You might be interested in

News

Weekly Small Cap and IPO Wrap: It's a Pass mark for fresh Labor Gov despite tech sell offs and choppy Chinese outlook

IPO Watch

IPO Wrap: A lottery operator and SEVEN explorers listing in the next two weeks

Mining

Mining

Copper has a strong outlook but ageing mines may have an impact on supply says top expert and MineLife founder Gavin Wendt

Give us a quick recap of the copper market in recent years.

A cursory glance at copper’s recent price performance (see below) shows a metal that’s effectively been in a bull market since a broader commodity market low in late 2015 and early 2016.

That coincided with a bottoming of negative sentiment related to a perceived Chinese economic slowdown and a somewhat sluggish world growth picture. But it has been on the up ever since.

Copper’s price recovery has significance from a broad perspective, because of the metal’s value as a barometer of economic health more generally — as a staple of construction and infrastructure building.

Its gains have coincided with increased optimism about the state of the world economy and more optimistic growth forecasts. That’s seen best with the subdued performance of copper following China-US trade uncertainty in the past few months.

That being said, it is my view that the bullish thematic for copper remains firmly in place, based on a very sound outlook in terms of demand-supply fundamentals.

Where do we get the most of our copper today?

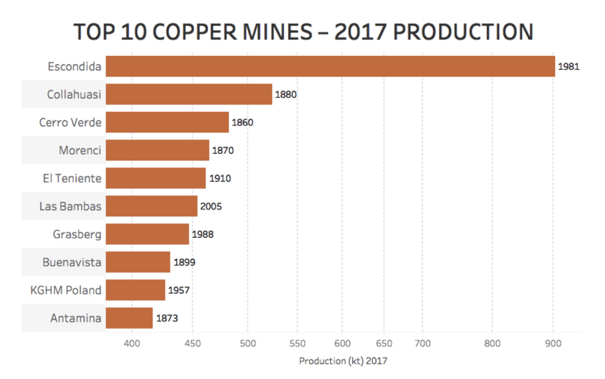

The graphic below shows that steady copper supply depends on a few giant deposits that were discovered many generations ago — and have been mined for decades.

The age of the mines in current production does pose a significant threat.

The median age for 2017’s top ten copper mines (in terms of production) is 95 years. The ten largest mines constitute nearly 25 per cent of annual world production.

Applying a cut-off for 2017 of 400 kilo tonnes per annum (ktpa), only one project – Oyu Tolgoi’s underground expansion – will enter the top ten in the coming decade. The Mongolian mine is expected to reach peak production of 560ktpa by 2025, following a $5.3 billion investment from Rio Tinto.

What do the ageing mines mean for global supply?

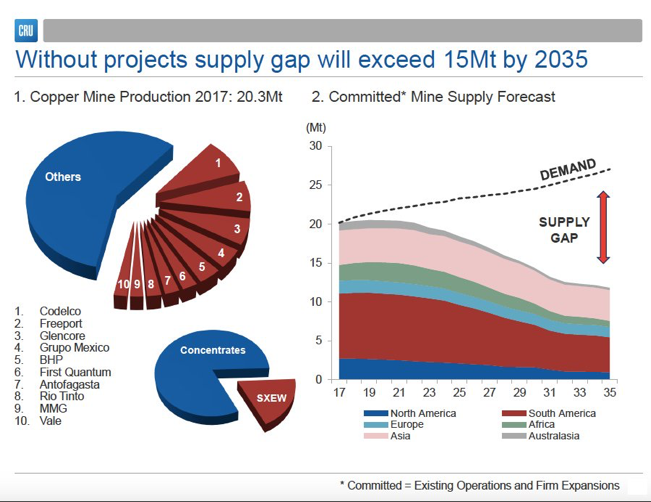

The latest data from the International Copper Study Group (ICSG) reflects this reliance on ageing mines.

It points to a 21 per cent year-on-year widening in the global deficit of refined copper, as refined supplies have remained stagnant.

During 2017, the global refined copper balance slid to a deficit of 163,000t — compared with 135,000t recorded during 2016.

Global copper mine output fell by 2 per cent to 20 million tonnes during 2017 — mainly attributable to a 1 per cent decline in Chilean production (the world’s largest producer).

Meanwhile lower grades at mines in Argentina, Canada, Mongolia and the US resulted in 59%, 14%, 14% and 12% fewer tonnes of copper produced respectively.

