Guy on Rocks: Copper supply crunch ‘to end all supply crunches’ is coming

Experts

Experts

Guy on Rocks is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

While gold was more or less flat last week finishing up US$4 per ounce to US$1782, that hasn’t stopped some die-hard believers such as NYSE listed analytics software manufacturer Palantir from taking the plunge, adding US$50 million in gold bars to their treasury, according to their latest earnings statement.

DiMartino Booth from Quil Intelligence said many companies have lost confidence in central bank monetary policies.

She pointed out the distention among Federal Reserve Committee members regarding the handling of interest rate moves, inflation and tapering policies.

From what I can work out the Fed is reluctant to ‘upset’ financial markets, however with little or no prospect of a fourth round of stimulus and with the inflation genie out of the bottle, it is only a matter of time before we see a return to a tightening of monetary policy.

Quil also noted the rapid rise in second tier lenders in the United States known as Private Credit (apparently the banks are reluctant to lend to them?) who have extended credit beyond $1 trillion…

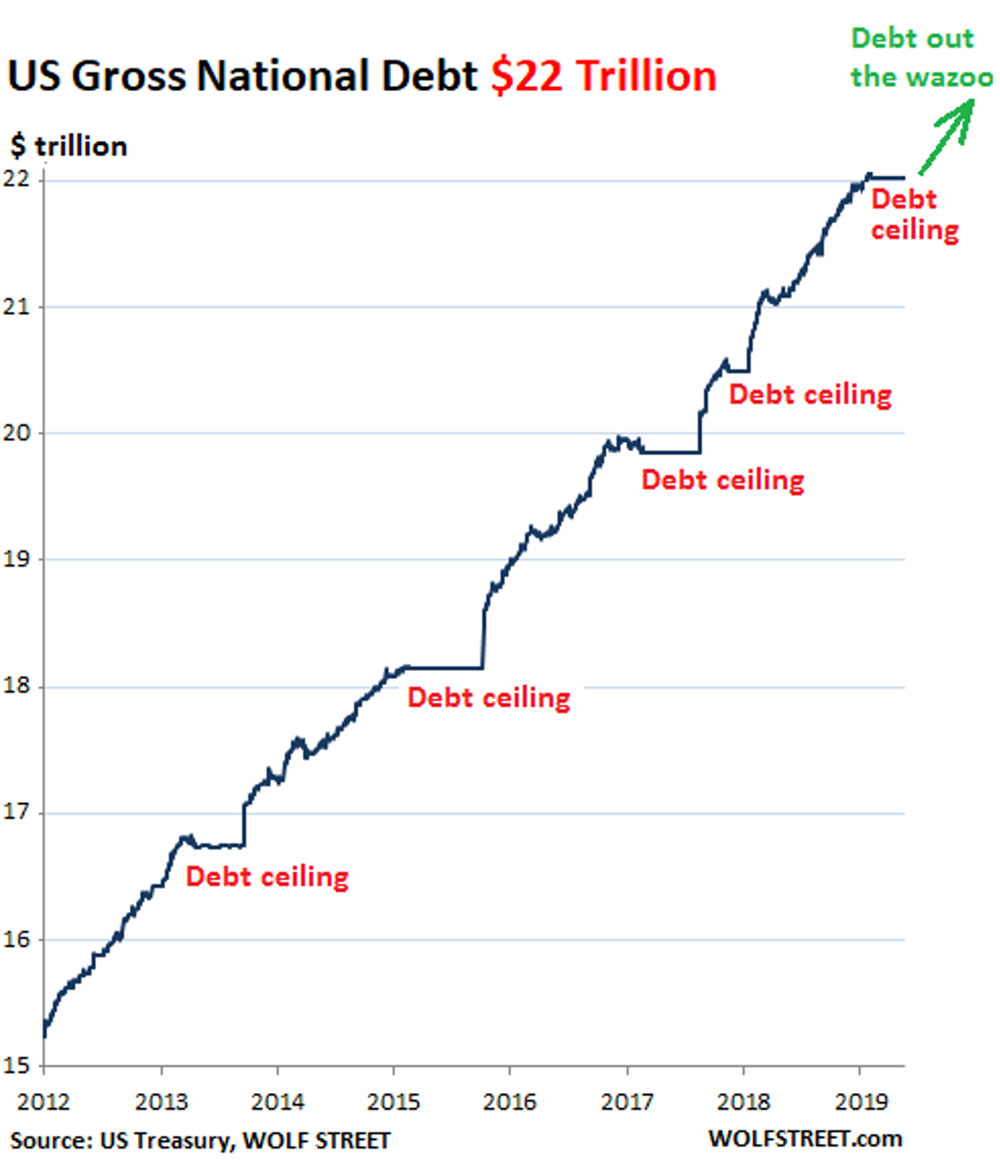

