Guy on Rocks: Are cracks starting to appear in the EV story?

Experts

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

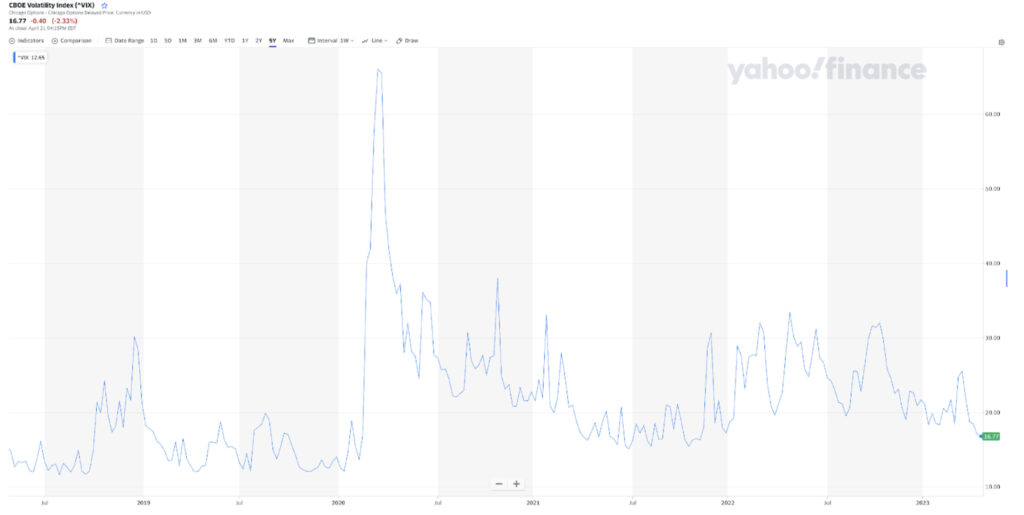

A relatively quiet week if the VIX index (figure 1) is anything to go by which closed at under 17 well below the 5 year mean and median. Major indices were also little moved as US, European and UK PMI figures came in higher than expected. The US came in at 53.5 (consensus 51.2) while Europe came in at 54.4 (consensus 53.7).

The market is now waiting for what looks like an almost certain interest rate rise next week around the 25-basis point mark with a remote possibility of 50 basis points.

Gold dropped US$23 to close at US$1,982/ounce for a 1% loss and silver closed the week down 1.3% to finish at US$25.02/oz. There was no obvious reason for these moves other than some likely profit taking as the USD index was little changed.

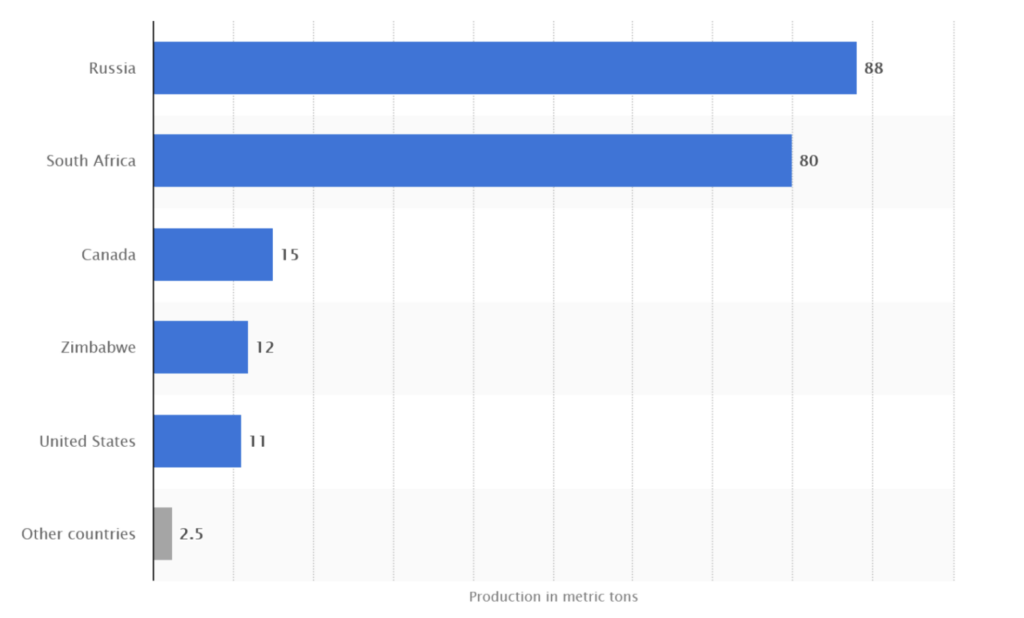

Platinum on the other hand closed up 7.5% to a year – to date high of US$1,123/ounce while Palladium finished the week at US$1,535/ounce up almost 7% as the market reacted to power blackouts in South Africa which accounts for just under 40% of world production (figure 2).

