Commission-free trading is ramping up, but experts warn investors to do their homework

Experts

Commission-free trading is gaining momentum around the globe, and it’s only a matter of time before it comes Down Under, but experts are warning it’s a case of ‘buyer beware’.

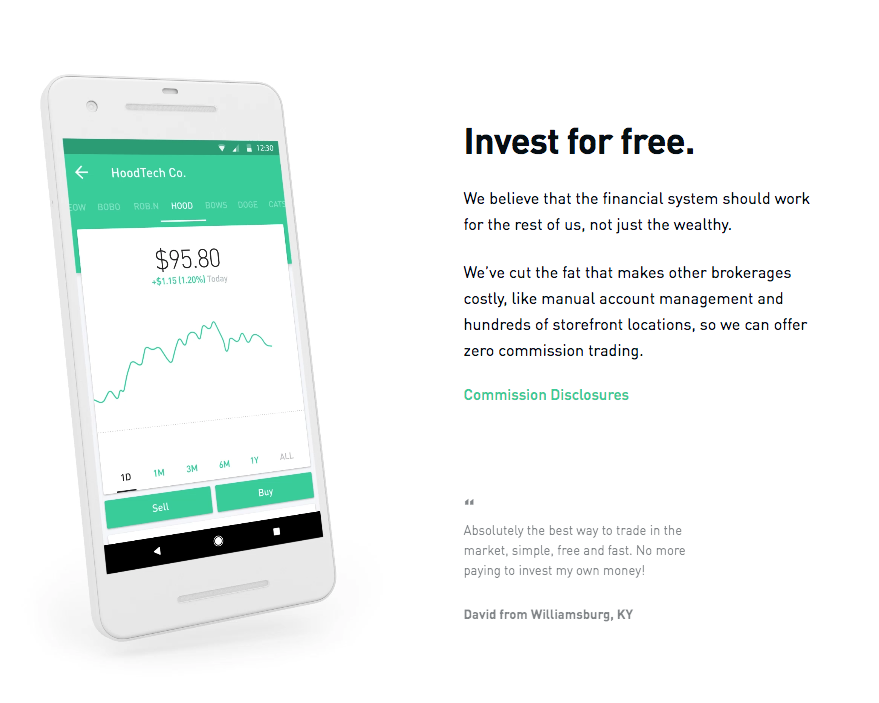

Five years ago the first ever commission-free brokerage was Robinhood. As it gained traction, more established brokers such as Charles Schwab, Ameritrade and E-Trade followed the company’s lead.

The emergence of commission-free trading could threaten local brokerages Bell Potter (ASX:BFG) or Euroz Securities (ASX:EZL), among others, which rely on commission as a source of income.

Exchange Traded Funds are another industry in the financial market where costs are plummeting.

Compared with traditional portfolio management and directly investing in currencies and commodities, which some ETFs track, they have lower management fees and are easier to trade.

Since the first ETF launched over two and a half decades ago, the market has grown to hold $5 trillion in assets.

While ETFs still charge management fees these are typically small percentages of the customer’s investments (usually below 1 per cent).

At the start of 2019 multiple fee-free ETFs began to emerge.

US institution Salt Financial turned the industry even further on its head by launching an ETF that would temporarily get 50c back for every $US1,000 sitting in the fund.

So in effect you’re getting paid to invest.

Balaji Gopal, head of product strategy at Vanguard, said last week at a Bloomberg seminar that while the cost of investing was going down, there was no such thing as a free lunch.

“The big winners out of this are investors whether you’re an investor or an institution,” he said.

But he labelled Salt’s ETF and zero-cost ETFs “ridiculous”.

“Our view is in order to launch a product it costs money,” Gopal said.

“How can you offer something at zero, what is the value and what is the utility of that zero fee – where else you are paying?”

Brokerage-free platforms such as Robinhood make their money through alternative ways, particularly fees.

While it is not yet known how Robinhood’s structure would work in Australia, regulatory trading fees are still charged for US investors.

One example is the SEC & FINRA’s Trading Activity fee which is $US0.000119 per share. Admittedly this is rounded up to the nearest penny and is no greater than $US5.95.

Robinhood would not comment on its expansion into Australia or its potential fee structure in that country, with a spokesperson saying only that the company is “currently focused on our expansion into the UK and don’t have any other updates to share at this time”.

Another platform we have had exposure to is Stake, which focuses on US stocks. Stake makes money by charging a forex conversion fee on each deposit. For a $10,000 deposit, this equates to $73.50 or 0.735 per cent.

There’s no suggestion any platform is hiding fees or not being transparent. These are publicly available before you sign up as a client.

As for ETFs, no other company has yet followed Salt Financial’s lead of paying clients to invest.

The regular fees apply once you have invested over $100m in Salt’s ETF and the ‘cash back’ offer will cease starting April next year.

Kris Walesby from ETF Securities argued investors were not doing enough homework generally.

“Many read the title of the ETF and get in,” he told the Bloomberg seminar. “Many think ‘it’s a US yield fund so I know how it works’. They don’t know what it does.

“When Obama passed regulation easing on Cuba, the ticker with CUBA went up even though it had nothing to do with Cuba.

“People expect simplicity because it’s an ETF but they’re on a scale of complexity. You do need to do research.”

Read More:

Is commission-free share trading coming to Australia?

The Secret Broker: When men in tights ain’t a bad thing