With the Republicans doubtful as to whether they will vote in favour of lifting the debt ceiling (figure 1) beyond US$3.6 trillion later in 2021, anything can happen!

In February 2021 Tesla also signalled a potential move into gold.

Sounds like a re-run of the collateralised debt obligations (CDOs) blow-up as eloquently explained by Margot Robbie in the bubble bath in “The Big Short” (2015).

Central banks, governments and the broader investment community now appear to be in denial pointing to the yield gap between interest rates and equities supported by a politically correct low interest rate environment.

And as we know (according to a HotCopper luminary), ‘denial’ is not a river in Africa.

My view is the Federal Reserve wouldn’t know its arse from a hole in the ground when it comes to forecasting interest rate movements so we shouldn’t rely too much on any of their calming statements ahead of its September meeting in Jackson Hole.

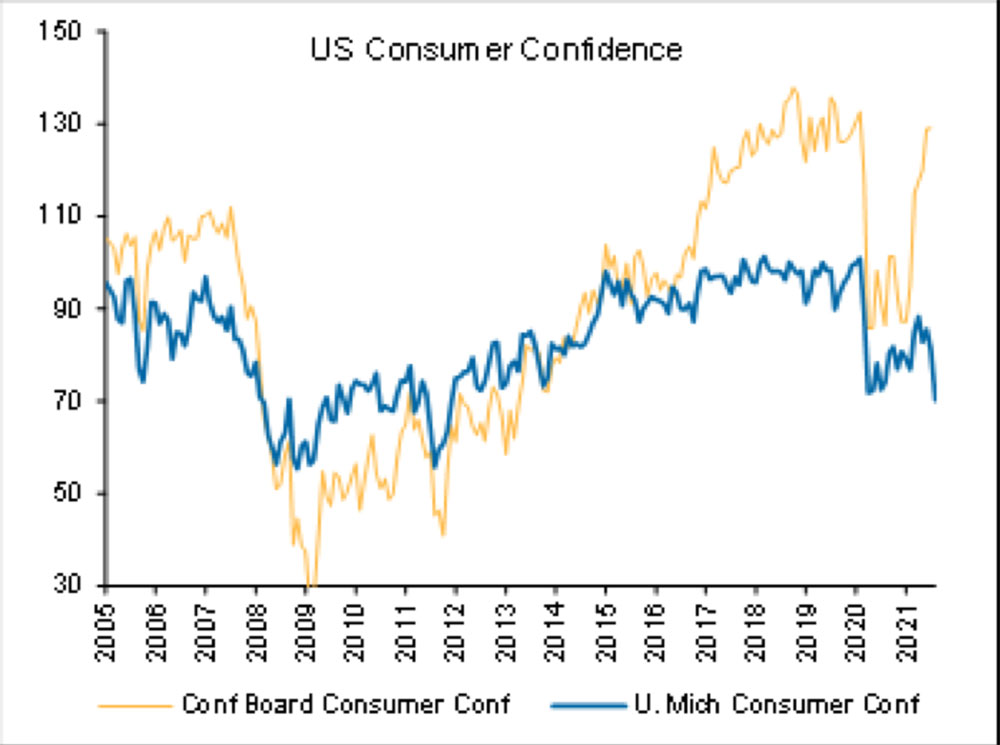

Recent falls in US consumer confidence (to 70.2 – figure 2) shows greater levels of trepidation emerging among the population in the land of peace and justice. And while the Delta COVID-19 variant takes hold, things aren’t likely to improve in the short term.

