USDC parent company Circle aims to become a full-reserve digital bank; Tether reveals latest holdings

Coinhead

Coinhead

Amid US and global regulatory crackdowns on crypto, Circle, the company behind the stablecoin USDC, has revealed it has plans to become a fully regulated digital currency bank.

The US digital payments company filed its banking licence application with the SEC on Monday, and made its intentions clear that it plans to become a full-reserve national commercial bank in the US, with global reach.

USDC is a stablecoin pegged to the US dollar and and has the fastest-growing reserve among stablecoins – there is now more than US $27.9 billion of it circulating through exchanges and hardware wallets, up from US $4.7 billion in January of this year.

In comparison, Tether (USDT) has a $62.78 billion circulating supply and is the most widely used stablecoin (and digital asset) by trading volume, but USDC’s rate of adoption has steadily been gaining ground on it this year.

Circle co-founder and CEO Jeremy Allaire made the announcement in a blog post on Monday and said that his Goldman Sachs-backed firm plans to operate under the “supervision and risk management requirements” of the Federal Reserve, the US Treasury, the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation.

Allaire said: “We believe that full-reserve banking, built on digital currency technology, can lead to not just a radically more efficient, but also a safer, more resilient financial system.”

NEWS: Circle intends to become a full-reserve national commercial bank.https://t.co/QF3G2JkuT3

— Circle (@circlepay) August 9, 2021

Founded in 2013, Circle expanded from its original core business of electronic peer-to-peer payments to move into the crypto space in 2018, when it acquired Poloniex – one of the leading crypto exchanges at that time. Later that year, Circle unveiled its stablecoin creation USDC – a joint venture with crypto exchange giant Coinbase.

Circle is not associated with the original Poloniex owners’ US $10.4 billion settlement with the SEC for apparently operating as a security without a licence. That’s a whole other story.

The company’s full-reserve banking ambition can be perceived as a move in the right direction towards allaying persistent fears of instability behind digital stablecoins and their fractional-reserve models.

It also can’t hurt as a strategic move by Circle and USDC to stay in line with, or get ahead of, the US regulatory landscape for cryptocurrencies, which remain murky for the moment, to say the least.

“We are embarking on this journey alongside the efforts of the top US financial regulators,” said Allaire in his blog post.

“In the coming years, we anticipate that USDC will grow into hundreds of billions of dollars in circulation, continue to support trillions of dollars in low-friction, high-trust economic activity and become widely used in financial services and internet commerce applications,” he continued.

“Establishing national regulatory standards for dollar digital currencies is crucial to enabling the potential of digital currencies in the real economy, including standards for reserve management and composition.”

Tether has faced plenty of criticism over the past couple of years for a lack of transparency when it comes to audits, or at least assurance reports. That said, it has been making strides just lately, including this week, to try to prove what’s in its coffers.

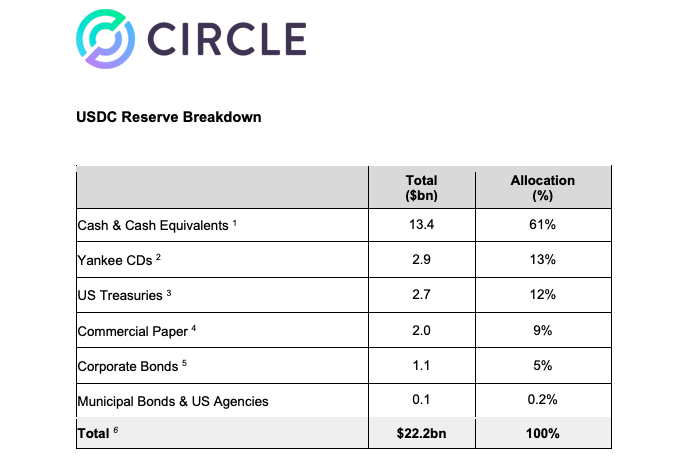

As for Circle and USDC, it doesn’t suffer from nearly as much perceived FUD from the general crypto community in that regard. And that’s because it has been more consistently upfront about its fractional reserve holdings since its inception and is a registered and regulated “Money Service Business” in the US.

“You can see from our latest attestation that USDC reserves are made up of cash, cash equivalents, and other high quality investment-grade assets,” said Allaire, “all issued within the United States rather than offshore, and consistent (of course) with the requirements of our regulators.”

Allaire did, however, address the concerns some crypto participants have about the potential for illiquid reserve holdings from stablecoins during times of particular market demand or stress.

“Market observers have correctly focused attention not just on reserve sufficiency and credit quality, but also on fundamental questions of liquidity, including liquidity in times of intense demand to redeem USDC,” said the Circle CEO.

“As we move towards national bank-level regulatory supervision we will begin to publish information about the fundamental liquidity of USDC and our liquidity coverage under Basel III [global banking industry standards for liquidity],” he continued.

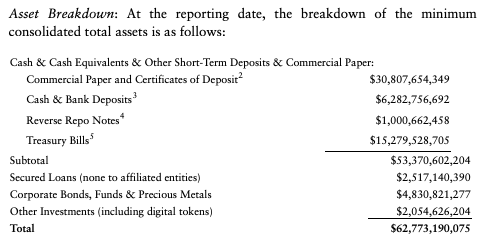

As for Tether, its latest report suggests it is backed by more than 50% cash equivalents, including 10% actual cash reserves and bank deposits.

The 10% figure, however, won’t win USDT too many plaudits from a safe-holdings point of view, but it is still a big increase from its May assurance report, which showed that just 3% of its reserves were pure, hard, cold cash.