Guy on Rocks: A ban on Russian copper would send shockwaves through markets

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

With negative real interest rates and US inflation at 16% (based on 1982 metrics) it is not surprising to see figure 1 showing a broad lift in the key commodities including copper and oil.

In a recent Kitco interview Steve Hanke, Professor of Applied Economics at Johns Hopkins University, suggested last week’s 25 basis point hike in the US won’t do much to dent inflation which he anticipates will be in the 6% to 9% range until 2024.

Oil price volatility has continued, trading in a range of US$96-US$106/bbl for the week closing at US$104.42 or off 4% for the week.

Copper (figure 2) closed up 6 cents to US$4.65/lb, up 6 cents or 1.3% for the week and remains in a significant 7 cent contango for three-month delivery suggesting a bullish copper outlook.

The dramas in South America are ongoing with NYSE listed Southern Copper Corporation reporting a cessation of mining at the Cuajone Mine in Peru after being blocked by protesters.

The mine producers around 7,000 tons of copper annually.

The LME’s copper industry group recommended banning new deliveries of Russian metal to LME warehouses which, if it proceeded, would send shockwaves throughout the markets.

As the Stockhead faithful are well aware, Russia is the third largest exporter of refined copper and seventh largest producer of copper accounting for approximately 4% of global production.

The LME then went on to comment that its “priority is to maintain an orderly market for the benefit of all participants”.

If the nickel market is anything to go by (Russia accounts for just over 16% of global nickel production), such a move could see a chaotic and dysfunctional copper market.

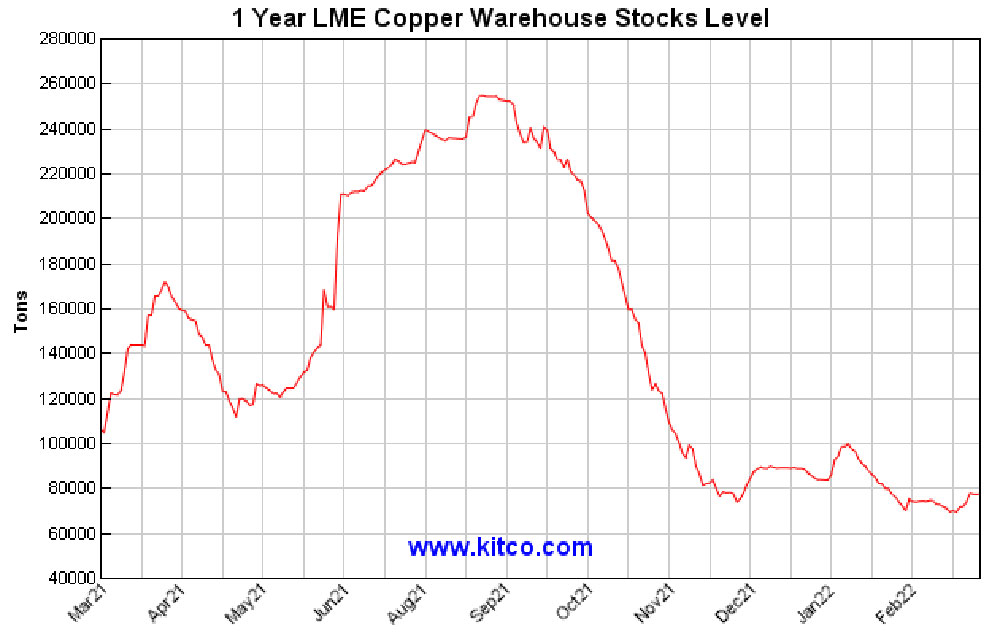

With copper inventories at a 16-month low (figure 3) this might be a bridge too far and to date Europe has not placed any sanctions on Russian metal producers.

Just over 11 years from the Fukushima incident (not “disaster” as some Woke luminaries like to refer to it), uranium briefly touched US$60/lb last week and closed at around US$52/lb with the Sprott uranium trust adding around 300,000 pounds bringing their total inventory to just under 52 million pounds.