All other metals appeared to be in correction mode from their July 2021 highs, with platinum down US$32 to close at US$991/ounce and palladium down US$370 to US$2,206 per ounce.

Platinum is now down 13% and palladium 21% from their recent highs with news that car manufacturers are cutting production.

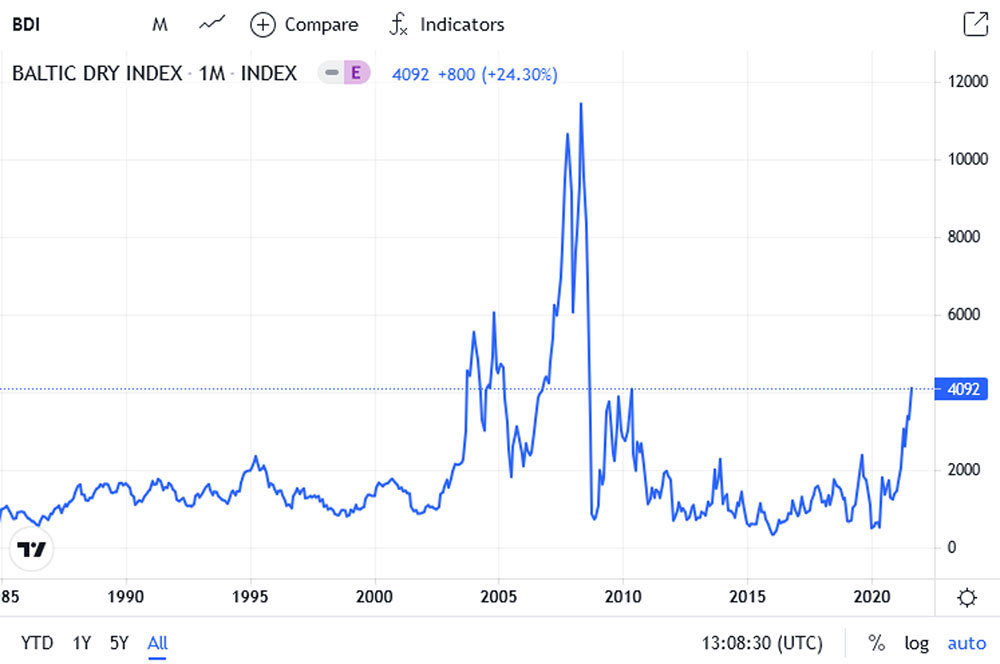

Going against the trend however is the Baltic dry index (a measure of the cost of moving raw materials by sea) at just over 4,000 (figure 3), close to its highest level since the 2008 GFC.

For those who weren’t around back in 2008, that is a time when many of us here in Perth (and elsewhere for that matter) almost disappeared up our respective rear ends.

