Hydrogen shipping company GEV fully funds vessel project with $6.3m capital raising

Energy

Energy

Hydrogen shipping company Global Energy Ventures (ASX:GEV) has completed a $6.3m capital raising from institutional and sophisticated investors to accelerate the construction of its C-H2 ship for delivering compressed hydrogen to Asian markets.

Global Energy Ventures successfully placed 63 million new shares priced at 10 cents per share with investors, representing a slight discount to recent traded levels for its share price.

The ASX company said it has first-mover advantage in the compressed hydrogen shipping market with its innovative ship design which will soon be covered by a US patent.

“The company is now comfortably funded to continue with business development opportunities for compressed natural gas Optimum [ship] and to support an accelerated development program for the new C-H2 supply chain and ship for the hydrogen economy which continues to receive global interest in the application of compression for both onshore and offshore loading and export applications for hydrogen,” executive chairman, Maurice Brand, said.

Brand said the company was delighted by the support shown from institutional investors for its share placement for which PAC Partners and KG Capital were the joint lead managers.

Hydrogen is becoming an in-demand green fuel as Asian countries start to decarbonise their economies away from carbon emitting fossil fuels such as coal, oil and gas.

Global Energy Ventures has designed a ship to carry compressed hydrogen, its 2,000-tonne capacity C-H2 vessel, which has significant industry support, the company said.

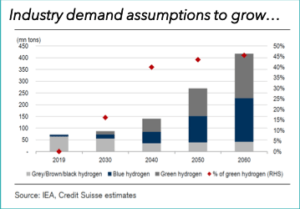

As a result, the global market for hydrogen is set to expand by 10 times its current size by 2050 and account for 20 per cent of global energy consumption worth $US2.5 trillion.

Countries including Australia, China, France, Germany, Japan and South Korea have spending commitments amounting to $US30bn to develop hydrogen-based businesses.

GEV said in a presentation there are multiple hydrogen projects including in Australia that are within several thousand kilometres of Asian export markets.

The company has developed intellectual property in marine pressure vessel designs including its CNG Optimum ship for carrying compressed natural gas.

Front-end engineering and design is expected to commence later this year for the CNG Optimum ship and an offshore site in the Gulf of Mexico has been selected for its initial operation.

The company is also pursuing multiple commercial opportunities in Brazil for a fleet of up to five CNG ships to carry compressed gas exports.

Floating CNG shipping offers a more competitive transportation solution than conventional liquefied natural gas (LNG) shipping and it has a lower capital cost, GEV said.

Around 90 per cent of the capital cost of conventional LNG shipping is spent on complex onshore processing facilities, liquefaction and loading and unloading facilities.

Only one-quarter of the capital cost of compressed natural gas or CNG shipping is focused on compression and unloading and loading facilities.

This is because only a floating pipeline is required to deliver gas from stationary gas platforms to arriving CNG ships instead of costly onshore processing plants.

The remaining three-quarters of capital spending for CNG shipping projects is earmarked for actual transportation costs – the cost of vessels.