Copper finished at just under US$4.00/lb down 2.5% for the week, remaining flat on fears of further Chinese lockdowns and recession fears.

UBS have downgraded their near-term lithium carbonate prices (figure 3) by 10-30% over 2023/24, a huge variance which will clearly demonstrate how difficult pricing lithium equities will be in the short to medium term.

No doubt this challenge will extend to mine financing however there appears to be enough industry participants and downstream players to finance lithium projects. The downgrades have come on the back of weaker Chinese demand. At the same time UBS have upgraded longer-term spodumene, carbonate and hydroxide prices by around 20%. This was also reflected, according to UBS, in a decline in the popularity of EV’s as affordability in Europe appears to be a concern with a subsequent 5-15% drop in lithium demand.

I think there are a few cracks starting to appear in the EV story.

If anyone would like to know what the food-ration lines looked like in WWII they should head down to Dunsborough and watch the line of EV’s inch forward in the extended line as they recharge their batteries. Bringing adequate clothing (in case the seasons change while you are in the line), food and water is essential for this exercise. The DC fast or ultra-rapid station should see times reduced to around 20-60 minutes depending on a range of factors.

And how green are they really?

Yang Shao-Horn, a Professor of Engineering at MIT (15 July, 2022) points out that most lithium is extracted from hard rock mines or underground brine reservoirs with much of the energy used in the extraction and processing coming from CO2-emitting fossil fuels. Furthermore, to synthesize materials needed for production, heat between 800 to 1,000 degrees Celsius is required, which can only be cost effectively reached by burning fossil fuels, which adds to the CO2 emission footprint.

With China using coal fired power stations to satisfy 77% of the world’s supply one could argue that we are going backwards?

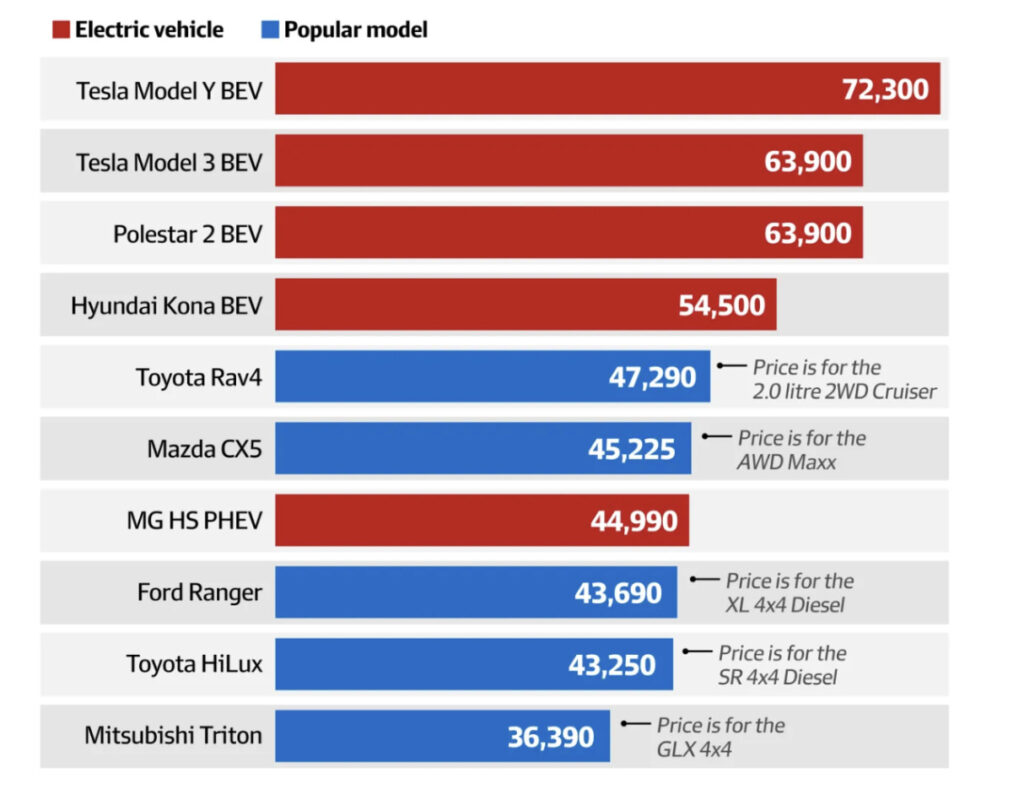

While affordability is an issue in Australia (figure 4), range anxiety is likely to see Australia lag behind the rest of the world in terms of market penetration.

