This is the only ASX small cap explorer in North Sea oil right now

Energy

Talon Petroleum (ASX:TPD) has joined the big boys in the highly prospective North Sea and it reckons now is the right time to be a new entrant.

The North Sea is a marginal sea of the Atlantic Ocean located between the UK, Denmark, Norway, Sweden, Germany, the Netherlands, Belgium and France.

Talon is particularly interested in the UK North Sea after it made its foray into the region in late October last year with its farm-in to a 10 per cent stake in Corallian Energy’s 45-million-barrel Curlew-A discovery.

It has increased its footprint in the region further with the recent acquisition of EnCounter Oil.

Talon managing director Matt Worner told Stockhead what initially started out as an interest in EnCounter’s two North Sea licences ended up with Talon acquiring the whole company.

“[EnCounter] had two interesting licences with great prospects that we liked technically and then as we started to get into those things more deeply, we got to know one another more,” he explained.

“There was good alignment on what we were both trying to achieve as companies and so hence out of an asset review a corporate transaction kind of evolved.

“We are really the only North Sea-focused exploration company on the ASX at this stage.”

With these acquisitions, Talon has now joined the likes of petroleum heavyweights BP, Royal Dutch Shell and CNOOC.

While exploration activity had dropped off in the area, this year is looking a lot better with an increase in the number of wells slated to be drilled.

“It was a historically low year in 2018 for exploration wells,” said Graham Doré, a founder of EnCounter Oil and now a director of Talon.

“There is certainly almost double the number of exploration and appraisal wells slated for 2019.

“So I think you’re seeing a turn in the enthusiasm for exploration and appraisal in the North Sea.”

Mr Doré told Stockhead there had been a lack of “new blood” coming in and kickstarting exploration.

“It’s primarily due to the cost of doing business there and the drop in the oil price,” he said.

“Now the oil price has picked up a bit, the cost of drilling wells has dropped I think quite significantly and certainly it’s a great time to come into the North Sea as a new entrant and pick up acreage.”

The Brent crude price has made good headway since hitting a low of $US50.77 ($71.89) a barrel around Christmas time last year.

It is up over 33 per cent and trading at nearly $US68 a barrel.

Brent crude is named after oil fields in the North Sea in between Britain and Scandinavia where it initially came from. Today it comes from multiple fields in the North Sea.

Brent oil is considered the best in the world because the oil is light and sweet, hence useful for multiple refining purposes. Furthermore, being at sea it is easy to transport on oil tankers.

For all these reasons, Brent has been the dominant benchmark since 2012, even though it is a very small portion of the world’s oil.

According to the recently published UK Oil and Gas: Reserves and Resources report, the UK’s petroleum reserves “remain at a significant level”.

The UK Continental Shelf 2P reserves at the end of 2017 were 5.4 billion barrels of oil (boe) equivalent, which could sustain production for over 20 years.

‘Reserves’ refer to oil or gas discoveries that are commercially recoverable using existing technology while a resource is an initial, untested estimate.

A 2P reserve means it’s proven and probable.

Meanwhile, the report published by the Oil and Gas Authority said the 2C resources are also significant with an estimate of discovered, undeveloped resources of 7.5 billion boe.

A 2C resource is a best estimate of how much oil or gas is in a deposit. A 1C resource is a low estimate and a 3C is high.

Exploration success in 2017 added an additional 181 million boe of 2C resources.

And the mapped lead and prospect inventory is now estimated to amount to about 4.1 billion boe, with an additional prospective resource of 11.2 billion boe estimated to be contained in plays outside of the mapped leads and prospects.

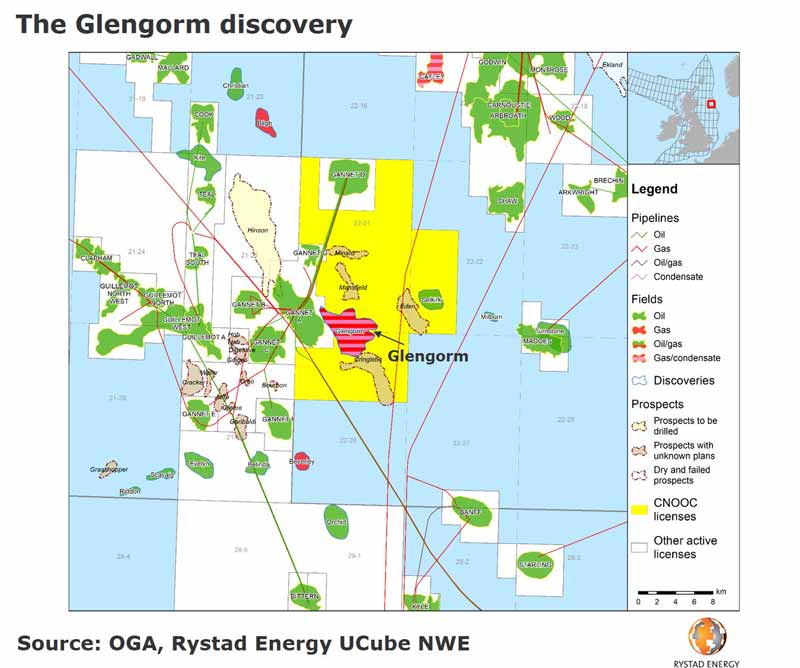

Earlier this year CNOOC and French partner Total revealed they had made the “largest discovery in a decade in the UK North Sea” of 250 million boe.

Independent energy research firm Rystad Energy said a material discovery of this size had not been seen in UK waters since Culzean was drilled in 2008.

Mr Worner said Talon’s MR Olmos project in Texas “never really got off the ground” due to the drop in the oil price.

That prompted a change of direction for the company, hence its UK North Sea strategy.

Now Talon plans to divest the East Texas projects.

“We’re in the process of looking at how we divest those now we’ve really set ourselves up with a new suite of assets,” Mr Worner said.

“They’re becoming very much non-core to Talon now. We will deal with those when we can, but there will be a bit more of a focus now on moving those along.”

Talon is also still eyeing new opportunities in the North Sea.

The company is waiting to find out if it has won another licence it applied for in the North Sea in a recent licencing round.

Talon expects to find it if it was successful in the next month or two.

“We’ll look to keep filling the pipeline most likely through that licencing round process at the moment, because it does allow us to pick up interesting assets very cheaply with low commitments and look for funding partners,” Mr Worner said.

“So there’s no drilling or major events that we’re committed to through picking up those licences.

“Hopefully we can build our portfolio out relatively cheaply and easily over the next 12 to 24 months just through the bid round process.”