You might be interested in

Energy

Pure Hydrogen’s green hydrogen micro-hub strategy is taking off

Energy

Pure Hydrogen unlocks value with strategic asset sale to accelerate development of its hydrogen business

Energy

Energy

Australian governments are getting serious about the country’s fledgling hydrogen industry announcing further multi-million-dollar commitments to position Australia as the home of hydrogen.

Ingrid Kukuljan – head of impact investing, lead portfolio manager at US-based investment banking firm Federated Hermes – says hydrogen is rightly being hailed by industry and investors alike as the fuel of the future.

“Over the last 18 months, we have observed a material increase in the number of companies, across the energy, materials & resources, and capital goods value chains outline their grand visions for the hydrogen economy,” she said.

“We believe that critical progress to realising these innovations is investible today and point to a number of key areas.”

The main areas hydrogen is expected to play a significant role are as a blended gas and as a transport fuel.

Kukuljan says hydrogen fuel cell technology is on the precipice of mass commercialisation on the back of a generous $2bn subsidy program launched in China, as well as strong incentives in Europe and California.

“At present, over 30 countries have hydrogen roadmaps and 228 large-scale hydrogen projects have been announced with a total value of $300bn,” she noted.

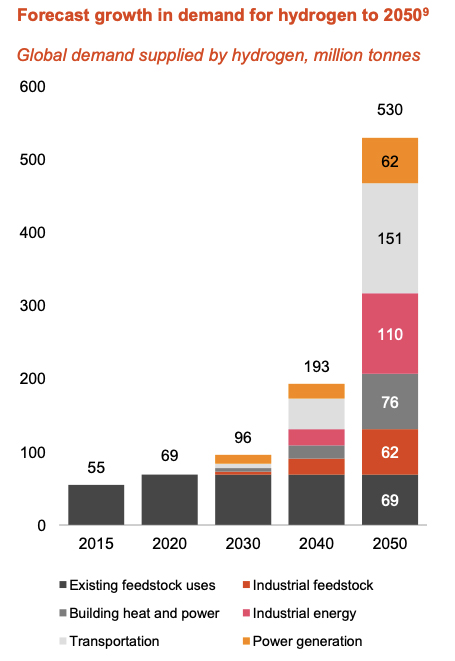

PwC sees the global hydrogen market exploding between 2030 and 2050, but substantial investment is needed by Australia to help fuel that growth.

The firm predicts global demand will increase to 100 million tonnes by 2030 and exceed 500 million tonnes by 2050. That is a massive 668 per cent increase on the 69 million tonnes of demand recorded in 2020.

Governments around the world are ramping up their financial pledges to give the industry a kick start. Just last week Australian Prime Minister Scott Morrison promised $540m in the upcoming budget for hydrogen and carbon capture storage projects.

That is on top of the $70m, five-year commitment announced in last year’s budget.

It is part of a much bigger $18 billion spend planned by the federal government to slash the country’s carbon emissions and meet its climate goals.

Iron ore producer Fortescue Metals Group (ASX:FMG) is leading the charge in the mining sector to help substantially reduce its carbon footprint.

The company has recruited former Australian prime minister Malcolm Turnbull to be chairman of its Australian Fortescue Future Industries (AFFI) group.

The group will identify renewable energy and green hydrogen – hydrogen produced using renewable energy – projects for development both in Australia and globally.

An increasing number of juniors are also joining the march into hydrogen.

Iron Road (ASX:IRD) is developing a green hydrogen project for iron ore pellet production at South Australia’s proposed Cape Hardy port.

Emerging vanadium producer Australian Vanadium (ASX:AVL) has also mapped out its own hydrogen strategy, which will see it incorporate green hydrogen into its namesake vanadium project.

“On the hydrogen side there’s clearly a very strong understanding that using hydrogen does assist this move towards reduction of global emissions footprint,” managing director Vincent Algar told Stockhead.

“AVL has quite a clear strategy on what we want to use hydrogen for and that is to reduce what we call our ‘scope one’ footprint which is in the generation of the vanadium product.

“We want to get our footprint as low as possible, making it attractive to investors. We’ll do that by using hydrogen in the gas component of our work. That includes roasting.

“We can feed up to 10-15 per cent hydrogen into our roaster and that will reduce its carbon footprint.”

In November last year, Australian Vanadium signed a green hydrogen supply deal with ATCO – the same major energy provider Fortescue has signed on with.

Investors are responding favourably to those adopting hydrogen strategies.

Vanadium and oil shale company QEM (ASX:QEM) has been on a tear since announcing its plans to undertake studies into green hydrogen opportunities at its Julia Creek project in North Queensland.

