Mooners and Shakers: Twitter board approves Elon Musk takeover; DOGE and other cryptos bounce

Coinhead

Coinhead

Mooners and Shakers is sponsored by Dacxi, the world’s first purpose-built Crypto Wealth platform.

Crypto is having a better day in general, and Twitter knows it. Speaking of which, DOGE fan Elon Musk looks set to take over the social-media giant at last.

The closest thing the world has to a real-life Tony Stark (if that’s what the world wanted) has been hogging the headlines lately, and so it continues.

Elon Musk appears to finally be close to completing his US$44 billion takeover of Twitter, with the company’s board of directors today unanimously approving his buyout offer, according to a Securities and Exchange Commission filing.

The regulatory filing comes a few weeks after the Tesla and SpaceX CEO put the deal on hold pending a review of Twitter’s policies regarding bots and spam accounts. And it comes just days after he held a virtual meeting with all Twitter employees.

Bullish af https://t.co/bifZ6NgceG

— George Harrap ☀️ CFA PHD DR GMI HFSP (@George_harrap) June 21, 2022

Is it bullish for crypto, then? Maybe. The crypto market has been known to react well to any perceived Elon Musk win, although the industry has also seen major mood-swing dumps in the past based on the whims of the billionaire’s Tweet-happy thumbs.

But just this week, Musk has confirmed he’s buying the crypto dip amid the recent carnage. Specifically, the Dogecoin (DOGE) dip (which is actually up about 13% today).

He’s clearly not concerned about the US$258 billion lawsuit some chancer filed against him last week in a US federal court, which relates to a supposed Dogecoin pyramid scheme.

I will keep supporting Dogecoin

— Elon Musk (@elonmusk) June 19, 2022

"I have never said that people should invest in crypto," says Tesla CEO Elon Musk. He reiterated his support for Dogecoin and spoke about his crypto investments #QatarEconomicForum https://t.co/K56VQzGV5m pic.twitter.com/0qleFBaQ0N

