Frontier locks in peak capacity credits to guarantee renewable energy project revenue

Frontier Energy aims to finalise financing after securing peak capacity credits for Waroona Stage One. Pic: Getty Images

- Frontier Energy secures 88.06MW capacity credits for Waroona Stage One renewable energy project in WA

- Credits to generate $160m revenue over five years, underpinning project financing

- Further revenue for the first stage will come from energy sales and other market opportunities

Special Report: Frontier Energy has locked in revenue for the first stage of its Waroona renewable energy project in WA after being assigned 88.06 megawatts of peak capacity credits by the Australian Energy Market Operator.

The peak capacity credits for the 2027-28 Reserve Capacity Cycle are expected to generate pre-energy sales revenue of ~$32 million for that year based on the expected Reserve Capacity Price of $367,700/MW.

As Frontier Energy’s (ASX:FHE) Stage One Waroona project is nominated to be a fixed price facility for the first five years of operation – from October 2027 to September 2032 – revenue from capacity credits alone over that period will total at least $160m.

This excludes any revenue from energy sales and other market opportunities available to the project and provides the guaranteed revenue needed for project financing.

The company was able to secure the credits by electing to upscale the battery duration for its stage one development to at least six hours from the original 4.75 hours.

This is in line with the minimum Energy Storage Resource Obligation Duration of six hours for the 2027/28 Reserve Capacity Cycle set in the AEMO’s 2025 Electricity Statement of Opportunities report.

“This is a major milestone for the company as the assignment of capacity credits, coupled with being a fixed priced facility, means the guaranteed revenue required by both equity and debt financiers has now been secured,” chief executive officer Adam Kiley said.

“Revenue from capacity credits in the first year will be approximately $32 million, with total revenue from capacity credits over the first five years of operations of approximately $160 million.

“Importantly, this foundational revenue is in addition to revenue from energy sales and underpins the project’s already robust economics. With this major milestone achieved, the company aims to finalise the financing for development in the coming months.”

Revenue and financing

Revenue from the capacity credits represents about 50% of the forecast revenue for stage one with the remainder coming from energy sales, large-scale Generation Certificates and other market opportunities.

Average energy price on the Wholesale Energy Market increased from $80 per megawatt hour in 2024 to $94/MWh in the nine months ending September 30, 2025, with the peak price between 5pm and 9pm averaging $134/MWh in 2025.

FHE believes its hybrid solution that combines low-cost solar energy with battery storage to discharge that energy into peak periods is the optimal strategy to maximise returns in the WA energy market.

With the RCP fixed, the company now has considerable optionality to structure the financing to optimise long-term value creation.

Negotiations with financiers, which have been underway throughout 2025, are continuing with finalisation of a preferred funding strategy expected in the coming months.

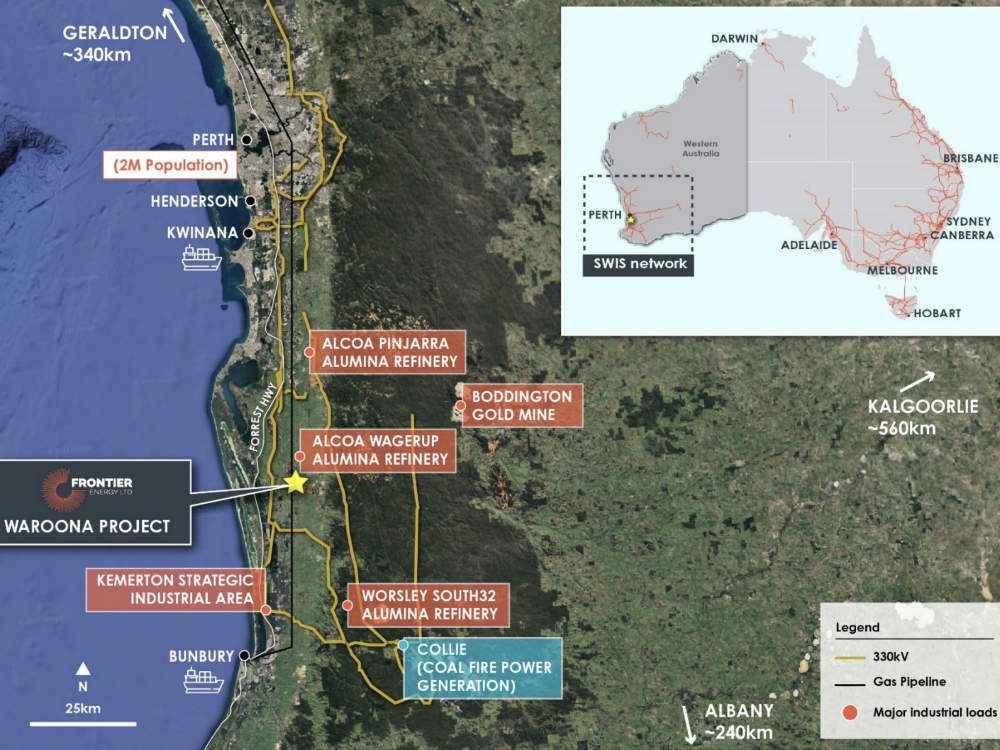

Waroona Energy Project

Stage one of the Waroona project will have 120MW of solar generation capacity and 81.5MWh of battery capacity.

FHE is progressing negotiations with equipment manufacturers, to finalise the cost of the larger scale, six hour duration, battery along with updated costs for all key equipment.

It notes that since the release of its definitive feasibility study in 2024, the cost per MW of battery storage has fallen considerably.

This represents just the first part of the company’s strategy to expand the project into a multi-stage renewable energy precinct known as the Waroona Energy Park, the largest renewable energy precinct in the southwest of WA.

Such as move is timely given the planned retirement of at least 1.3GW of ageing coal and gas generation assets in the state before 2031.

Waroona’s Stage Two is about the same size of Stage One and has already secured development approval.

FHE is currently targeting revenue certainty for Stage Two during 2026 to underpin financing for the expansion.

This article was developed in collaboration with Frontier Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.