A rash of pipeline deals could be about to free gas trapped in Queensland

Energy

Energy

Trapped gas in the Galilee basin in Queensland is being opened up, but via commercial deals and not political promises.

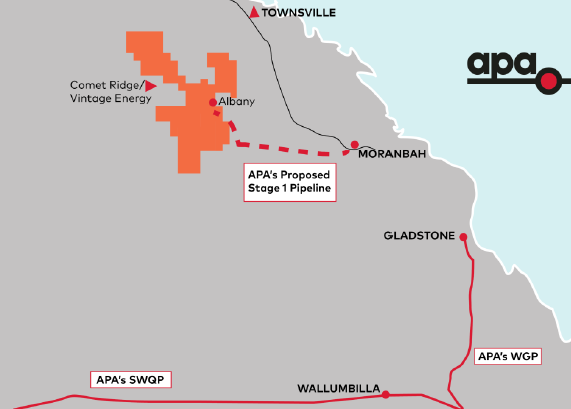

APA (ASX:APA), one of Australia’s biggest gas pipeline owners, has done a deal with Galilee Basin gas explorers Vintage Energy (ASX:VEN) and Comet Ridge (ASX:COI) to find a route from the basin to the coast.

The MoU is a renewal of a prior non-binding version signed in 2016 between Comet Ridge and APA, but this one specifies a potential pipeline route east to the Moranbah gas processing hub and a possible east coast link later on.

The Galilee is estimated to hold as much as 8000 PJ of gas resource, but no pipelines traverse that region yet. A resource is an estimate rather than a confirmed volume.

Comet Ridge’s Tor McCaul says they could have a small production project serving a nearby customer, likely one of the proposed coal mines in the area, running within 18 months, provided appraisal drilling of two wells in June delivers what they expect.

He says Comet and APA had been talking since late last year to revive the MoU, after the explorer brought Vintage Energy into their project and flowed gas from their Albany-1 well in June last year.

During its election campaign Labor promised $1.5bn for pipelines that could connect the Galilee and neighbouring Bowen Basins to the coast, and the unexplored Beetaloo Basin in the Northern Territory to Darwin.

As Stockhead outlined at the time that would open major markets up to 15 companies, some producing and some still in development phase.

But that promise is likely to prove unnecessary as both major pipeline operators already had plans afoot.

The other major pipeline company Jemena has future plans for a $4-5bn extension of its Northern Growth Strategy to cut across the top of the Galilee and Bowen basins.

It has a binding agreement with Galilee Energy (ASX:GLL) for a new, short pipeline to connect to Jemena’s QGP line, effectively a southern extension of its recently commissioned NEGI line from Tennant Creek to Mt Isa.

McCaul says $1.5bn is money less well spent than $50m appraising suitable areas in the Galilee. Once reserves are proved, customers will come and “pipeliners” will start looking hard at the area.

He said they’re talking to “all the same people” for offtake agreements as other gas producers in the area, from industrial gas users to owners of the proposed coal mines.

RBC Capital Markets’ energy analyst Ben Wilson said in a note the Liberal government’s re-election had put the Adani coal mine back in the picture, a project which is close to Comet’s licence area and which could be a buyer for their gas.

“Having two large, well funded pipeline companies proposing Galilee midstream solutions is a boon for Galilee Basin developers. Midstream development is frequently the biggest hurdle for developers of stranded gas resources,” Wilson says.

“We think the Galilee Basin has long been overlooked and consequently under-explored for conventional targets.”

Comet Ridge and Vintage are on track for Galilee drilling in mid to late June.