— Bloomberg TV (@BloombergTV) June 21, 2022

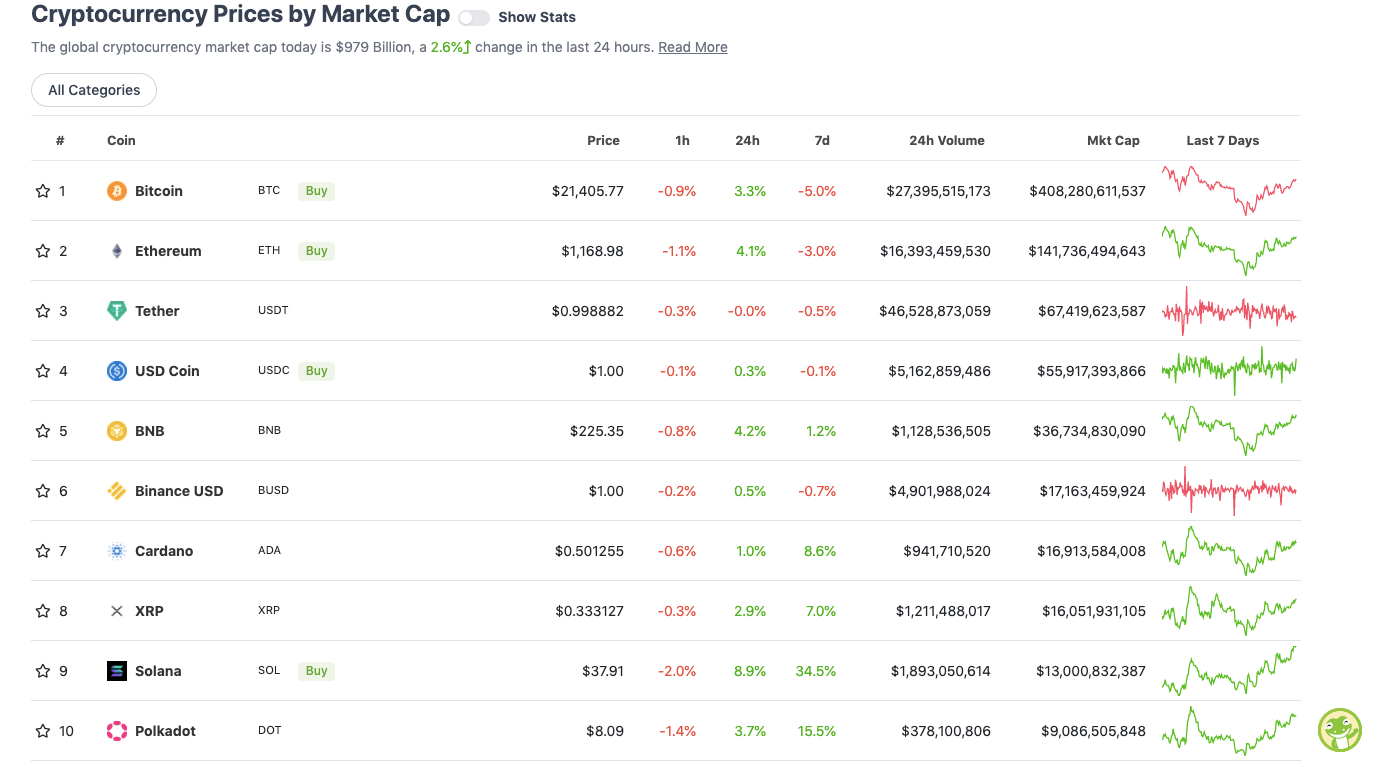

With the overall crypto market cap at roughly US$979 billion, up 2.6% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Some decent green on the daily timeframe there, with Solana (SOL) leading the way (+8.9%). And that’s despite some over-leveraging, potential DeFi-defying drama going on at Solend – a major lending platform built on the Solana blockchain.

Meanwhile, Ethereum (ETH) co-founder and talisman Vitalik Buterin has taken a swipe at the famed Bitcoin Stock to Flow (S2F) model, which was created by the pseudonymous investor and analyst PlanB in March 2019.

After a crash aome people are looking for scapegoats for their failed projects or wrong investment decisions. Not only newbies but als "leaders" fall victim to blaming others and playing the victim. Remember those who blame others and those who stand strong after a crash. https://t.co/4nJdHq84pm

— PlanB (@100trillionUSD) June 21, 2022

In the past, the S2F model had maintained course pretty accurately, but it’s recently gained a lot of critics for its more recent significant deviations.

PlanB has been pretty open about the model’s limitations, which accounts for the built-in, four-yearly supply (“stock”) reduction of Bitcoin, and the “flow” – the number of new coins mined each year. It doesn’t, of course, factor in changing market sentiment due to black-swan events and macroeconomic factors.

Correct, the model only accounts for scarcity/s2f-ratio, that is the only model input. All the rest, demand, macro, crypto, covid, war etc, causes deviation. The model is VERY rough. Also, current extreme macro backdrop causes all metrics (rsi, 200wma etc) to show extreme values.

— PlanB (@100trillionUSD) June 20, 2022

Sweeping a market-cap range of about US$8.9 billion to about US$405 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Waves (WAVES), (market cap: US$682 million) +43%

• Celsius (CEL), (mc: US$495 million) +33%

• TitanSwap (TITAN), (mc: US$462 million) +32%

• Shiba Inu (SHIB), (mc: US$6.15 billion) +28%

• Zilliqa (ZIL), (mc: US$606 million) 23%

• Aave (AAVE), (mc: US$1.01 billion) 21%

• Uniswap (UNI), (mc: US$2.27 billion) 19%

• Dogecoin (DOGE), (mc: US$8.9 billion) 13%

There are a few interesting pumps here today, including the Waves layer 1 blockchain, which is now up 17% over the past month, and doggy meme coin Shiba Inu (SHIB) which, it seems, is right into burning off its tokens to reduce supply…

