‘Open for business’: UK government reveals bid to become a ‘global crypto hub’; plans Royal Mint NFT

'The name's Nakamoto… Satoshi Nakamoto.' (Getty Images)

The UK has crypto in its sights. And, for a change, it’s in a very encouraging way. The British government has laid out a detailed plan to make the country “a hospitable place” for the digital-asset class.

Late on Monday, the UK government announced several new initiatives as part of its plan to make the UK “a global cryptoasset technology hub”.

These include creating a regulatory framework for stablecoins, legislating for a “financial market infrastructure sandbox” to help firms innovate, holding a Financial Conduct Authority (FCA)-led “Cryptosprint” and even working with the Royal Mint on a non-fungible token (NFT).

Additionally, an official engagement group will be established with the remit to work more closely with the crypto industry.

The British chancellor of the exchequer, Rishi Sunak, said: “It’s my ambition to make the UK a global hub for cryptoasset technology, and the measures we’ve outlined today will help to ensure firms can invest, innovate, and scale up in this country.”

https://twitter.com/cobie/status/1510986715217154055

Sunak received various encouraging responses from crypto Twitter, including the tongue-in-cheek one above from the crypto-famous Brit “Cobie”, who co-hosts the UpOnly podcast.

Later, John Glen, the UK’s economic secretary to the Treasury, elaborated on the British government’s crypto plan at the Innovate Finance Global Summit:

“We want this country to be a global hub — the very best place in the world to start and scale crypto-companies,” he said, adding…

“If there is one message I want you to leave here today with, it is that the UK is… open for crypto businesses.

“If crypto technologies are going to be a big part of the future, then we – the UK – want to be in, and in on the ground floor. In fact, if we commit now… if we act now… we can lead the way.”

Whether John Glen is known to his mates as “Godspeed”, incidentally, we can’t confirm. But maybe he should be.

Further UK crypto outlook

Regarding what the future of crypto in the UK would look like, Economic Secretary “Godspeed” said, “No one knows for sure.” However, he noted that: “We’re on the cusp of something important” and “We have the opportunity to shape and lead it,” adding:

“We think that by making this country a hospitable place for crypto we can attract investment… generate swathes of new jobs… and create a wave of ground-breaking new products and services.”

Glen and his cohorts will also be:

• Examining the British tax system to see how it can be shaped to “encourage further development of the cryptoasset market in the UK”.

• Reviewing how DeFi loans – in which crypto holders lend out their digital assets out for a return – are treated for tax purposes.

• Conducting an FCA-led two-day “CryptoSprint” in May with industry participants, with the aim of better understanding key issues relating to crypto innovation.

• Establishing a Cryptoasset Engagement Group, convening key figures from the regulatory authorities and industry to advise the government key crypto-industry issues.

The Royal Mint’s NFT

And as for things officially British and non-fungible, Chancellor Sunak said he’s asked the Royal Mint to create one commemoration NFT to be issued by the summer (Q3) “as an emblem of the forward-looking approach the UK is determined to take”.

Chancellor @RishiSunak has asked @RoyalMintUK to create an NFT to be issued by the summer.

This decision shows the the forward-looking approach we are determined to take towards cryptoassets in the UK. pic.twitter.com/cd0tiailBK

— HM Treasury (@hmtreasury) April 4, 2022

There are scant further details at this stage about the nature of this NFT, what it’ll be built on (rumour is Ethereum) and whether it is actually just one, or a one-off collection.

A pixelated Punk Harry, perhaps? A Bored Charles or a Pudgy Andrew? Whatever form it takes, it might be one to bung onto OpenSea a day later and flip for a fraction of an ETH. (Not financial advice.)

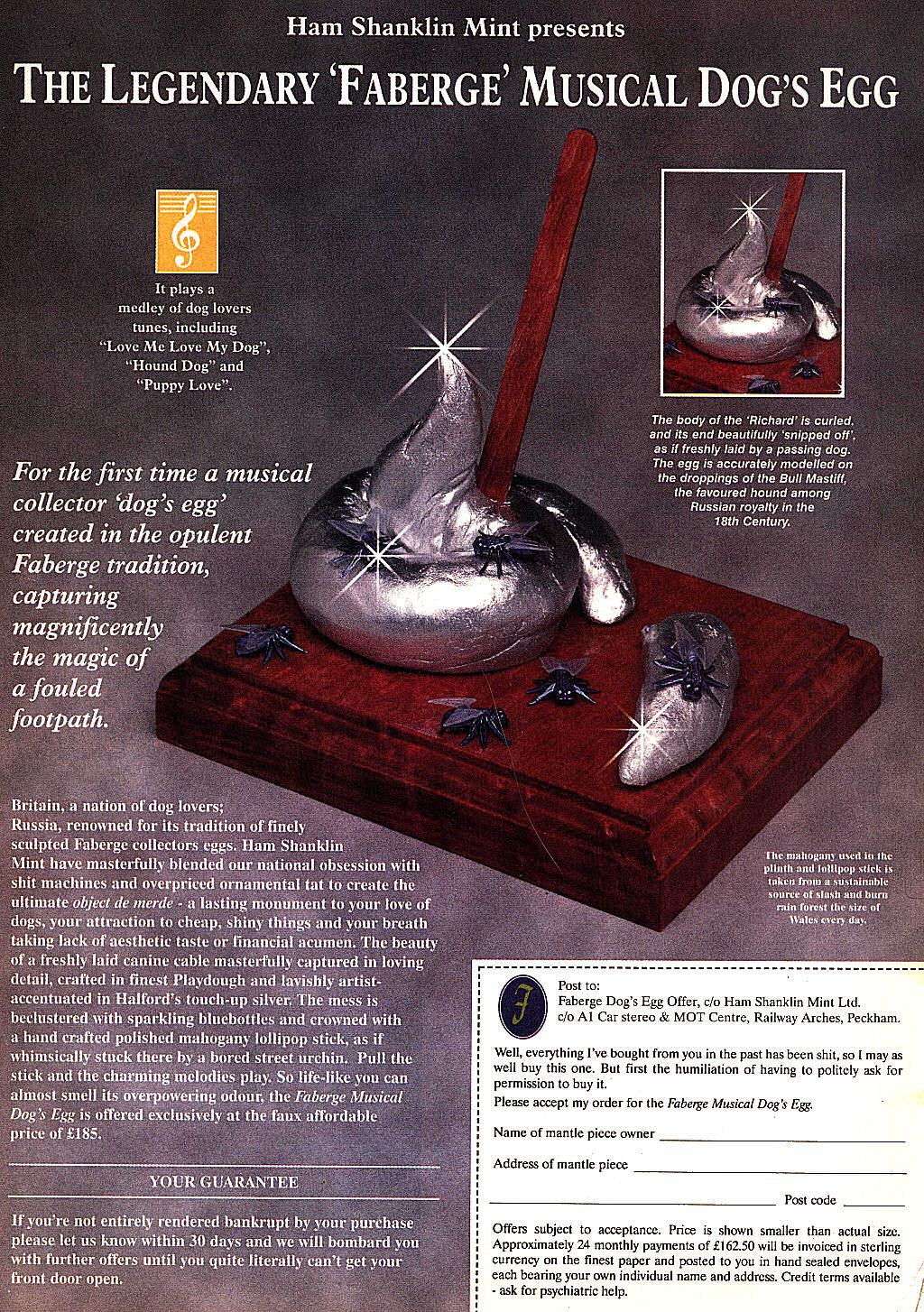

That said, this Coinhead writer will be more interested if another great British institution – Viz comic’s “Ham Shanklin Mint” – ever decides to NFT something…

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.