Since mid-March shares have more than tripled.

QEM (ASX:QEM) share price chart

While there is a rapidly growing focus on green hydrogen in particular, blue hydrogen is still going to be a key part of establishing Australia as a major hydrogen economy, according to Hexagon Energy Materials (ASX:HXG) chairman Charles Whitfield.

Green hydrogen is produced using renewable energy, while blue hydrogen is produced using natural gas or coal but is considered carbon neutral because it uses carbon capture and storage to negate CO2 emissions.

“To create the fastest path to lowering carbon emissions, the world cannot wait for undeveloped technologies, immediately available solutions are available and as such converting traditional industry to low or zero carbon allows the fastest way to tackle climate change,” Whitfield said.

“A key cornerstone of this is the advancement of ‘blue’ hydrogen in many applications where previously LNG, natural gas or liquid fuels were used. So called blue hydrogen has zero carbon emissions at either manufacture or consumption and is a solution to reduce carbon emissions today at low cost and the volumes required by transport, industry and energy suppliers.

“While Australia hopes to become a major player in green hydrogen using renewable energy in the future, it is blue hydrogen that it is backing to create a rapid scaling up of the conversion to hydrogen economies both here and in the potential markets of Asia.”

Hexagon recently completed the acquisition of Ebony Energy, adding the Pedirka blue hydrogen project in the Northern Territory to its portfolio.

The company has kicked off a pre-feasibility study on the project which is due for completion later this year.

Western Australia’s Pilbara is expected to be one of the regions that receives federal funds to establish it as a hydrogen hub, but WA Minister for Regional Development Alannah MacTiernan also wants the state’s Mid-West region to be considered as a potential location.

Pilot Energy chairman Brad Lingo backs MacTiernan’s call for the Mid-West to be considered as well.

“The Mid-West is ideal for a hydrogen hub and is a key focus of the WA government’s hydrogen initiatives as evidenced by the Oakajee Strategic Industrial Area Renewable Hydrogen Project,” he said.

Lingo said there had been a strong response to the state government’s expressions of interest process for developing the Mid-West region at Oakajee as the key hydrogen hub for the state.

Late last year, Pilot Energy provided an expression of interest submission centred around its Mid-West Integrated Wind and Solar Project and its position in the Cliff Head Oil Field.

One of the key barriers to hydrogen uptake is cost, but Pilot Energy believes it can deliver an industrial scale hydrogen solution at a cost as low as $2 per kilogram with zero CO2 emissions for both domestic supply and export.

The Hydrogen Council estimates renewable hydrogen production costs will drop to a range of $1.40 to $2.30 by 2030 making it cost competitive in 20 applications.

Australian Vanadium’s Algar said there were a number of start-up and pilot scale hydrogen projects in the Mid-West being supported by the state government.

He said those projects would generate sufficient quantities of hydrogen for miners and other industries to use in a variety of ways, including in their power mix, blended into the gas network and in transportation.

Port Anthony Renewables has locked in four joint venture partnerships as it works to build a major hydrogen hub in Victoria’s southeast.

The company has inked deals with Infinite Blue Energy, GrapheneX, Pure Hydrogen (ASX:PH2) and Patriot Hydrogen to build a series of hydrogen facilities at Port Anthony, 180km southeast of Melbourne.

Hunter-based Sweetman Renewables last week revealed it was undertaking a $2.5m pre-IPO raise to help set it up to make its ASX debut down the track.

The company is working to elevate its revenue base tenfold with its expansion to three divisions covering hydrogen production, biomass supply and selling high-quality timber products.

Verdant Earth Technologies, meanwhile, is heading to the NASDAQ – the world’s second largest exchange behind only the New York Stock Exchange.

The company is planning to build Australia’s first scalable hydrogen production plant, which is expected to initially deliver 6.5 tonnes per day before being scaled up to 60 tonnes per day by 2024.

Verdant is undertaking a feasibility study to locate the Monarch green hydrogen plant at its $550m 151MW renewable energy power station in NSW.

Trojan H2 Logistics is aiming to become Australia’s very first molecular storage, haulage and distribution company as it looks to fill a big gap in the market.

The company has signed a memorandum of understanding (MoU) with suppliers for the delivery of 100 LH2 Fuel Stations, as well as a $US2.8m ($3.6m) agreement to immediately acquire 2 ADR-approved liquid hydrogen trailers capable of holding around 55,000 litres, or nearly 4 tonnes.

This is expected to be the start of a planned 1,000 strong fleet of H2 trucks to be rolled out Australia-wide.

Trojan has also signed an MoU with another supplier to secure 50 hydrogen prime movers.