In developments on the copper front, Chile announced that they are nationalising the lithium industry, an interesting move which has previously failed for those who can recall their attempt to nationalise the copper industry around 50 years ago.

Uranium started making the headlines again a few years ago hitting US$44/lb back in September 2021 which represented a nine-year high. Sprott launched its Sprott Physical Uranium Trust back in July of that year and has since accumulated around 61Mlbs of uranium. Over the last three years, the Uranium spot price has slowly inched up to US$51.63/lb. In a move that is likely to tighten the uranium spot market even further, I read over the weekend that Swiss based Zuri-Invest have just closed their initial US$100 million placement in a new physical Uranium Trust.

Rumour on the street on Toronto is that there are more physical uranium-based funds in the hopper ready to launch.

With producers US, France, Japan, UK, and Canada, agreeing to form an alliance to combat Russia’s dominant position in the global nuclear fuel market, which last year supplied nearly 40% of the global market in enriched uranium, you would think the stage is set for Uranium to explode and re-test the highs of 2007.

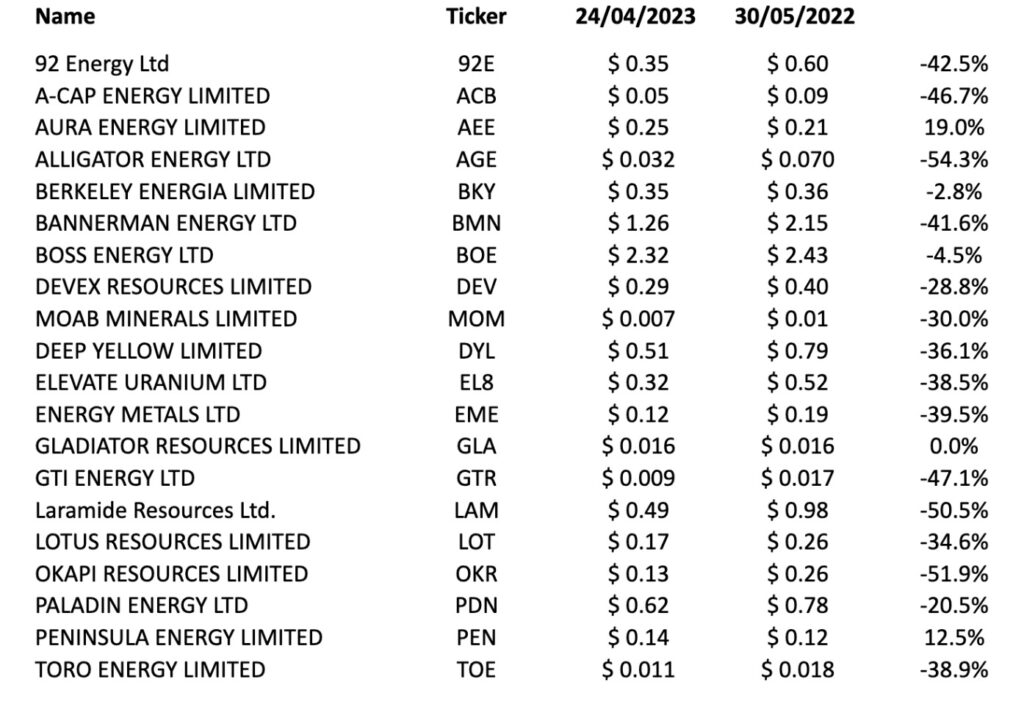

Meanwhile, uranium equities are approaching 52-week lows, surely there must be an opportunity here?

As table 1 demonstrates, uranium equities have had a tough year since I last review the ASX uranium players, despite the uranium spot price outperforming much of the base metal and energy sectors for that matter. A quick glance at the TSX-V list of uranium players tells a familiar story.

If you prefer a lower risk approach I would lean towards the near-term producers and advanced developers such as Paladin Energy Ltd (ASX: PDN) that are gearing up for a restart in Q1 CY 2024 with Langer Heinrich now 40% complete. The company is fully funded for a restart and had in excess of $140 million in cash at the end of last quarter. The Company has five uranium offtakes, with counterparties from the US, Asia, and Europe.

