American Patriot Oil is building a US takeover target for Aussie investors

Energy

American Patriot Oil and Gas has spent the last year quietly changing the way they do business as they prepare to build a significant oil and gas production business in the US which will be an attractive takeover target.

American Patriot (ASX:AOW) boss Australian ex-banker and analyst Alexis Clark, says the original model when they entered the US was “like a real estate play”: buy a good asset, get a local partner in to do the drilling, then flip it. The dramatic fall in oil prices impacted this strategy.

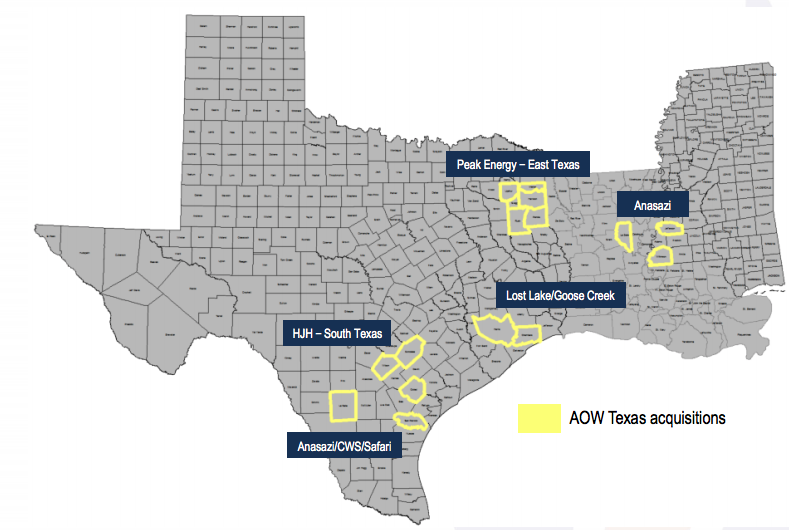

Now they’re rapidly collecting oil assets in Texas and doing the tidying up themselves.

The plan is to take advantage of slowly rising oil prices and distressed asset sales to build a portfolio of cash flow positive assets, that’ll ultimately attract the eye of a larger buyer.

“We’re building a conventional oil and gas production business focused on Texas and the Gulf coast. We’re focused on getting the production from 500 barrels per day (bpd) up over 2000 bpd by the end of next year so we’re attractive to a bigger player,” he told Stockhead.

“Our model now is to get bought.”

Building the new-look business

Mr Clark has been in the US for most of this year, “running around finding assets and getting money out of New York”.

He says they’ve rejected 10 deals that didn’t stack up, and closed on five.

The five assets cost $US5.3 million ($7 million) and they’ve increased company reserves by 2.3 million barrels of oil equivalent.

“We’re buying producing assets where we add a small amount of capex — doing workovers, adding fixed pumps, small scale stuff — and any drilling would be in-fill within the property as opposed to exploration,” Mr Clark said.

American Patriot says those reserves, producing 500 barrels of oil equivalent a day, are worth about $US20 million — or $US83 million in revenue if they’re selling at $US50 a barrel vs a current market cap of only $8 million.

West Texas Intermediate (WTI), the benchmark for US oil, is above $US55 for the first time since 2015. It closed last week at $US57.14 a barrel.

Last week Brent crude, a benchmark for European oil, closed at $US63.40, and the more bullish analysts are picking that measure to get as high as $US80 before 2018 is finished.

Six older assets in Montana, Colorado, Utah and Wyoming will be sold off.

Bidding up

American Patriot — named because one of the original backers was a fan of the New England football team — has already fielded two takeover offers, but both failed to pass muster.

The first was a speculative $US20 million ($28 million) cash bid in 2015 for the assets only, and the second in 2016 valued the whole company at $US35 million.

The board and shareholders reckoned they were worth more then, and the number they’re looking for now is well north of those figures.

Mr Clark says other US companies with similar production levels, around 2000 bpd, have market caps of $200 million plus.

“The assets we are building and folding into this company will have significantly greater value than our previous assets and they’ll be in production too. They won’t just be undeveloped acreage,” Mr Clark said.

The good days are back

Mr Clark says the US oil industry is picking up steam.

“There’s growing positivity in the sector. Some of the companies that have been on their knees have come back, but investors are being selective,” he said.

“They want to go into opportunities that have good growth potential, good balance sheets and have a strategy that is sustainable.”

Mr Clark thinks oil prices could get back up to the mid-$US60s, but he says they aren’t banking on that.

“That’s why targeting conventional assets, they’re protected on the downside because they’re cheaper to produce. If the oil price rises, we have cheap production and we’ll make even more money.”

Indeed, an International Energy Agency report last month suggested that the US oil production growth until 2025 will be the strongest ever seen by any country in history.

It estimates US crude oil will peak in the 2020s at about 17 million bpd.

American Patriot, through its asset-acquisitive strategy, is lining itself up take advantage of next oil boom.

This special report is brought to you by American Patriot Oil and Gas.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a Product Disclosure Statement (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.