You might be interested in

Energy

ADX Energy adds engine to power oil revenue with commissioning of Anshof permanent production facility

Energy

ADX cheers Welchau-1 discovery as it sets the stage for future testing

Energy

Energy

As the world moves increasingly towards low carbon emissions, ADX Energy is leveraging its Austrian oil and gas acreage to progress its renewable energy projects.

The narrative begins with its Vienna Basin asset, specifically the Gaiselberg and Zistersdorf oil fields that it acquired from RAG Austria in December 2019.

While the two fields currently produce about 320 barrels per day (bpd) of oil, ADX Energy (ASX:ADX) executive chairman Ian Tchacos – a veteran oil and gas executive – noted that they had previously produced up to 4,000bpd and ADX saw plenty of behind pipe reserves potential.

“There were something like 50 reservoirs in the area but in the past when oil prices were US$6 or US$7 per barrel, they would shut in reservoirs even when they were still producing at relatively high rates,” he told Stockhead.

“So we see quite a lot of additional production and reserves potential which can be accessed from existing wells at low cost. We have new 3D seismic provided through a data trade with OMV that has let us do a lot of reservoir simulation work on the fields and over the next month or two we hope to go out with a revised reserves position, which we believe will deliver a lot more cash flow from those fields at relatively low investment.

“With that cash flow we are also looking at further synergistic production acquisition opportunities as well as low risk exploration right next to existing infrastructure.”

However, it is the same oil and gas acreage that ADX is looking to redeploy into the renewable energy sector.

“Quite often oil and gas is seen as the villain, but with reservoirs located in the right place, as is the case with our Vienna Basin acreage, we can actually be part of the solution,” Tchacos explained.

Here’s how it all works.

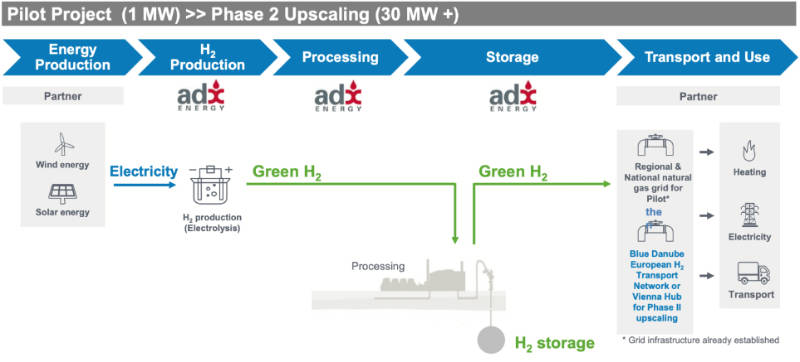

The company’s Vienna Basin assets include multiple depleted gas reservoirs that are at the ideal temperature and pressure for hydrogen storage and are conveniently located next to the biggest wind farms in Austria.

“We are also connected to the gas network and the gas network in Austria and Europe – both the national and international network – you are able to put about 10% hydrogen into the network,” Tchacos noted.

He added that like most of Europe, Austria has a huge load factor between summer and winter in Austria as the amount of wind and solar energy overloads the grid in summer, resulting in up to 2 terawatt hours per month of power being shed.

This provides ADX with the opportunity to take that green power to Hydrogen electrolysers that will produce hydrogen from water that can be stored in its reservoirs for sale in winter, essentially creating a hydrogen battery where each reservoir can store approximately 500 times more energy than the largest Tesla energy storage Mega Pack (about 200MWh) at a much lower price. In practical terms that is the power needs 20,000 households for a year. We have at least 10 reservoirs that can be deployed so this becomes a long term energy solution.

With natural gas (methane) commanding prices up to two or three times higher in winter than in summer, even selling hydrogen at an energy equivalent to methane could deliver profits to the company.

This also excludes the potential for receiving a premium price for hydrogen as well as carbon credits for displacing methane with hydrogen.

There is also substantial government support with Austria having mandated the increase the amount of renewables by a factor of six while the European Union offers a range of subsidies and preferential financing options for renewable projects.

Tchacos adds that with Austria’s capital of Vienna is planning to become a hydrogen hub with ambitious plans to use the green gas for all town heating by 2026 and to power its transportation network, the company sees a significant number of new green opportunities.

And there’s more opportunity with the Vienna refinery is looking at replacing hydrocarbon-created hydrogen with green hydrogen, which would require large volumes of the gas.

ADX is looking initially at a 1MW electrolyser for its pilot project before scaling up to a minimum of 30MW.

The company has also been holding discussions with green energy producers who are keen on the concept as it represents a way for them to deploy their assets further into the future.

The company’s oil and gas acreage in Upper Austria is also central to the other prong of its renewable energy efforts, which is tapping into the geothermal potential made possible by the Alps heating up the relatively shallow reservoirs present in the prolific Mollasse Basin.

While this potential has been picked up on by the Germans, particularly around Munich, the reverse is not yet true across the border in Australia.

“Unlike geothermal projects in Australia, where you had to drill very deep wells to find fractured basement, the aged reservoirs are very pervasive which exist all over the basin,” Tchacos told Stockhead.

“What we are planning is drilling structures for oil and gas, which they are also prospective for, produce the gas and then you have got a reservoir that you can then use for geothermal.

“I think oil and gas is still a lot more profitable in the short term, but geothermal just has a very long life and great way to redeploy your assets.”

And geothermal is where the company’s pilot project with Siemens Energy comes into play with Tchacos noting that their technology has the potential to produce 6 times the power per well compared to conventional geothermal power systems.

“That’s what we are field testing with Siemens; the reason it is exciting is because the amount of power that you can generate is about six times more than a conventional geothermal well.

“The economics of geothermal then becomes much more interesting.”

While hydrogen and geothermal are undoubtedly where the company’s future lies, oil and gas still plays an important role for the company in the short to medium term.

Besides its behind pipe plans in the Vienna Basin, the company is making full use of the 3,650sqkm of 3D seismic – worth over 100 million euros – that it had acquired to identify prospects which it is now looking to drill.

Excitingly for ADX, some of these prospects look more like appraisal wells than exploration wells due to their proximity to existing producing fields.

“The first prospect we will drill is called Anshof that is right in the oil window. It is relatively shallow, relatively cheap but importantly, just 1-2km away from an oil processing plant,” Tchacos noted. Importantly we have already negotiated access agreements with oil processing plant owner ensuring a rapid development time frame.

He added that the company hopes to announce shortly an expansion of its exploration footprint to take in some large gas prospects, some of which could host about half a trillion cubic feet of gas, which are significant in an onshore setting.

ADX also holds the Nilde oil field redevelopment project offshore Sicily, Italy, though that is still under the country’s moratorium on oil and gas exploration.

As such the company will focus its attention on Austria where it can get on the ground and drill a well within six months.

It also plans to start reengaging with parties to introduce a farm-in partner for Nilde once the moratorium is lifted that could help fund the drilling of an appraisal/production well.

“We had a lot of interest previously from industry players who wanted to be involved in the project,” Tchacos added.

For its renewable projects, the company plans to move forward with its hydrogen pilot project next year.

This will involve building an interconnector from a green power producer, installing the electrolyser unit and securing the regulatory approvals.

“We have already appraised the authorities and had positive feedback, once we are up and running, we will then be able to move into the upscaling of that project,” Tchacos said.

He also flagged that the company may form a subsidiary that can focus exclusively on its renewable projects as this would allow it to access ESG funding for an upscaled Hydrogen project, which could cost more than 100 million euros. Some of which would likely be equity and some green loans with favourable terms.

This article was developed in collaboration with ADX Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.