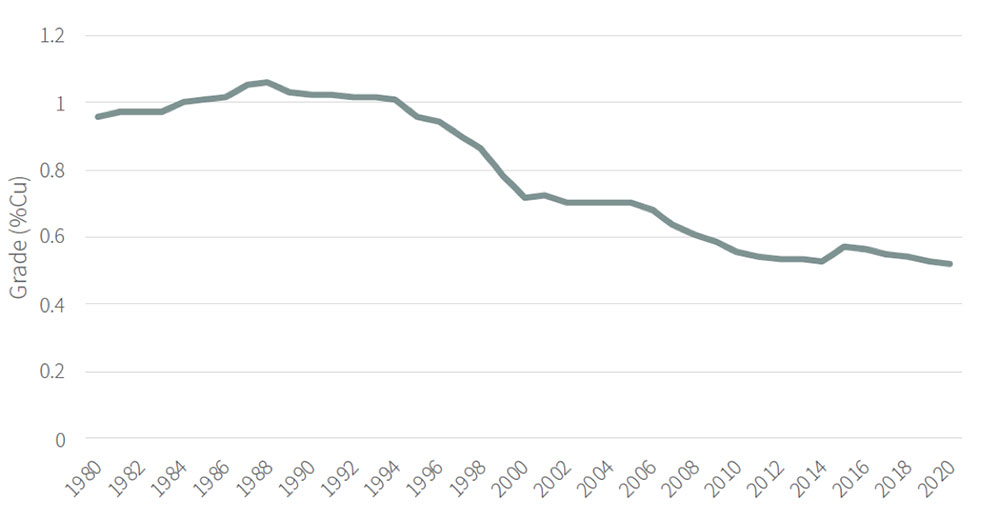

Before I get in my bubble bath for some deep thinking (I haven’t received a return phone call yet from Margot Robbie but that can’t be far away), here are some interesting statistics on copper showing declining grades (figure 4) and reserves (table 1) .

Looks like a supply crunch to end all supply crunches is on its way.

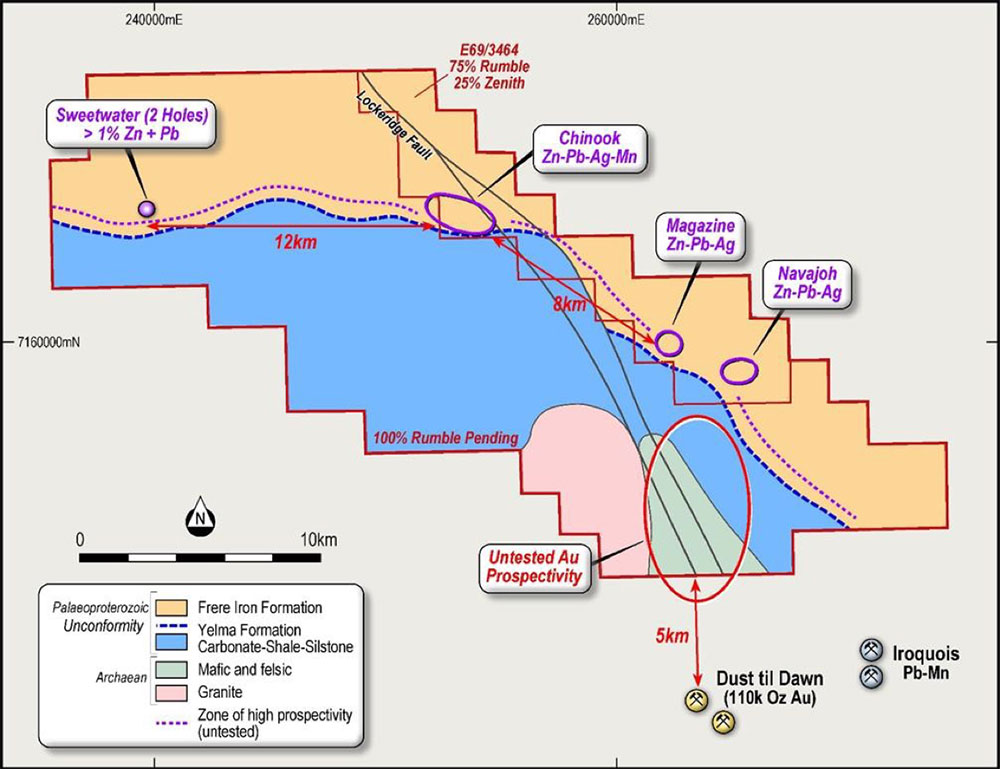

We picked up Rumble Resources (ASX:RTR) (figure 5) at 16.5 cents back in April 2021 and it looks like they are turning their Chinook Zinc-Lead discovery (figure 6) at the Earaheedy Project (approximately 110km northeast of Wiluna, WA) into Swiss cheese with a 40,000 metre RC and diamond drilling program (and a few sonic holes thrown in).

