Escrow: Here’s why it’s worth watching and which stocks are releasing shares soon

Escrow Watch

Escrow Watch

Just what is escrow in relation to ASX shares and why should you care?

ASX shares in escrow are “locked away” so owners can’t sell them – until they’re released. Such shares are typically called “restricted securities” by the ASX.

Escrowing shares is a common move for ASX-listed companies raising money, particularly when they’re seeking to IPO. It’s geared to show investors’ confidence in the company and remove concerns they’ll just “sell out” after listing.

While there’s no guarantee the holders of those shares will sell, the mere fact they will have the power to do so, after lacking it for a period of time, can be unsettling to other shareholders.

The temptation to cash out may be high if the stock has gone up or down substantially and this can affect the share price for other shareholders. While it’s difficult for company directors to cash out and still hold face, it’s not so much for fund managers or brokers who may have moved on to other deals long ago and may want to share in their winnings or take the tax loss.

Escrow agreements will be publicly disclosed in a company’s prospectus and are typically for a set calendar period such as 12-24 months.

Most of these are voluntarily agreed to between the company and the shareholders but the ASX has the power to otherwise force such agreements.

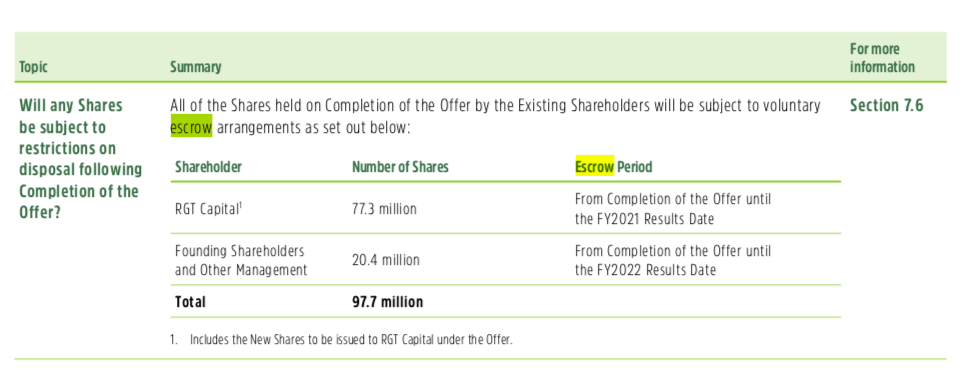

To illustrate, here’s the example of listee Youfoodz (ASX:YFZ). It escrowed 97.7 million shares owned by founders, management and major shareholder RGT Capital.

Elsewhere in this document it disclosed that these shares were worth 72.6 per cent of shares on issue. The amount of escrowed shares as a portion of shares on issue can vary substantially – this example is at the higher end.

As ASX companies must release full FY results within two months of the end of their financial year, these escrow releases will happen some time in late August in 2021 and 2022.

When the escrow period is nearing its end, the company must notify shareholders and formally apply for those shares to be quoted on the ASX.

There are limited circumstances under which they can be released earlier such as if required by law or to accept a takeover offer. The death of a shareholder and transfer to another party typically doesn’t end escrow arrangements.

| Code | Company | Date of Release | Shares | % of company |

|---|---|---|---|---|

| MIO | Macarthur Minerals | 12 March | 233,076 | 0.02% |

| EOF | Ecofibre | 29 March | 186,759,521 | 55% |

| BDM | Burgundy Diamond Mines | 19 March | 10,000,000 | 4.01% |

| AND | Ansarada | 12 March | 7,772,392 | 9.57% |

| ZNO | Zoono | 15 March | 300,000 | 0.02% |

| SRJ | SRJ Technologies | 17 March | 48,418,978 | 40% |

| PAM | Pan Asia Metals | 18 March | 20,000 | <0.01% |

| AT1 | Atomo Diagnostics | 16 April | 49,106,320 | 12.04% |

There aren’t many ASX companies releasing shares held in escrow in the coming weeks.

One reason is because this time last year the ASX was in an IPO drought with no listings for the entirety of March due to the COVID-19 market crash. There also weren’t many already listed companies raising capital.

The drought breaking stock was Rapid HIV and COVID-19 test kit maker Atomo Diagnostics (ASX:AT1) . It’s releasing 49 million shares – worth over 10 per cent of its listed capital – come April 16, which is a year since it first listed.

While companies only have to advise shareholders 10 business days in advance, the company reminded shareholders of the forthcoming release earlier this week.

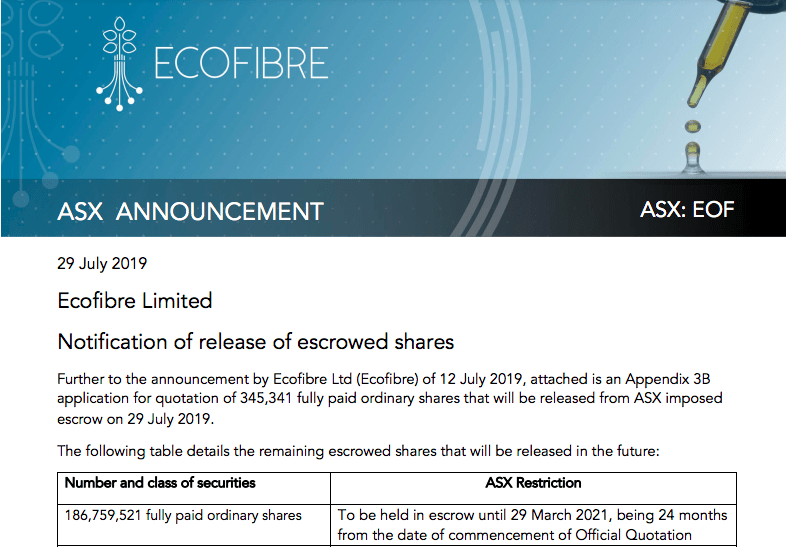

Another is Ecofibre (ASX:EOF) which listed on March 29, 2019 and according to its prospectus has 186.7 million shares set for release two years on.

Tech stock Ansarada (ASX:AND) is releasing 7.7 million shares tomorrow having advised shareholders on Monday.

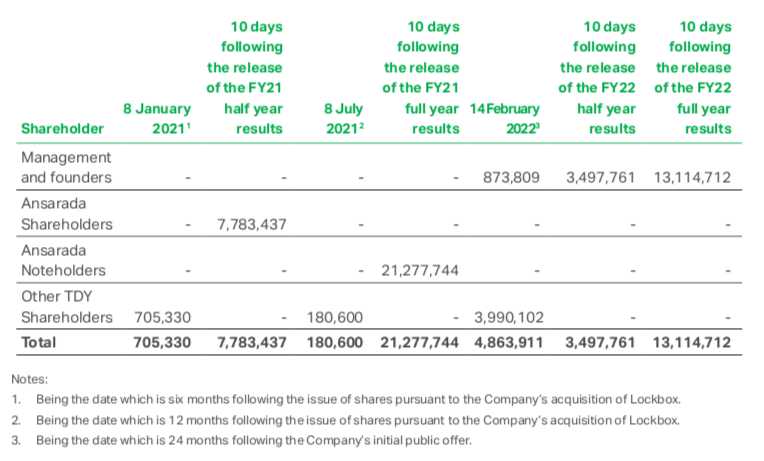

This was agreed to when it listed on the ASX last year through the reverse takeover of thedocyard (ASX:TDY) and will be 10 business days after the release of Ansarada’s results for the first half of FY21.

Larger parcels are set for freedom following the release of later financial results.