BloombergNEF: Global energy storage to hit one terawatt-hour by 2030, US and China lead the way

Energy

Energy

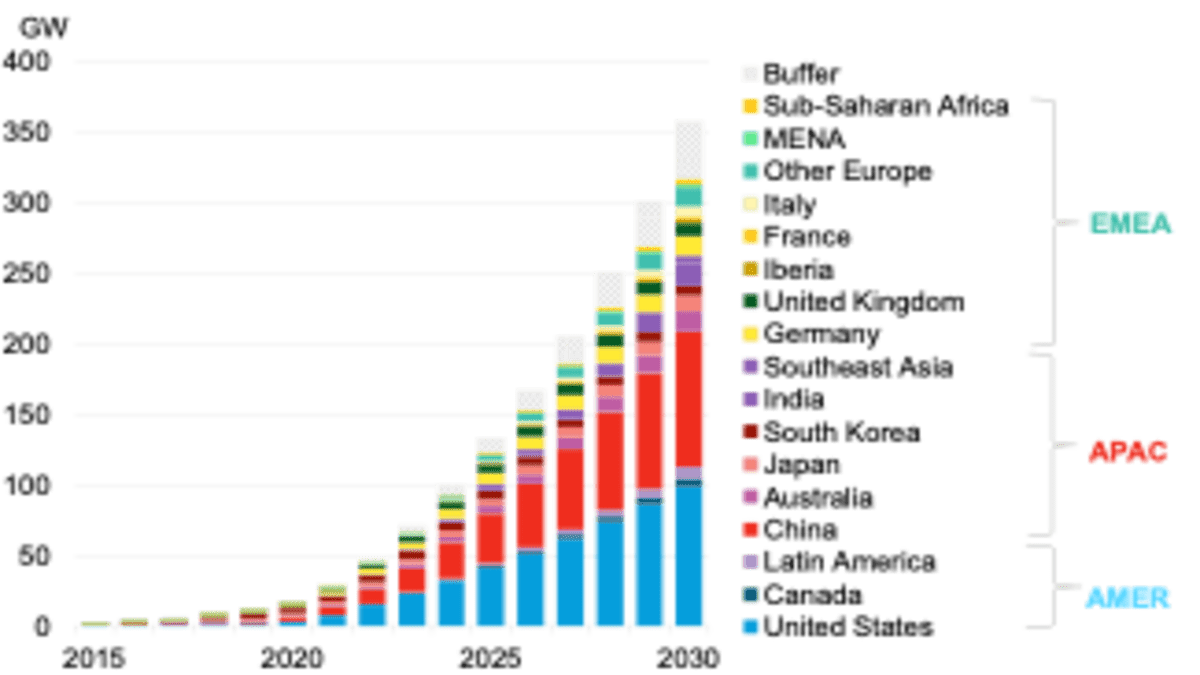

Energy installations around the world are set to reach a cumulative 358 gigawatts/1,028 gigawatt hours by the end of 2030 – more than 20 times larger than the 17 gigawatts/34 gigawatt-hours online at the end of 2020, according to the latest forecast out of BloombergNEF.

The 2021 Global Energy Storage Outlook suggests that 345 gigawatts/999 gigawatt-hours of new energy storage capacity will be added globally between 201 and 2030, which is more than Japan’s entire power generation capacity in 2020.

China and the U.S., the two largest markets, will represent over half of the global storage installations by 2030, BloombergNEF says.

Other top markets include India, Australia, Germany, the U.K., and Japan with “supportive policies, ambitious climate commitments, and the growing need for flexible resources are common drivers.”

According to the report, the Asia-Pacific region will lead the storage build on a megawatt basis by 2030, but the Americas will build more on a megawatt-hour basis, “because storage plants in the U.S. usually have more hours of storage.”

Despite Europe’s ambitious climate targets, the combined regions of Europe, Middle East and Africa (EMEA) currently lag behind their counterparts due to the lack of targeted storage policies and incentives.

Growth in the region could accelerate as renewables penetration surges, more fossil-fuel generators exit, and the battery supply chain becomes more localised.

Clean power specialist at BloombergNEF and lead author of the report, Yiyi Zhou, said the global storage market is growing “at an unprecedented pace.”

“Falling battery costs and surging renewables penetration make energy storage a compelling flexible resource in many power systems,” Zhou said.

“Energy storage projects are growing in scale, increasing in dispatch duration, and are increasingly paired with renewables.”

BNEF’s forecast suggests that the majority, or 55%, of energy storage build by 2030 will be to provide energy shifting (for instance, storing solar or wind to release later) while co-located renewable-plus-storage projects, particularly solar-plus-storage, are becoming commonplace globally.

Consumer-sited batteries, both residential and commercial and industrial, will also grow at a steady with countries like Germany and Japan leading the way and sizeable markets in Australia and California following closely behind.

And as the desire for more self-generated solar power and back-up power continues to grow, BNEF expects energy storage located at homes and businesses to make up about one quarter of global storage installations by 2030.

However, it is the rapidly evolving battery technology space driving the energy storage market.

In 2021, lithium-iron phosphate (LFP) will be used more than nickel-manganese-cobalt (NMC) chemistries for stationary storage for the first time.

LFP, the report says, will become the major lithium-ion battery chemistry choice in the energy storage sector until at least 2030, driven by its dominant role in China and increasing penetration in the rest of the world.

BNEF also updated its outlook to include sodium-ion batteries — a technology in the lithium-ion battery sector — which could play a meaningful role by 2030.

Non-battery technologies are also under development including air and thermal energy storage which could provide longer dispatch duration compared to batteries, looking to supply during prolonged periods of low renewable energy generation.

But BNEF expects batteries to dominate the market at least until the 2030s, in large part due to their “price competitiveness, established supply chain, and significant track record.”