Processing of the recently completed infill gravity and passive seismic survey is also underway.

RTR also has eight geologists and 13 field technicians operating out of a 24-man mobile camp.

Drilling is targeting the northeast dipping Zn-Pb-Mn-Ag mineralisation at Chinook and will then move on to test multiple inferred feeder structures containing near surface higher-grade Zn-Pb-Mn-Ag mineralisation.

The program will also test for mineralisation between Chinook and the Magazine/Navajoh prospects, situated approximately 8-10km SE along strike from Chinook.

The company has an exploration target of 100-120Mt (3.5% – 4.5% Zn-Pb).

With an enterprise value of around $200 million, still some room to move on the share price in my considered opinion…

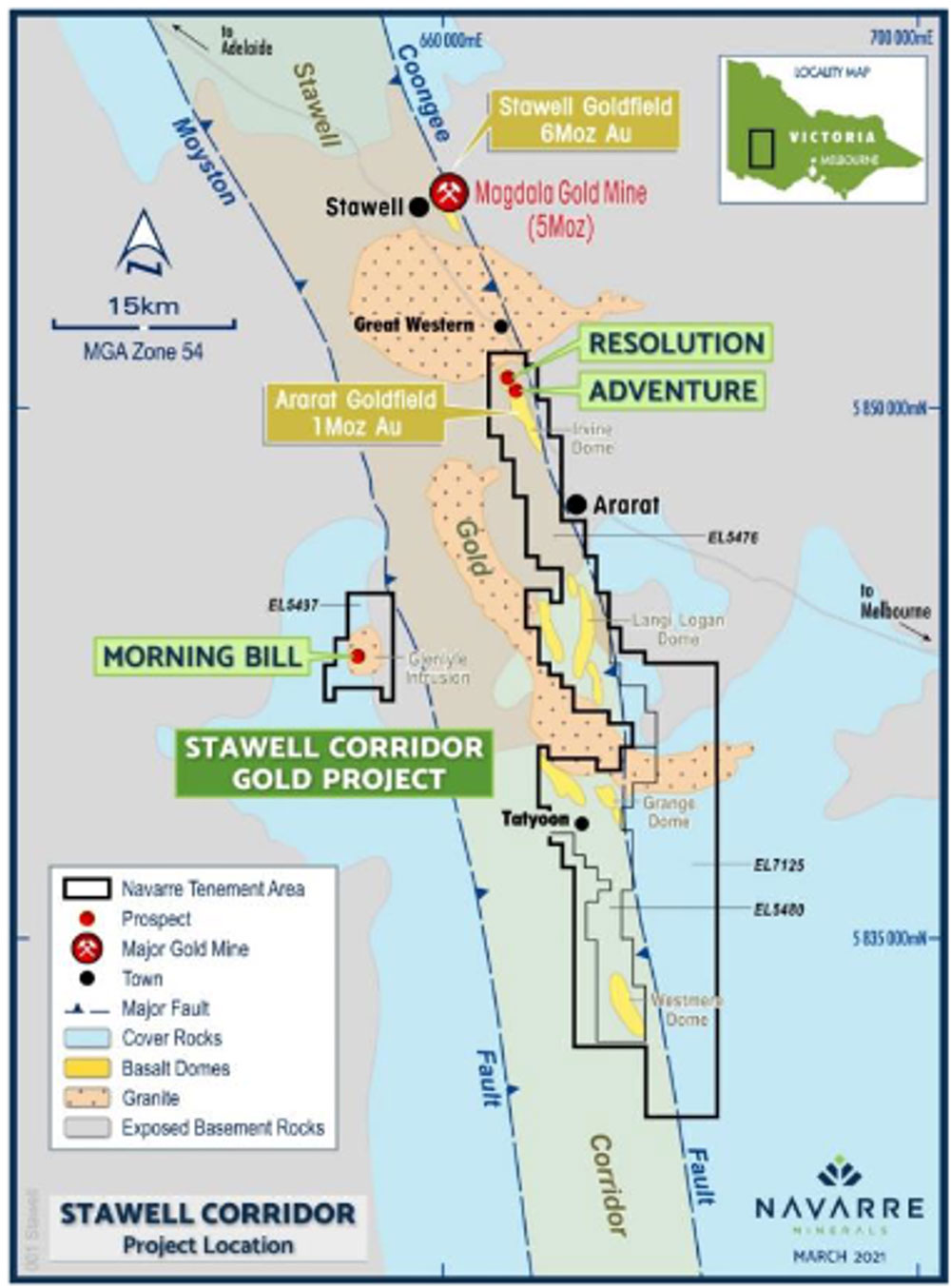

I have been following explorer Navarre Minerals (ASX:NML) (figure 7) for a few years which has been active in the highly prospective Stawell Corridor (figure 8 and 9) in Victoria (a forgotten state somewhere on the east coast of Australia).

Until now however I have thought the stock somewhat expensive.

