Free Whelan: Why we haven’t seen the worst of the global food crisis, and what that means for investors

Experts

Experts

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Writing this on Monday arvo, and first off there’s a serious issue in the food space that we’re all starting to acknowledge.

(Actually I’ve been crowing about it for two years and it’s reaching some kind of explosion point, the likes of which we can’t even imagine.)

You see, the issue is — OH MY LORD WILL SMITH JUST HIT CHRIS ROCK WTF!!!

OK, more on food in a bit. But for now, I’ve taken my ‘Market is Out of Traction and Back in Action‘ theme of last week to new levels.

Money flow is still strong in the markets you’d like to see it flowing strongly in, even though everyone around you keeps pointing at all the issues in front of us.

Know why that’s bullish?

Because they can’t identify that list of things at all and the details behind them means the Unknown Unknowns become Known Unknowns and are converting to Known Knowns.

(Ed note: If you think the Whelan train started rattling off the tracks there, school yourself on this classic footage.)

For example:

We know what the Fed wants.

We know what Biden wants.

We know what China wants.

We even know what Russia wants.

There isn’t much that isn’t already known to the market as being ‘the worst thing that could happen’.

Will the economy break? Possibly.

But everyone is talking about it, so it’s not an amazing shock that’s waiting in the wings for us.

For investors, that’s an important difference (if you want to know why, read this).

Jobs are still abundant, and growth is still where it needs to be.

Here’s something very smart to think about:

Many asking how $SPX rallied 400+ points on horrible news. It always does: Every low in history (see March 2020) occurred on a bearish news backdrop. "Markets climb a wall of worry". If trading headlines instead of the chart, you'll always be on wrong side. Vice versa for highs pic.twitter.com/U2dVTeNeNH

— Adam Mancini (@AdamMancini4) March 27, 2022

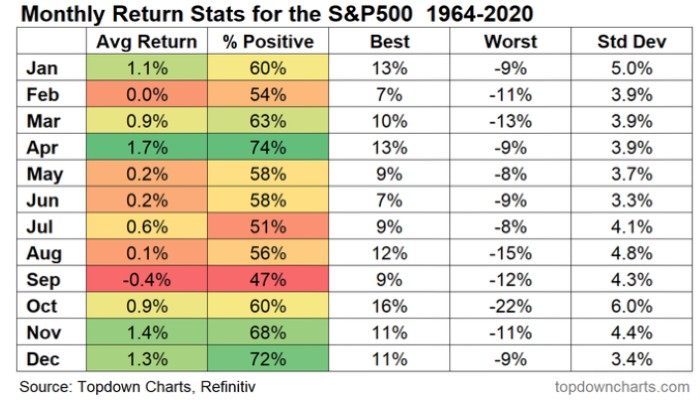

You want to run with something for April? How about that April is green (on markets) about 80% of the time?

Hat tip to Callum Thomas at Topdown Charts for this, which I start every presentation with. The market just moves pretty much the same way every year:

I really should update this chart to include 2021, but there’s enough data here to make an assumption if you’re into seasonality.

In other news, more parts of the yield curve are inverting and you’ll see everyone talk about how that means we’re in for a recession.

This is correct; yield curve inversions are recessionary indicators.

Also, it’s historically been impossible to get inflation back below 5% after it goes above it (which it has now done in the US) without causing a recession.

Just…be aware of that, OK?

Now, to food.

I could (very easily) drop three recent links from solid journalists showing just how severe the fertiliser issue is getting.

Materials and energy costs fuelled by, well, pretty much everything means farmers have to use less.

Crops will be smaller, food will be more expensive.

Globalisation looks like it’s dead too. Borders up, food hoarding like we’ve not seen since after the GFC.

Pick a fertiliser company you like and get after it. For me, FOOD is a handy ETF with a mix of good global food and fertiliser and machinery companies.

Take a look at the FOOD chart. I know what you’re thinking; it’s run pretty hard already right?

My take; I honestly think we haven’t seen the worst of the food crisis.

Trade that as you see fit.

All the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.