Super fund Cbus commits to 2030 carbon cut for property holdings

Energy

Energy

Industry super fund Cbus has pledged to move its $5bn commercial property portfolio to a carbon neutral position by 2030 as part of its commitment to tackle climate change.

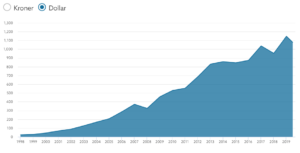

Cbus is following the lead of other investment funds such as Norway’s $US1 trillion ($1.3 trillion) sovereign wealth fund, which has reduced its holdings in energy companies and miners that emit carbon dioxide through their supply chains.

According to its website, Norway’s sovereign wealth fund had $US16.5bn invested in 300 Australian companies in 2019, including BHP (ASX:BHP), Boral (ASX:BLD), Fortescue Metals Group (ASX:FMG), and Horizon Oil (ASX:HZN).

The super fund that covers workers in Australia’s building and construction sector made the pledge at the Global Climate Action Summit in San Francisco, California.

“This is a commercial decision that reflects Cbus’ values as a responsible investor,” chief investment officer Kristian Fok said in a statement.

“The economics of it are coming together very quickly and creating opportunities to future proof our portfolio, support jobs for our members, and provide a just transition to a low-carbon future.”

Around $5bn of property assets is held in the flagship Cbus Property subsidiary, and in property fund managers such as AMP, and the value of these holdings are expected to grow to $10bn by 2030.

Property managers overseeing Cbus property investments will be given until the end of the year to outline their plans for achieving the net zero emissions target for 2030.

“We know that the commercial market is looking for high-tech, low-emissions tenancies. What is more, we can access cheaper finance from lenders who view high-quality building projects as low-risk assets,” Fok said.

The zero emissions pledge goes beyond building managers installing rooftop solar panels, and means energy efficiency measures like insulation, and smart systems for climate control.

Cbus said its super fund members understood the impact of climate change and expected the fund to manage these risks when it came to its investment portfolio.

“Cbus members build Australia’s cities and we will make sure that they are part of building a resilient climate future,” Fok added.

The superfund’s 2030 net zero emissions target covers carbon dioxide emitted by businesses in its investment portfolio, termed scope 1 emissions.

Emissions from the power used by those businesses, known as scope 2 emissions, is also counted towards Cbus’s target.

But carbon emissions from its businesses’ customers, termed scope 3 emissions, are not yet included in the 2030 target.