NML is chaired by ex-stockbroker and geologist Kevin Wilson (no relation to Kevin “Bloody” Wilson) and led by former Vice President of gold miner Kirkland Lake Gold (TSE: KL). (That’s the Canadian company making the equivalent of the GDP of NZ every week from the Stawell Gold Mine.)

Looking at the share price trajectory, with around $14 million in the bank and an enterprise value of $40 million, I am thinking I might be getting close to dipping a toe in the water.

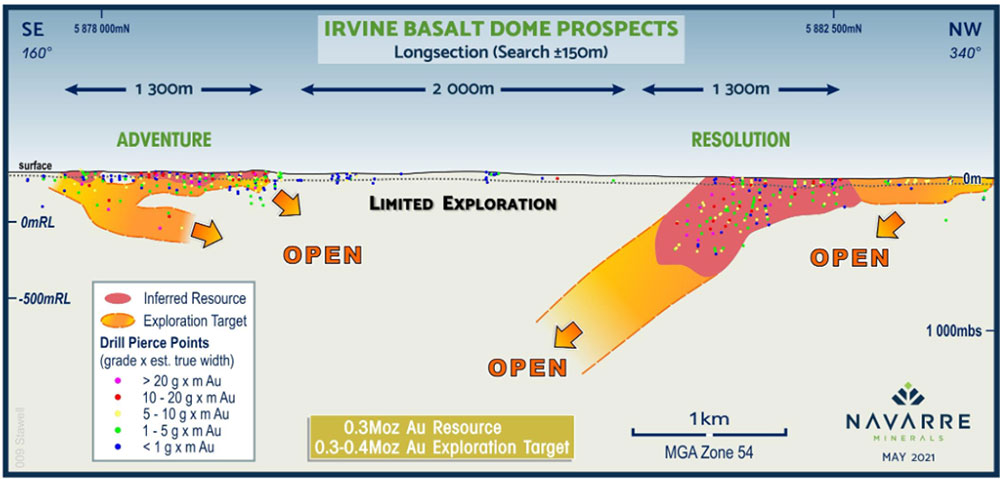

The company, surprise surprise, is chasing mineralisation along the Stawell structure with a view to adding to its existing 300k ounce gold JORC resource at Resolution and Adventure (figure 10) in the northern part of the tenements (figure 9).

There are also multiple targets to the south of these resources as set out in their 19th August 2021 Virtual Gold Presentation.

A busy 2H 2021 exploration schedule as figure 11 suggests so it would be good to see some further exploration success here before we handball it to another Canadian company on the cheap…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.