Life of mine production is projected to be over 75Mplbs of Uranium at a C1 cost of around US$27/lb. Macquarie (Macquarie Research, 20/4/2023) have pegged the valuation at around $1.00/share which I wouldn’t disagree with.

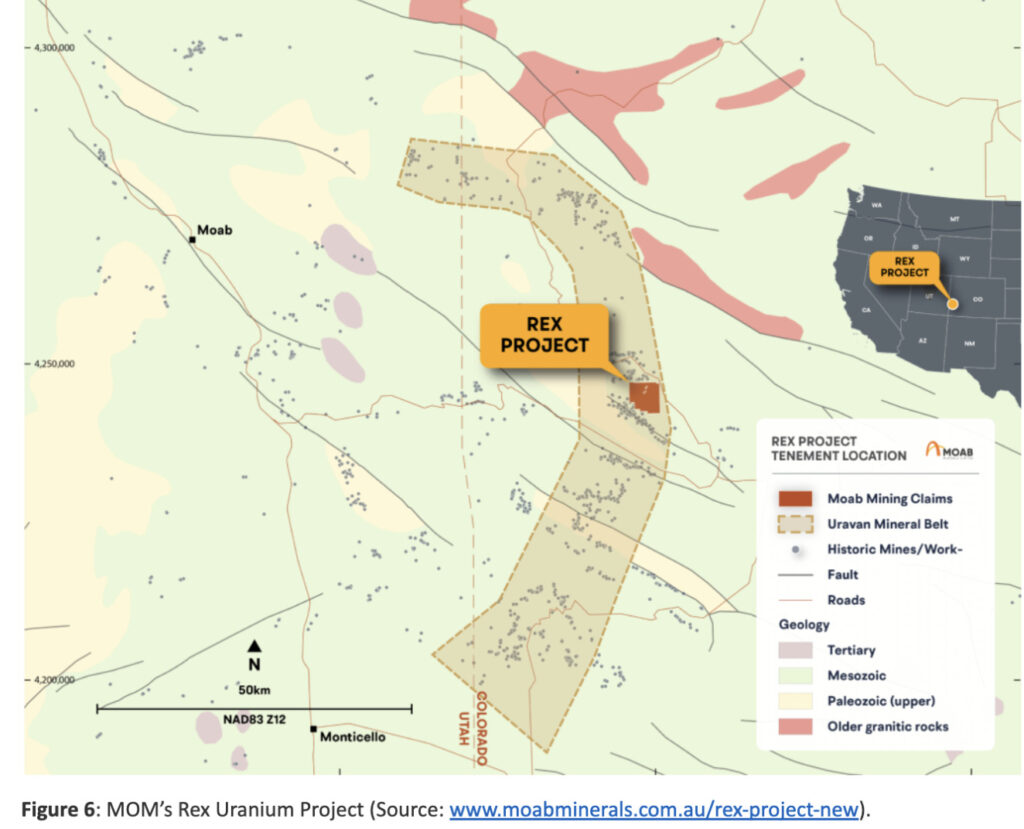

I think an investment in PDN could be rounded off with something on the smaller end such as Moab Resources Ltd (ASX: MOM) who have some good acreage in the US which is being managed by fellow Cigar Social member and Chairman of the Cigar Social Climate Change sceptic committee Mr Geoff Balfe. As you recall Moab was formerly called Delecta and was in the business of selling fluffy toys with batteries in them to the school drop off set in the Western Suburbs of Perth (and to similar wildlife in other capital cities).

I wonder if those toys could be reconfigured to run on nuclear power? Well, that could be hard to compete with!

The 60% owned REX project (figure 6) in Colorado covers around 256 contiguous claims (around 20 square kilometres) and contains a number of historic uranium mines including, Blackfoot/Rattlesnake, Wedge, Merry Widow, Sunbeam, and Vanadium King that have seen little or no comprehensive exploration since the 1970’s. The nearby Mi Vida uranium mine also produced around 22,000 tonnes of uranium from its discovery in 1952 to 1965.

Significantly, the project is situated within trucking distance of the White Mesa Mill, an operating uranium-vanadium mill with 90% spare capacity available to toll treat ore.

