ASX oil companies float higher on Alaska drilling plans

Energy

Energy

Alaska-focused ASX oil companies are experiencing share price gains amid a depressed oil market as they step up moves to develop oil assets in the US state.

Shares in 88 Energy (ASX:88E) ticked 14 per cent higher Thursday, while Oil Search (ASX:OSH) is up 48 per cent this month.

88 Energy sparked some consolidation in the Alaskan oil fields when it acquired XCD Energy and its Peregrine project this year in a $8.9m takeover.

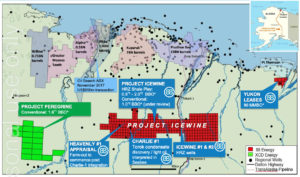

The transaction created an Alaskan-focused oil explorer with three highly prospective project areas; Project Icewine, Yukon leases, and Project Peregrine.

88 Energy has this week raised $10m from sophisticated and institutional investors from a share issue priced at 0.006c to fund development of its Peregrine wells.

Drilling at its Alaskan wells is due to start in early 2021 and the company recently drilled its Charlie-1 well within its Project Icewine which has a resource of 1.77bn barrels of oil equivalent.

“Completion of this placement positions the company strongly as preparations continue for the drilling of the Merlin-1 and Harrier-1 wells, which will test multiple conventional targets in Q1 2021,” managing director, Dave Wall, said.

Oil Search said in an update Thursday it had increased its contingent oil resource in the Alaskan North Slope region by 33 per cent to 968 million barrels of oil equivalent.

The increase reflected recent drilling success the company has had in Alaska’s North Slope since it acquired the assets two years ago.

Gross contingent oil resources for Oil Search’s Alaskan North Slope project are 93 per cent higher than the original 500 million barrels resource estimate at the time of the project’s acquisition.

“The latest increase in resources within our Alaskan portfolio continues to underpin the genuine world class nature of our giant Pikka oil field in Alaska,” managing director, Keiran Wulff, said.

The company is ready to progress to front-end engineering and development in early 2021 for a drill site at its Pikka project in Alaska.

Oil production at the Pikka project is set to begin in 2025.

“The 2019-2020 construction program in Alaska has well positioned us to progress this development quickly and efficiently as market conditions improve,” Wulff, said.

The project has a break-even cost of supply of less than $US40 per barrel, and a capital cost of less than $US3m.

Other oil companies operating in north Alaska include US-based company Armstrong Oil and Gas, Australian company Borealis Petroleum, and US company Conoco-Phillips.

Conoco-Phillips said Wednesday it plans to restart drilling next month at its Alaska oil projects after voters in the US state rejected a proposal to raise oil taxes.

“Since April when COVID-19 caused oil prices to drop and we were facing a potentially large increase in oil taxes, we have had no rigs running in the Prudhoe Bay, Kuparuk River and Colville River units,” Conoco-Phillips president, Joe Marushack, said.

“But it is now our plan, pending corporate budget approvals, to have three rigs total working in Kuparuk and Colville in the second half of 2021,” he added.

In May, Conoco-Phillips halved production at its Alaskan oil unit, which produced 218,000 barrels per day in the March quarter.

The decision was the company’s response to low oil prices resulting from global oil demand destruction caused by the impact of the COVID-19 pandemic, and a global supply glut.

“The actions Conoco-Phillips Alaska is taking with this production curtailment underscore the extraordinary challenges currently facing the oil and natural gas industry in Alaska and elsewhere,” said the company in an April statement.