2.2 Billion SHIB Destroyed by This Amazon Burner Since November at Price 50% Higher Than Now

The tweet says that over the past seven months since November a total amount of 2,257,736,799 Shiba Inu tokens (of $55,000) has been removed from circulation and sent to dead-end wallets pic.twitter.com/CBg6FOa5Tj

— Shib 2022 (@SuhelMemon4) June 21, 2022

… although it might well be pumping on the back of Dogecoin’s Musk-induced exuberance, too.

But wait, what’s going on with the Celsius (CEL) token pump? The thing’s actually up more than 325% over the past seven days. It appears to be a mass, possibly coordinated short-squeeze event…

1/ The Case for the #CELShortSqueeze — $GME 2.0?

Dream setup for a short squeeze. Approximately 87% of $CEL token supply is locked on @celsiusnetwork (withdrawals are frozen) & $CEL token is being massively shorted on FTX. pic.twitter.com/pN4YLR5xnm

— Jade (@cryptoismyjam) June 21, 2022

$CEL this actually might become the trade of the year. Shorters got REKT big time…🤣

You can't make this shit up, that's why I love #Crypto 👏#Celsius #CelShortSqueeze pic.twitter.com/A6OQwoQMhS

— DoopieCash® (@DoopieCash) June 21, 2022

DAILY SLUMPERS

• BitDAO (BIT), (market cap: US$483 million) -2%

• ApeCoin (APE), (mc: US$1.38 billion) -1%

• FLEX Coin (FLEX), (mc: US$462 million) -1%

• Helium (HNT), (mc: US$1.15 billion) -1%

• LEO Token (LEO), (mc: US$5 billion) -1%

To finish, a selection of randomness that stuck with us on our daily journey through the Crypto and financial Twitterverse…

The same people who said inflation is transitory are now saying a recession is unlikely.

— Patrick Hansen (@paddi_hansen) June 21, 2022

Hmm, while various major world banks and analysts seem split on the topic of US recession, it appears Joe Biden and his cronies, including US Treasury Secretary Janet Yellen, are keen to get start putting their pre-election positive narratives in place…

Yellen: There is nothing to suggest the US will face a recession pic.twitter.com/t1C4hfmzaP

— Sven Henrich (@NorthmanTrader) June 13, 2022

Moving on, though…

The #crypto market the last week#Bitcoin is under 20k sell now before it goes to zero! #bitcoin is back over 20k buy now before it goes to 100k!

— Lark Davis (@TheCryptoLark) June 21, 2022

And another from Lark, indicating Google searches for the word “Bitcoin” are up. That’s cool… although searches for “Bitcoin dead” are also spiking pretty hard, too!

Google trends showing a huge spike in searches for #bitcoin.

Highest in a year! pic.twitter.com/2pgSC2ccj8

— Lark Davis (@TheCryptoLark) June 21, 2022

Ethereum still creating blocks.

AAVE still facilitating loans.

Uniswap still swapping coins.

MakerDAO still minting DAI.

Curve blessing us w/ liquidity.DeFi 1.0 has passed yet another stress test, and remains based 😎

— Kris Kay | 🍩 DeFi Donut (@thekriskay) June 20, 2022

nft haters in nyc pic.twitter.com/C9iTkDZkDn

— Loopify 🧙♂️ (@Loopifyyy) June 20, 2022

Finally, Illuvium‘s “Overworld” game element appears to be coming along nicely…

Finally a little glimpse at the Overworld we are building! Obviously there are a few things missing and very much WIP. But, we are very well on our way! @illuviumio #NFTgaming#nft https://t.co/mdtwzQaVK5

— Rogier van de Beek ♊️ (@Rogiervdbeek) June 21, 2022