China will drive ‘marginal’ global increase in nuclear capacity over next two decades

Energy

Energy

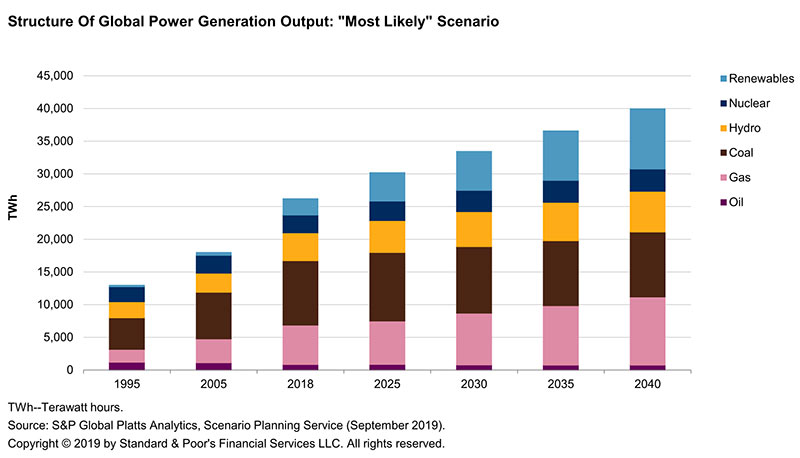

Global nuclear output is set to increase marginally over the next 20 years, despite a “material decline” in key markets like the US and Western Europe, according to new research.

That’s because “developing” countries, such as China and Russia, continue to build new nuclear capacity, supported by government funding and significantly lower construction costs.

READ: We need nuclear power to reach our climate goals, but its future remains uncertain

“We see little economic rationale for new nuclear builds in the US or Western Europe, owing to massive cost escalations and renewables cost-competitiveness, which should lead to a material decline in nuclear generation in those countries by 2040,” S&P Global Ratings credit analyst Elena Anankina says.

“But developing countries such as China and Russia continue to build new nuclear capacities to supply growing energy demand, supported by funding from the government or from state-related banks and significantly lower construction costs.”

Nuclear currently accounts for 10 per cent of global power generation. The US remains the dominant generator with 97 gigawatts (GW) capacity across 97 reactors.

READ: Money Talks: Uranium has good ‘tailwind fundamentals’ and could be set to ignite

But China doubled its nuclear production between 2007 and 2017 and aims to become “the nuclear superpower in the near future”, says S&P.

“We expect developing markets will drive global nuclear growth, especially China, which has embarked on a major nuclear new-build program.

“We believe, however, it will have to accelerate the construction of new nuclear power plants to achieve its ambitious 2020 target of having 58 gigawatts (GW) of nuclear capacity in operation (from 45GW in 2019).”

Many other large Asian countries, like India, also see nuclear as an efficient way to meet soaring domestic energy demand, while Russia is set to continue gradual replacement of old nuclear units with new ones.

S&P says the long-term outlook for nuclear, post 2040, will depend on the progress in mitigating the intermittency of renewables through smart grids and storage — such as wider deployment of batteries.