Soaring gas price continues to plague Queensland domestic consumers

Energy

Despite living in one of biggest gas producers in Australia, Queensland gas consumers have been saddled with high gas prices. The Institute for Energy Economics and Financial Analysis (IEEFA) blames the export industry.

“Queensland gas consumers are paying 51 per cent more for their gas than [overseas] consumers of Queensland gas, according the ACCC,” IEEFA gas analyst Bruce Robertson said.

“And since gas sets the price for electricity in Australia, every electricity consumer is feeling the heat of blown-out bills.”

According to the most recent data from the Australian Competition and Consumer Commission’s (ACCC) spot gas price series, Queensland’s domestic customers were paying $7.82 per gigajoule (GJ) of gas compared to the “netback” export price of $5.19/GJ.

The “netback” price is calculated by taking the delivered price of liquefied natural gas (LNG) and subtracting the costs of liquefying natural gas and shipping it to the destination port.

“Queensland’s gas industry has a proven track record of price gouging consumers and destroying wealth, while fracking coal and shale to export LNG has negative economic consequences for locals,” Robertson added.

“Prior to 2015, Queenslanders had a stable domestic market for gas with reasonable prices of $3-4/GJ.

“With the advent of the construction of the six (LNG processing) trains at Gladstone, domestic gas prices increased rapidly to peak at $21/GJ in early 2017. Contract prices now stand at between $8-12/GJ according to the ACCC.”

He also asserted that Queenslanders are seeing a fraction of the royalties promised by the gas industry for existing fields, and despite earlier promises, gas companies are paying zero corporate tax.

Further development of the state’s fracking and gas industries will also fail to reduce prices due to the high cost of developing coal seam gas fields, Robertson argued.

He explained that rather than producing gas at a cost of between A$2.20 and A$2.70 a gigajoule as the operators expected, coal seam gas field produce gas between A$3.65 and A$6.40 a gigajoule.

Operators are also discovering that the wells decline more quickly than expected, and fields produce less gas and more water, increasing costs.

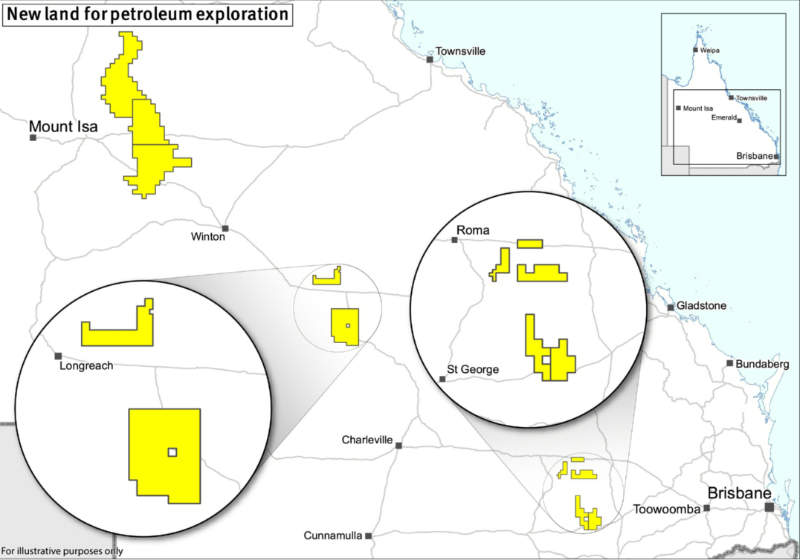

The Queensland state government appears to be taking steps to combat high gas prices, setting aside more than 30 per cent of the new 30,000sqkm land release for domestic supply.

“Business and industry – particularly our manufacturers — needs more affordable gas to fuel jobs and there’s one surefire way to do that – produce more gas,” Queensland Energy Minister Dr Anthony Lynham said.

The new land parcels are near Roma, Longreach and Mount Isa across six basins – Bowen, Surat, Galilee, Adavale, Eromanga and Millungera and will open for bids on November 7.

“More gas from more fields is the only long-term way to deal with affordable domestic gas supply,” Dr Lynham added.

“This latest land release further opens up under-explored Adavale, Galilee and Millungera basins.”

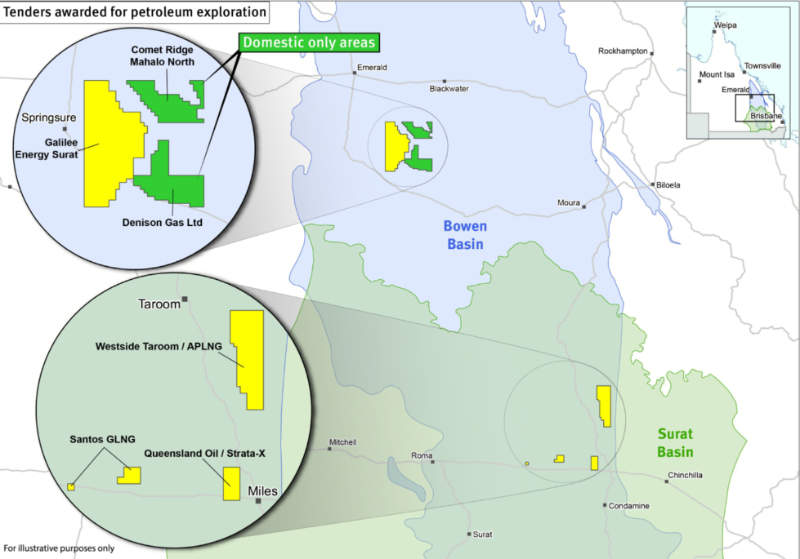

Queensland has also awarded six companies and joint ventures with the right to explore for gas over a total area of 3450sqkm.

These are:

“These operators now have the opportunity to hunt for gas in proven gas rich Bowen and Surat basins,” Dr Lynham said.

However, Robertson raised doubts the state government’s plan would work.

“Reserving only part of domestic production makes no difference to the east coast oligopoly of gas supply,” he told Stockhead.

“The prices paid by the vast majority of Australian consumers will remain well above global parity pricing.

“It may make a small difference to a select few large domestic consumers as was seen with the Incitec’s last contract for Gibson Island.”

Incitec had said at that time the fact that the gas could not have been secured without the Queensland government’s assistance clearly demonstrated that the east coast gas market was not working efficiently or effectively.

The new successful tenderers will need to negotiate land access agreements and fulfil any existing environmental and Native Title requirements before the exploration authority is granted and work can begin.