Green Energy: A recap of the biggest headlines and the five biggest gainers

Energy

Energy

Against a backdrop of tempestuous markets and an important meeting of the world’s leaders at COP26 in Glasgow, the inevitable transition towards a decarbonised future has started to take shape.

Joe Biden’s ascendency to the US presidency at the beginning of the year opened a swarm of new investment themes for Australian punters on the back of promises made to reduce US net emissions of greenhouse gases to zero by no later than 2050, the decision to re-enter the Paris agreement, banning new oil and gas projects, and investing $US400bn in clean sources of energy.

A number of countries submitted their targets before the grand COP26 meeting took place, including China with its commitment to ‘carbon neutrality before 2060 target’, while India made its pledge at the summit to reduce emissions to net zero by 2070.

More than 40 countries committed to the phase out of coal – Poland, Vietnam, and Chile all took the stand, however some of the world’s biggest coal dependant countries like the US and China failed to take the giant leap.

Including Australia.

We saw the electric vehicle sector make big strides with targets – both Volvo and Ford of Europe pledging to manufacture only electric cars for sale in Europe by 2030 and the world’s largest automaker, Toyota, revealing its plans to sell only zero-emission vehicles in Europe by 2035 with plans to becoming carbon neutral by 2050.

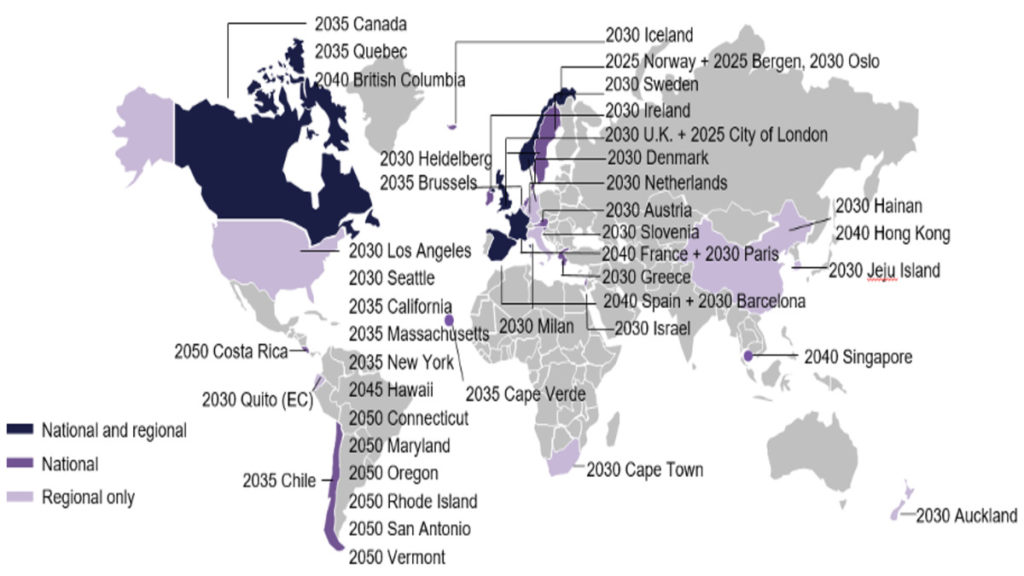

Of course, countries around the world jumped on this thematic too with policies to support the transition to net zero emissions through combustion engine vehicle phase-out targets.

Throughout the year, a great deal of company announcements focused on ‘green energy projects’, ‘carbon emissions’, ‘ESG’, ‘emission reductions,’ and ‘hydrogen’.

In fact, GlobalData released figures demonstrating that the word ‘hydrogen’ had increased by 21% in company filings during 2021 compared to 2020.

It was hard to miss the multitude of announcements out of Andrew Forrest’s green arm of Fortescue Metals Group (ASX:FMG) within the green energy space in 2021.

Fortescue Future Industries (FFI) laid the groundwork in July when it revealed plans to make “headway” on a number of problems, including the design and construction of hydrogen powered haul trucks and drill rigs – two areas of the mining industry which rely heavily on diesel fuels.

After that the announcements kept coming.

From a 1 GW solar factory, a hydrogen electrolyser Gigafactory in Queensland, plans to turn Gladstone into a hydrogen equipment manufacturing hub, and its work with Incitec Pivot on converting its gas-fed ammonia plant into a green ammonia plant, Forrest made it clear to all that FFI is serious about its target to produce 15 million tonnes of green hydrogen per year by 2030.