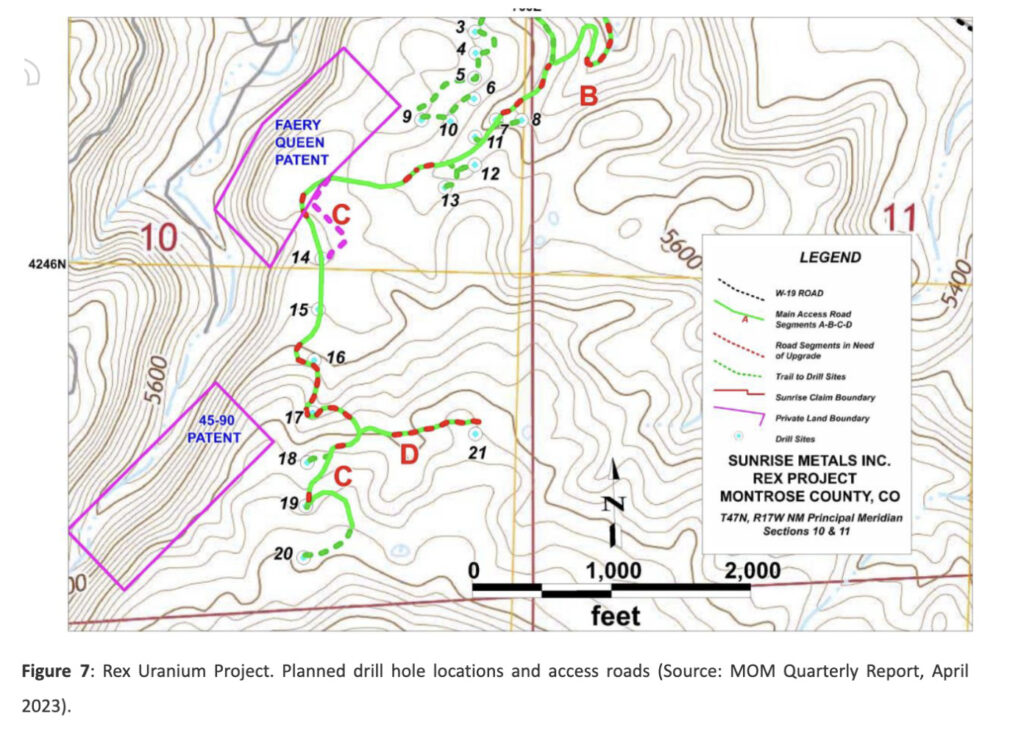

The Company has recently lodged a Notice of Intent to undertake a 3,000 metre, 21 drill hole program at Rex with a baseline environmental monitoring program having already commenced (figure 7).

Apparently Moab is a place in Jordan where God renewed his covenant with the Israelites before the Israelites entered the Promised Land. This has to be true as it is set out in Deuteronomy 29:1. I think all those who renewed the covenant could have also qualified for a free gift from Delecta.

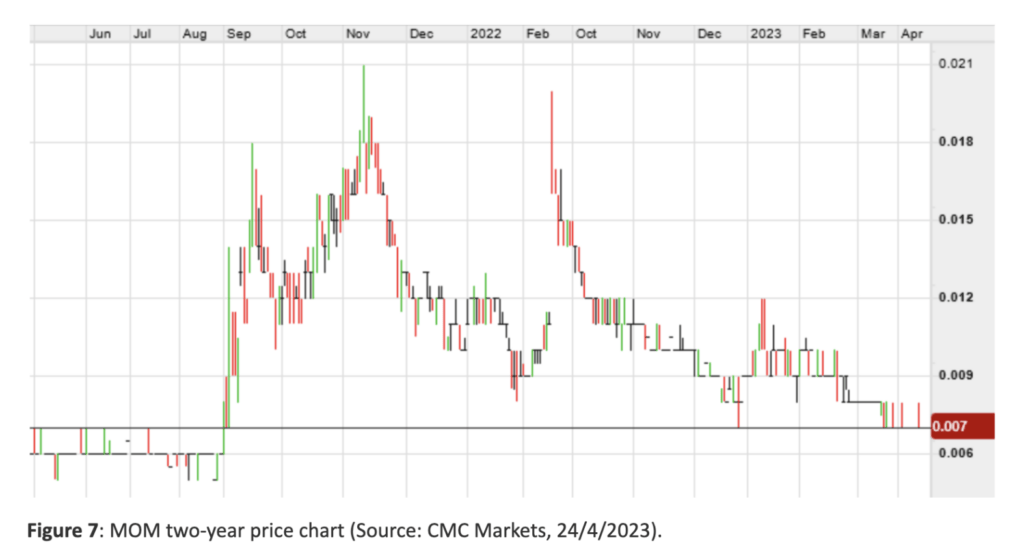

At $0.007/share, over $5.0 million in cash and market capitalisation of $3.3 million I can’t see too much downside. After all, the Company has a wealth of experience with things that are hot and glow in the dark…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.