Global refined output during 2017 rose by 0.6% to 23.5 million tonnes, while primary production declined by 0.15% and secondary production (scrap) increased by 4.5%.

Where will copper demand come from in the future?

Growth in copper metal demand will be driven by robust gains in building copper wire and tube, increased investment in electric power wire and cable and advances in durable goods manufacturing output.

Global demand for copper metal is likely to grow by around 4 per cent annually for the next few years.

Meanwhile, increased infrastructure investment, particularly in developing countries, will further benefit copper suppliers, as well as advances in global manufacturing output.

Not surprisingly, China drives the global copper metal market, accounting for more than two-fifths of world demand.

But we have to keep an eye on India — which is forecast by many market-watchers to register the fastest gains of any major copper metal market over the coming years.

How big an impact will electric cars have on copper demand?

Growing numbers of plug-in electric vehicles (PEV) will drive demand for more than 40 million charging ports by 2027, according to International Copper Association (ICA) research.

More than 100,000 tonnes of copper will be needed just in port-charging cables, charging units and wiring to electrical panels.

The global PEV population might now represent just 1 to 2 per cent of global car sales — but this will likely increase to 58 million by 2027.

Copper is also likely to be a major beneficiary of the growing global water crisis.

Copper use in water and waste-water utilities could grow to 260,000 tonnes per year by 2027, the ICA says.

Copper already exists in big quantities throughout the water utility segment. However as the spotlight falls on improving efficiency measures and replacing ageing infrastructure, the current demand level of 39,000 tonnes is set to grow rapidly.

What are some ASX copper stocks that stand to benefit?

Minotaur Exploration (ASX:MEP) has extensive exploration tenements in South Australia, NSW, Victoria, Queensland and Western Australia and specialises in the application of innovative geophysical techniques to locate mineralisation deep below the surface, where conventional exploration methods such as soil sampling cannot be applied.

MEP’s remote sensing and interpretative approach has proven highly successful, leading to the discovery of deposits including the world-class Prominent Hill orebody in South Australia, with the group being highly regarded by its peers.

The company is actively exploring for IOCG-style targets in South Australia, Queensland and the Northern Territory, where geophysics have identified numerous sub-surface anomalies prospective for copper-gold mineralisation and other targets prospective for base metals such as zinc, lead, copper.

Orion Minerals (ASX:ORM) took advantage of lacklustre commodity markets during 2015 to acquire strategic interests in what are advanced projects at Prieska in South Africa, with significant production potential and resource upside.

Prieska was a former mining operation that close in 1991 and there’s a lot of production-ready infrastructure left behind. Of particular recent significance is the maiden Mineral Resource for Prieska, which has far exceeded ORN’s original expectations.

It demonstrates that Prieska is a very large VMS body and also bodes well for a positive outcome from the comprehensive BFS that’s currently underway. Activity levels and news-flow will continue to be high during the course of 2018, as EIA and BFS studies are completed.

Nzuri Copper (ASX:NZC) is an emerging copper-cobalt play that’s focused on the identification, acquisition, development and operation of high-grade copper and cobalt projects in the Katangan Copperbelt of the Democratic Republic of the Congo (DRC).

All eyes so far have been on the company’s Kalongwe Copper-Cobalt project, which is its 85% owned flagship development project.

Kalongwe is located towards the western end of the world-class Central African Copperbelt, less than 15km from where Ivanhoe Mines Ltd (TSX: IVN) has announced a second world-class copper discovery at Kakula.

NZC’s Kalongwe project already hosts a near-surface JORC resource of 302,000t contained copper and 42,700t contained cobalt as predominantly oxide ore. NZC has just release an updated Stage 1 Feasibility Study that delivers an impressive pre-tax NPV of US$186 million, a 99% IRR and increased Ore Reserve that now underpins an 8-year mine life.

Gavin Wendt has been involved in the Australian share market for the past 20 years as a resource analyst. He specialises in researching and evaluating mining and energy companies.

After many years as a broking resources analyst with Intersuisse, Gavin helped establish the Fat Prophets Mining Report in 2005, writing and producing the report until he established MineLife in 2010. MineLife’s core reader group comprises sophisticated investors, finance industry professionals, resource industry executives, retail investors and self-funded retirees.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.