Forrest also took his green-making machine overseas to the Kingdom of Jordan, Papua New Guinea, the United Kingdom, and Canada… and there is much, much more.

It was a particularly big day when the Feds tipped $1.2 billion into its hydrogen strategy to facilitate a further two locations under the Clean Hydrogen Industrial Hubs program, taking it up to seven sites.

Those locations include Bell Bay in Tasmania, Darwin, South Australia’s Eyre Peninsula, Gladstone in Queensland, the Latrobe and Hunter Valleys in Victoria and New South Wales and the mining hub of the Pilbara in WA’s north.

The idea is to co-locate projects to optimise and spread investments in infrastructure.

We saw the Australian Government announce its Future Fuels and Vehicle Strategy which included $178m in new funding and more than $500m of private and public co-investment directed into the uptake of future fuels through the acceleration of charging and hydrogen refuelling stations to support 1.7m electric vehicles nationwide.

And we can’t forget when the NSW Government followed other states and announced its hydrogen strategy – a whopping $3b commitment in comparison to Western Australia’s $61.5m commitment and Queensland’s $2b commitment to, in the words of Premier Anastacia Palaszczuck, “develop a clean hydrogen industry, mine minerals needed for solar panels, build hydrogen plants, batteries and electric vehicles, and increase manufacturing across the renewables supply chain”.

| CODE | COMPANY | PRICE | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|

| RFX | Redflow Limited | 0.052 | 102 | $ 71,676,672.60 |

| IRD | Iron Road Ltd | 0.205 | 32 | $ 163,079,153.33 |

| PH2 | Pure Hydrogen Corp | 0.535 | 494 | $ 172,717,272.69 |

| MEZ | Meridian Energy | 4.65 | -26 | $ 5,862,129,775.50 |

| PRL | Province Resources | 0.1475 | 1129 | $ 163,800,672.60 |

| DEL | Delorean Corporation | 0.205 | $ 36,834,047.40 | |

| HZR | Hazer Group Limited | 1.095 | 60 | $ 173,485,511.61 |

| FMG | Fortescue Metals Grp | 19.13 | -19 | $ 59,855,078,005.92 |

| IFT | Infratil Limited | 7.58 | 13 | $ 5,409,350,645.22 |

| SKI | Spark Infrastructure | 2.87 | 33 | $ 5,036,718,783.60 |

| PRM | Prominence Energy | 0.008 | 14 | $ 10,276,870.55 |

| NEW | NEW Energy Solar | 0.815 | -2 | $ 261,279,208.59 |

| HXG | Hexagon Energy | 0.07 | 21 | $ 30,328,940.24 |

| AVL | Aust Vanadium Ltd | 0.028 | 115 | $ 88,598,045.86 |

| AST | AusNet Services Ltd | 2.525 | 40 | $ 9,689,810,149.58 |

| GNX | Genex Power Ltd | 0.2 | 14 | $ 203,281,008.55 |

| CXL | Calix Limited | 6.03 | 480 | $ 966,283,600.73 |

| RNE | Renu Energy Ltd | 0.08 | 158 | $ 12,733,033.84 |

| KPO | Kalina Power Limited | 0.022 | -42 | $ 33,259,115.67 |

| LIO | Lion Energy Limited | 0.062 | 288 | $ 23,323,973.60 |

| MPR | Mpower Group Limited | 0.04 | -42 | $ 8,527,737.89 |

| BSX | Blackstone Ltd | 0.555 | 46 | $ 218,062,154.57 |

| PGY | Pilot Energy Ltd | 0.05 | 67 | $ 25,080,085.05 |

| GEV | Global Ene Ven Ltd | 0.094 | 22 | $ 50,590,183.25 |

| QEM | QEM Limited | 0.175 | 150 | $ 19,849,083.28 |

| VUL | Vulcan Energy | 10.48 | 331 | $ 1,398,988,766.74 |

| LCK | Leigh Crk Energy Ltd | 0.15 | 7 | $ 134,262,923.55 |

| ECT | Env Clean Tech Ltd. | 0.034 | 240 | $ 44,825,555.70 |

Province Resources (ASX:PRL) was the biggest gainer over the year with shares up 1,129%.

The ball started rolling for PRL back in February when it went from being a former battler – as a furniture assembly business (AssembleBay) and vanadium explorer (ScandiVanaidum) – to the natural resources company it is today.

