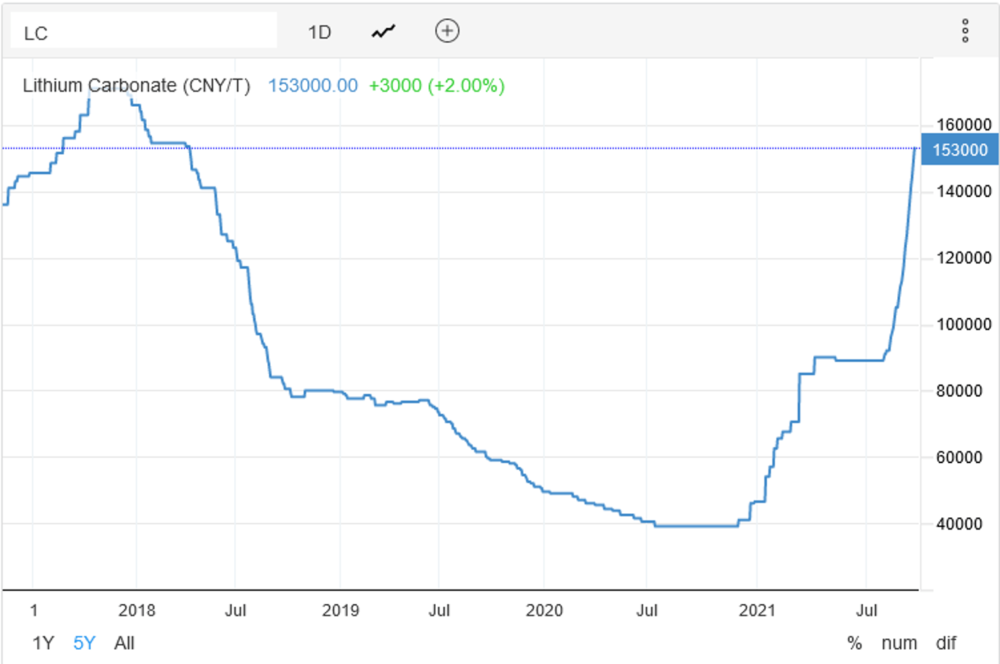

Domestic Chinese lithium carbonate prices on the other hand have been surging recently (figure 3) with S&P Global Platts battery-grade lithium carbonate at a record yuan 170,000/mt ($26,372.94/mt) compared to its previous high of yuan 160,000/mt.

Everyone is talking about iron ore and its apocalyptic retreat driven by the slowdown in China and reduced steel output.

With October delivery Dalian futures now around 625 yuan or US$96.6/tonne (figure 4), I would have thought those concerned about inflation and input prices would be relieved to see this play out.

Short term, I believe we will see a bounce in iron ore with a recovery in steel consumption after a very sharp drop over recent months.

With iron ore (CFR China, 62% fines) tanking to under US$93 (figure 4) it looks like GWR Group (ASX:GWR), which is currently in a trading halt, is about to put up the white flag at its C4 iron ore deposit near Wiluna, with the transport costs over the 711km journey to the port of Geraldton being a bridge too far.

The project was being operated by private developer Pilbara Resource Group. No doubt if market conditions improve, the project can be brought back online.

Fenix Resources (ASX:FEX), with C2 costs of around A$100/dmt, is still looking profitable with margins in the range of A$40-50/tonne after going ex-dividend (5 cents) on 21/9/2021.

Other iron ore juniors such as Strike Resources (ASX:SRK) have also seen significant declines from 30 cents in mid-July to around 11.5 cents at the time of writing.

I do feel for Venture Minerals (ASX:VMS) whose life as an iron ore producer lasted just one month before operations were suspended (VMS, ASX announcement 17/9/2021).

