You might be interested in

Energy

Emission Control: Australia pegs new areas for CCS exploration, but is the decarbonisation tech worth investing in at all?

Energy

Emission Control: US DOE maps pathways to nuclear commercial lift-off

Energy

Energy

According to a new report out of the International Renewable Energy Agency, almost two-thirds or 163 gigawatts of newly installed renewable power added in 2021 had lower costs than the cheapest coal-fired options in G20 countries.

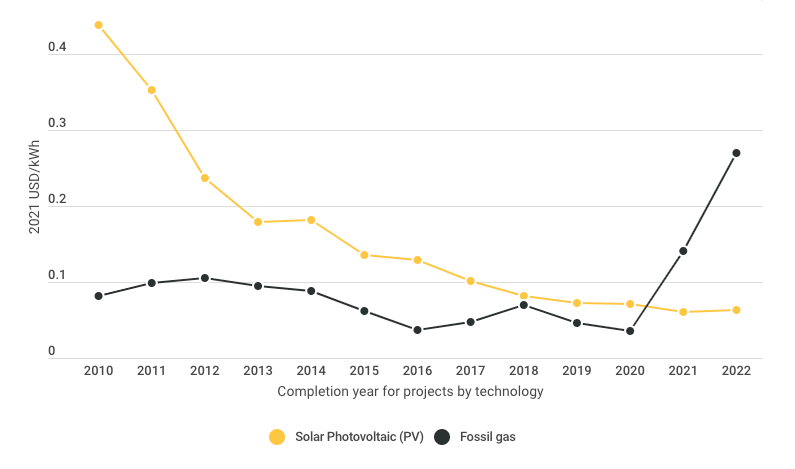

The cost of electricity from onshore wind fell by 15%, offshore wind by 13% and solar PV by 13% compared to 2020.

IRENA estimates that, given the current high fossil fuel prices, the renewable power added in 2021 saves around US$55 billion ($81.3 billion) from global energy generation costs in 2022.

The report confirms the critical role that cost-competitive renewables play in addressing today’s energy and climate emergencies by accelerating the transition in line with the 1.5°C warming limit and the Paris Agreement goals.

Solar and wind energy, with their relatively short project lead times, represent vital planks in countries’ efforts to swiftly reduce, and eventually phase out, fossil fuels and limit the macroeconomic damages they cause in pursuit of net zero.

“Renewables are by far the cheapest form of power today,” Francesco La Camera, director general of IRENA says.

“2022 is a stark example of just how economically viable new renewable power generation has become.

“Renewable power frees economies from volatile fossil fuel prices and imports, curbs energy costs and enhances market resilience – even more so if today’s energy crunch continues.”

The report stresses the point that high coal and gas prices in 2021 and 2022 will also profoundly deteriorate the competitiveness of fossil fuels and make solar and wind even more attractive.

With an unprecedented surge in European fossil gas prices for example, new fossil gas generation in Europe will increasingly become uneconomic over its lifetime, increasing the risk of stranded assets.

Investments in renewables continue to pay huge dividends in 2022, as highlighted by IRENA’s costs data.

In non-OECD countries, the 109GW of renewable energy additions in 2021 that cost less than the cheapest new fossil fuel-fired option will reduce costs by at least US$5.7 billion annually for the next 25-30 years.

Renewable energy, battery storage and micro-grid business, MPower, has successfully extended its banking facilities with St George Bank of roughly $5.1m for a further 12 months to July 15, 2023.

The company is set to make principal repayments of $50,000 per month with the facility terms otherwise unchanged.

MPR CEO Nathan Wise said the company welcomes the ongoing support from St George Bank as it continues to advance the establishment of a portfolio of renewable energy assets across Australia.

“The recently announced acquisition of the Lakeland Solar and Storage Project will considerably strengthen our revenue base and give us added flexibility to build our portfolio and fund ongoing operations,” he says.

“The development of our portfolio of 5MW renewable energy assets is an immediate priority and we are fielding a number of expressions of interest from potential partners to accelerate its roll-out.”