It was one of the first companies to enter the hydrogen arena this year, following the acquisition of both the HyEnergy Project and Gascoyne Projects, a move which sent the stock flying +250% on the day.

The HyEnergy Project is where the company intends to build a huge 8GW green hydrogen facility, taking advantage of the ample amount of wind and solar resources in WA’s northwest.

Ten months later and the company has a project partner in leading France-based power producer Total Eren, hauled in $18m to fund scoping and feasibility studies at HyEnergy, and entered into an MoU with Global Energy Ventures (ASX:GEV) to conduct studies on green hydrogen export to markets in the Asia-Pacific.

Most importantly, PRL welcomed changes to the land tenure regime by the Western Australian Government in November, which by way of a ‘diversification lease’, allows proponents of green hydrogen projects to locate wind turbines, solar arrays, and hydrogen production assets.

So pleased that the WA Government has deemed HyEnergy a project of State Significance and awarded it Lead Agency Status. Our green hydrogen development can help countries achieve their net zero by 2050 targets and support the economy in the Gascoyne. $prl #GreenHydrogen pic.twitter.com/C5OWhubUsD

— Province Resources (@Province_ASX) December 19, 2021

To cap it all off the company was recognised by the government as a significant project in the State’s interest on the award of ‘lead agency status’ in December.

In second place comes Pure Hydrogen (ASX:PH2) with shares hitting 494% for the year.

The company has its fingers in a few pies, one being a signed term sheet with CAC-H2 – a Singapore headquartered company to build three wood waste-to-hydrogen plants on the east coast of Australia.

Its first plant will be built north of Brisbane and is expected to be operational in late 2022 with Melbourne and Sydney to follow.

PH2 also has a strategic 24% stake in fuel cell pioneer H2X Global and plans to use the pyrolysis process (the thermochemical decomposition of organic matter into non-condensable gases) to convert methane from its Serowe coal seam gas project in Botswana and the Venus CSG project in Queensland into blue hydrogen.

Calix (ASX:CXL) takes out third place, gaining 480% over the year.

At the beginning of 2021, CXL said it was partnering with Sweden’s SaltX Technology to pilot a unique salt-based energy storage system using excess renewable energy available during the day to power Calix’s electric direct separation reactor (eDS) to heat and charge/dehydrate the salt.

When energy is required, the salt is recombined with water to produce heat to generate power.

The company has caught market attention around its low emissions lime and cement technology LEILAC, a calcination process which captures CO2 emissions as they are released from raw limestone, avoiding between €14-24 per tonne of CO2 in the cement making process.

It was big news and happy days when it revealed it had filed a patent to apply its core kiln technology to making iron.

Coined the ZESTY (zero emmissions steel technology), the company claims its technology would be able to reduce iron ore to iron in a hydrogen atmosphere at between 600-800C, about 1000C lower than a normal blast furnace and be electrically heated, meaning it could be powered by renewables.

Hydrogen would only be consumed as a fuel, the company said, not as a reductant, lowering input costs and avoiding the need to pelletise iron ore fines first.

Initial testing of Calix’s process is underway at the Imperial College in London, with Calix planning to scale-up testing at its Bacchus Marsh facility in Australia if successful.

Taking out fourth-best within the green energy space is Vulcan Energy (ASX:VUL).

The market is still very much divided about whether this stock will deliver on its proposed Zero Carbon Lithium Project in Germany’s Upper Rhine Valley.

Vulcan intends to produce a battery quality lithium hydroxide chemical product from its combined geothermal energy and lithium resource which it claims is Europe’s largest lithium resource.

It plans to produce a carbon negative lithium product by pumping deep geothermal brines to surface, using the excess geothermal energy to power its lithium chemical process and export additional power to the grid.

Slated to enter production in 2024 with a DFS and pilot plant underway, the company is up 331 % for the year – a solid effort.

And in fifth is Lion Energy (ASX:LIO).

The company rose more than 70% on the back of green hydrogen exploration news in April.

LIO raised $2.8m to undertake hydrogen studies in Australia as well as on Seram Island in Indonesia, where it currently holds oil interests.

In the months after, the company signed an MOU with Wagner Corporation – an Australian property and infrastructure developer to explore opportunities within in the development of green hydrogen facilities and related infrastructure at Wagner Corporation’s Wellcamp Business Park and Pinkenba Wharf locations in Queensland.

At Stockhead, we tell it like it is. While Pure Hydrogen is a Stockhead advertiser, it did not sponsor this article.