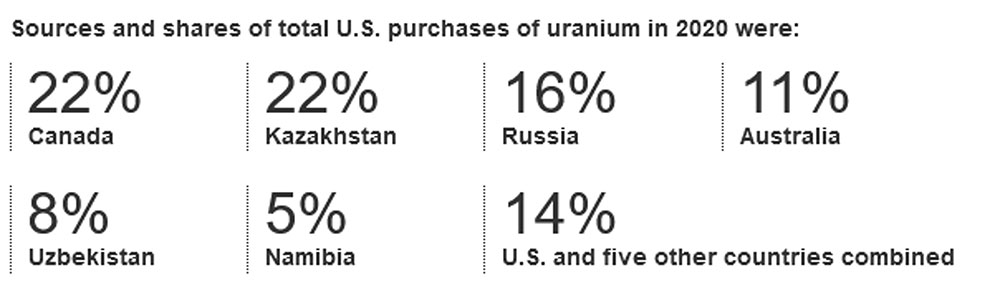

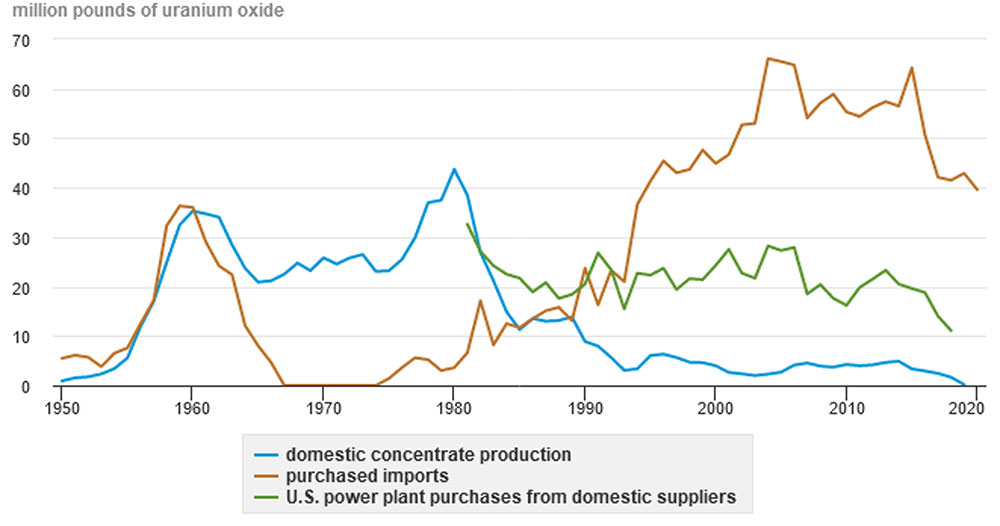

The US remains a net importer of uranium (figure 4, 5), another market that is looking “tight” with Russia accounting for 16% of those imports.

Kazakhstan has a pro-Russian government so that makes 38% of US uranium imports with Russia.

It will be interesting to see how this plays out. Not surprisingly, we are seeing a significant increase in the number of junior uranium listings both in Australia and Canada.

I know all of you brave Stockhead luminaries would have filled your boots with Nickel Mines (ASX:NIC) around $1.16 after having the benefit of reading this column last week.

Fortunately, the stock has put on around 10 cents since then, as we have now learned from state-backed Shanghai Securities that Tsingshan (JV and offtaker to NIC and world’s largest stainless-steel producer) has cut a deal to two companies to swap its nickel products with a purer form of the metal to close out its short positions.

Anyway, we await news that it has actually exited its 150,000-tonne short position but it appears to be under control, if there is such a thing in the nickel market.

As of 9th March 2022, Ord Minnett had a valuation of $1.60/share on NIC based on a nickel price of just over US$32,000/tonne.

Ord Minnett also consider that production could grow from to 130Kt p.a. of nickel generating free cash flow of US$500 million per annum by 2025.

By way of comparison Nickel West (BHP) produces around 90Kt per annum.

With a current market capitalisation of $3.3 billion, this could turn out to be an interesting 3–5 year play assuming no more drama on the LME…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.