Could the ASX be about to hit its all-time peak?

Experts

Experts

Hold onto your hats, one expert reckons the ASX could be very close to a new record.

Investors know all too well the pain of last year’s “bleak” end – when the All Ords slumped from a 2018-high of 6,481 points to 5,709 points.

Thankfully 2019 is looking a bit rosier. In fact, so much so that this year could be record breaking.

Investment analyst and commentator Rod North predicts that the All Ords now has the best chance of beating its previous all-time market high of 6,873 points in November 2007 and is set to reach 7,000 points by year’s end.

But it’s not going to stop there, according to North, who says he is no “side-show alley fortune teller” with over 30 years of experience in the analysis of sharemarket behaviour and movement in the world’s financial markets. He sees the All Ords moving higher still heading into 2020.

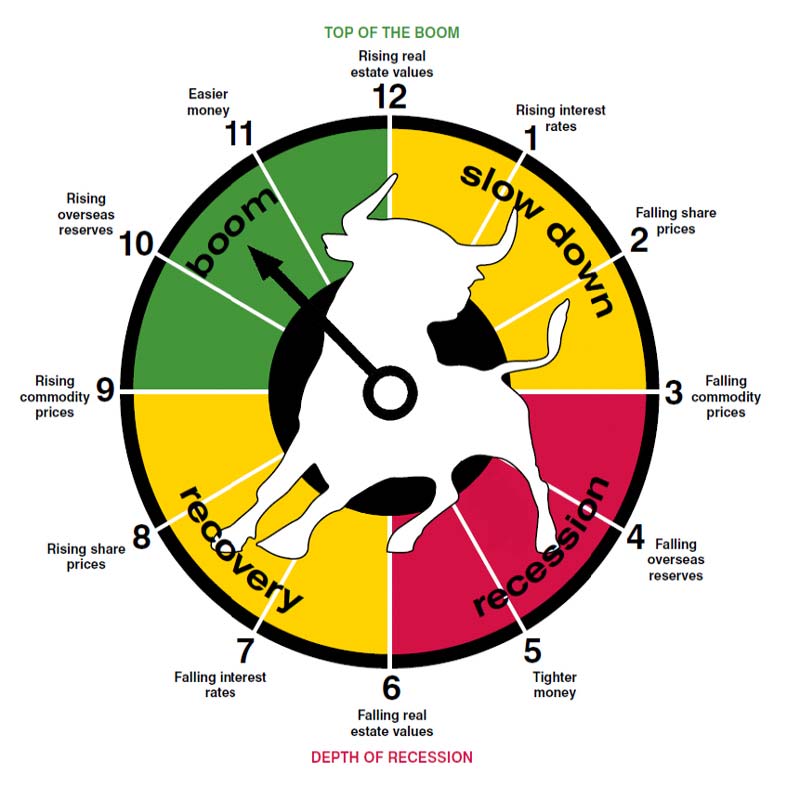

“We are now in the ‘Boom Phase’ of the Investment Clock (see below), meaning that the seeds of the recovery are now sown and given rising and sustainable earnings, share prices will rise as unemployment falls, commodities prices continue to increase, overseas reserves are rebuilt and property investment remains an attractive investment opportunity given gains achieved from sharemarket investment,” North said.

“However, this is a time where we need to become extremely cautious because at some point, in the mature stage of the ‘Boom Phase’, we will enter the ‘Greed’ cycle.

“Remember that earnings, earnings, earnings will always drive share prices up.

“As we advance further into the ‘Boom Phase’ don’t listen to advice on shares from the taxi or Uber driver, the tennis coach or the conversation at a dinner party. Often these amateur share tipsters are providing you with information that’s like a stick of gelignite with the fuse lit and set to explode at some point. You just never know how long or short the fuse might be.”

Here’s why North thinks the market is about to peak:

Profits, profits everywhere

According to CommSec, 93 per cent of the companies that reported half-year results this February earnings season posted a profit.

North says the second half of 2019 is also shaping up to continue a trend of improved earnings and profitability that will play a part in driving the sharemarket higher.

Hooray! Higher dividends

CommSec data also shows that around $29.4 billion was paid to shareholders over the February to June period, up from $26 billion in the August 2018 reporting season.

Rising commodity prices

North pointed to comments by the Reserve Bank of Australia that over the past year, the index has increased by 12.6 per cent in special drawing rights (SDR) terms, led by higher iron ore, LNG, and beef and veal prices.

In Australian dollar terms, the index has increased by 18.3 per cent.

Overseas reserves growing

Trading Economics says foreign exchange reserves in Australia increased to around $80 billion in May from $75.7 billion in April.

However, that figure edged back to $77.5 billion in June – still the second highest level over the past year.

Lower interest rates

In June the RBA cut the cash rate by 25 basis points to 1.25 per cent. It’s the first official interest rate move in almost three years, North noted.

The RBA then cut the rate by a further 25 basis points, taking it to a record low of 1 per cent.

“With the cash rate at this level and likely to go lower, the sharemarket will be a major beneficiary as investors chase yield,” North said.

Banking investigation done and dusted

The Banking Royal Commission was wrapped up in early February with the release of the final report.

Political uncertainty in Australia eases

With the May election behind us and the Libs back in power, investors have relaxed, according to North.

“This removed the uncertainty of which party would govern Australia for the next three years and confirmed the status quo,” he said. “Investment markets don’t like uncertainty.”