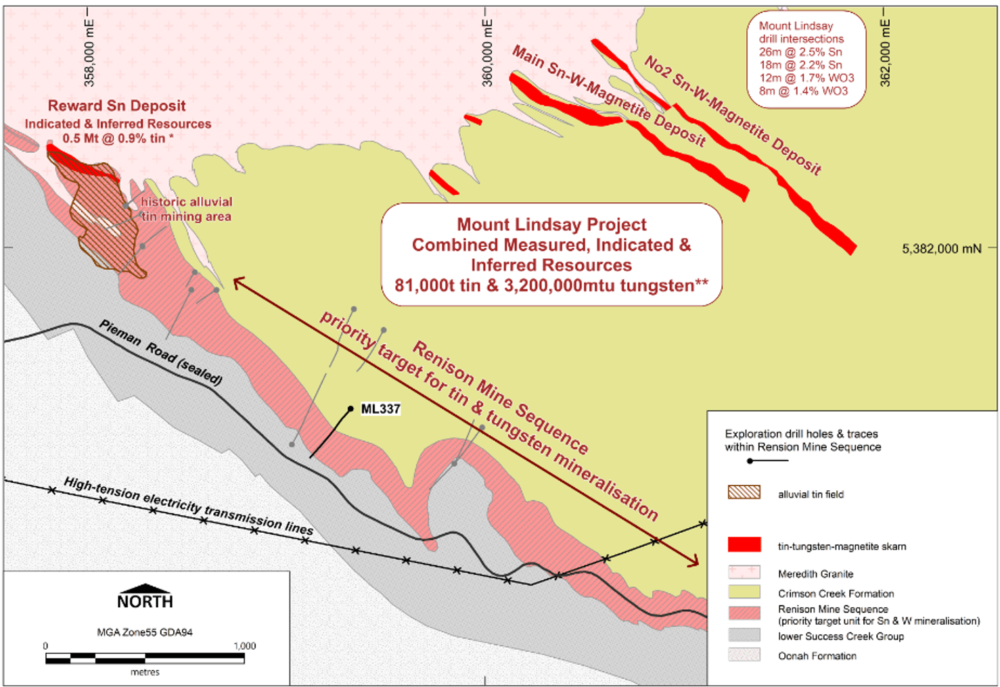

Anyway, not the end of the world for VMS, who are proceeding with a drilling program at Mt Lindsay targeting skarn mineralisation that may represent an extension of the Renison mine (former high-grade tin producer) sequence.

Recent drilling intersected potentially tin bearing magnetite rich skarns (figure 6).

Rio Tinto (ASX:RIO) ($133 to $93), BHP Group (ASX:BHP) ($53 to $37) and FMG (ASX:FMG) ($26 to $14) have led the decline.

In the case of FMG, margins still remain strong at CFR 62% Fe (equivalent) costs of around US$58/tonne, so there could be a trading opportunity here as always on any bounce (and short covering) in the iron ore price (figure 7).

This may well happen when Chinese steel mills kick back into gear, which can’t be too far away with margins well and truly restored to sustainable levels.

The elephant in the room short term, however, may be the prospects of Chinese property developer Evergrande whose debt has ballooned to US$300 billion and remains under significant pressure.

It will be interesting to see if any government support is forthcoming…

The Evergrande crisis comes as the US Federal Reserve has its two-day monetary policy meeting beginning Tuesday morning and ending Wednesday afternoon with a statement and press conference from Fed Chairman Jerome Powell.

The marketplace is wondering if a big sell-off in global stock and financial markets early this week would impact the Fed’s discussion on the timing of tapering its bond-buying program.

Merger and acquisition activity is in full swing, and the recent volatility may provide some interesting opportunities.

Metalicity Limited (ASX:MCT) is attempting to consolidate its position for its Kookynie and Yundamindra gold projects (WA) with a 4.81 for 1 paper bid for joint venture partner Nex Metals (ASX:NEX).

If successful NEX (figure 8) would end up with around 38% of the merged group. A bit more jousting to come yet but I think this deal makes sense and will eventually get across the line.

With the gold index off almost 40% from its July 2020 highs I believe it is time to re-enter the mid to large cap gold stocks and I think Evolution Mining (ASX:EVN) is probably a good option.

While FY21 gold production of 681,000 ounces was below FY2020 levels of 747,000 ounces, underlying net profit was still a robust $354 million for FY 2021.

The earnings outlook is a little flat, however there is reasonable growth from Red Lake (Canada) and Cowal over the next 4-5 years as they ramp up to full production.

All-in-sustaining costs are sub-A$1,300/ounce with CitiResearch projecting gold production to rise to over 940,000 ounces by 2024.

EVN are a little more conservative in their growth strategy, sticking to First World jurisdictions, and somewhat cautious about stretching their balance sheet, however the company provides good leverage to any bounce in gold.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.