Okay, Boomers: older Aussies are buying crypto, says BTC Markets report

Coinhead

Crypto investing is on the rise among Australia’s “Baby Boomer” generation, according to a new report from leading Australian crypto exchange, BTC Markets.

The exchange’s Investor Study Report 2020-2021, released on September 15, indicates a significant spike in older clients using its platform over the past financial year.

Baby Boomers are classified as those born between 1946 and 1964, although younger generations tend to bandy about the derisive “Okay, Boomer” phrase to just about anyone with a few more years on them. (Including 1989 Canberra Raiders Grand Final-remembering Gen-Xers, like this reporter.)

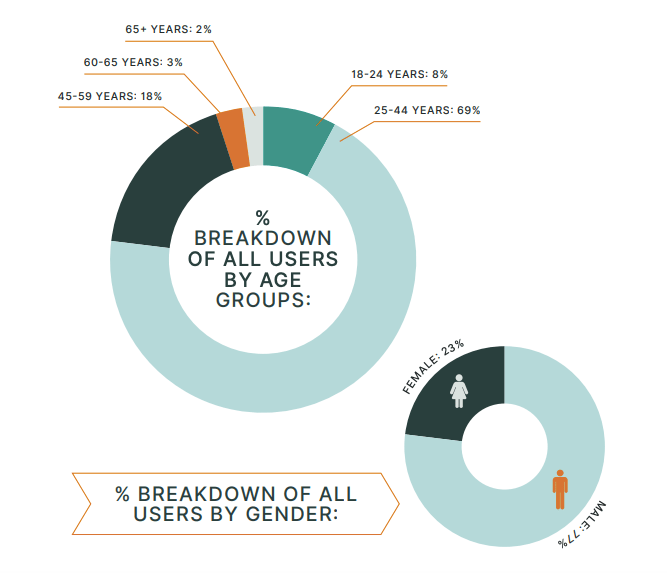

Actual Boomers, however (although not to be confused with the likes of Patty Mills), now make up five per cent of BTC Market’s 325,000 customer base, and that includes a 15 per cent increase in investors over the age of 65.

That total customer base, by the way, has now traded more than AUD $17.1 billion since the exchange opened in 2013.

The report indicates that there has been a shift in crypto-trading and investing demographics, with the Boomer growth stat the second-highest after the 18 to 24 age category.

“In the main, [crypto] is a retail market with a significant number of younger traders who trade frequently,” wrote BTC Markets CEO Caroline Bowler in the report’s foreword.

“However, we also note increased interest from older investors, with much deeper pockets. While they may not trade as frequently, they are trading in much larger amounts.”

• BTC Markets surveyed 1,800 Australian clients. The top motivation, for 70% of respondents, was to build wealth from investing in crypto.

• Other chief motivations include: early retirement (34% of those surveyed), portfolio diversification (28%), and FOMO, or fear of missing out (23%).

• Younger traders, aged 18 to 24, had far smaller initial deposits and portfolios, around a quarter of their older counterparts.

• More than a quarter of the exchange’s customers are investors over the age of 44 with more money to invest than the younger age categories.

• The over-65 demographic had the highest average initial deposit (US$3,200) and an average crypto portfolio size of US$3,700.

• Female investors are also on the rise. Platform user growth by women accelerated rapidly in 2020-2021, growing by 172%, compared to 79.5% growth for men.

• The average portfolio size on the platform for women in 2020-2021 was US$2,650, compared to US$3,049 for men.

• However, the average initial deposit for female investors was higher (US$2,381) compared with the figure for males (US$2,060).

• The number of SMSFs (self-managed superannuation funds) using the platform rose by 95 per cent in the 2020-2021 financial year.

• And those SMSF average portfolio sizes on the platform increased substantially, rising by 145 per cent.

.@CaroBowler, head of the Australia's largest digital asset exchange BTC Markets, discusses the adoption of regulatory oversight.

She speaks with @HaidiLun and @SheryAhnNews on some stereotype-breaking toplines from inaugural 'BTC Markets Investor Report' https://t.co/zUv9uXyy4z pic.twitter.com/V22Vyecaq0

— Bloomberg Crypto (@crypto) September 15, 2021

The report also makes note of increasing regulatory oversight globally and in Australia – something CEO Bowler says the exchange “welcomes wholeheartedly”.

Speaking to Bloomberg Crypto on Wednesday, Bowler said that the the type of crypto regulatory rhetoric coming from the European Union, which is apparently looking to “regulate innovation in”, is something that the “industry can cling on to”.

That said, Bowler did point out, while responding to a question about the US Securities and Exchange Commission’s latest actions, that there is “a concern that regulation can become overbearing” and “squish innovation”.

“Here in Australia, we take heart from the recent [Australian] Senate Select Committee and the research they’re doing,” she continued. “Our hope is that we would see that kind of progressive framework of regulation for crypto locally.”