Mooners and Shakers: NEAR still stirring; Bitcoin does some Christmas chopping

Coinhead

Coinhead

While crypto market leaders Bitcoin (BTC) and Ethereum (ETH) appear to have settled in sideways with an eggnog or two, it’s looking like a Christmas to remember for Near Protocol (NEAR).

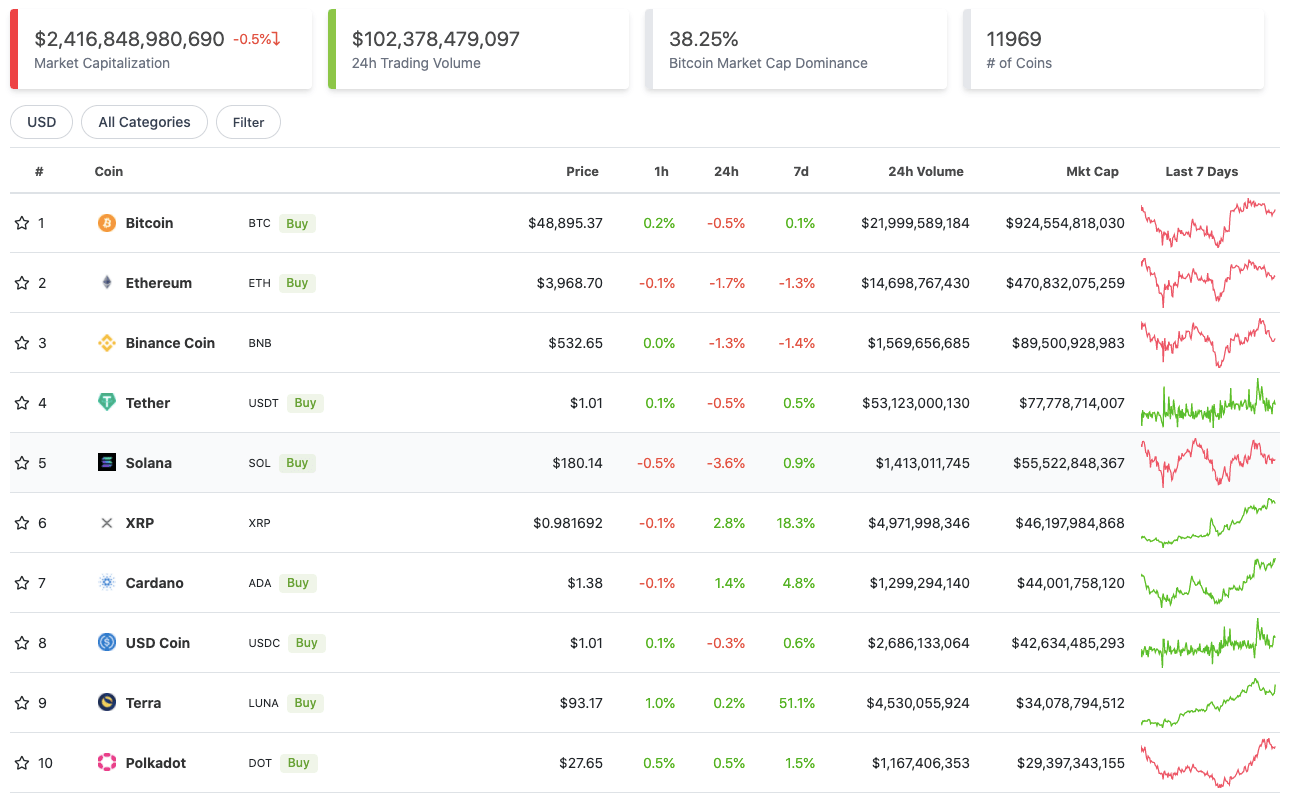

The entire cryptocurrency market cap, meanwhile, has pretty much put its feet up since this time yesterday, down 0.1% and sitting around US$2.41 trillion.

There’s still a good chance for a last-minute Santa rally, or a lump of crypto coal for that matter. But a quiet Christmas period might suit most market participants just fine after another hectic year of fretting over charts and green and red candles.

Who knows what we’ll wake up to on “Cryptmas” morning, though.

Here’s the state of play in the top 10 by market cap at press time, according to CoinGecko data.

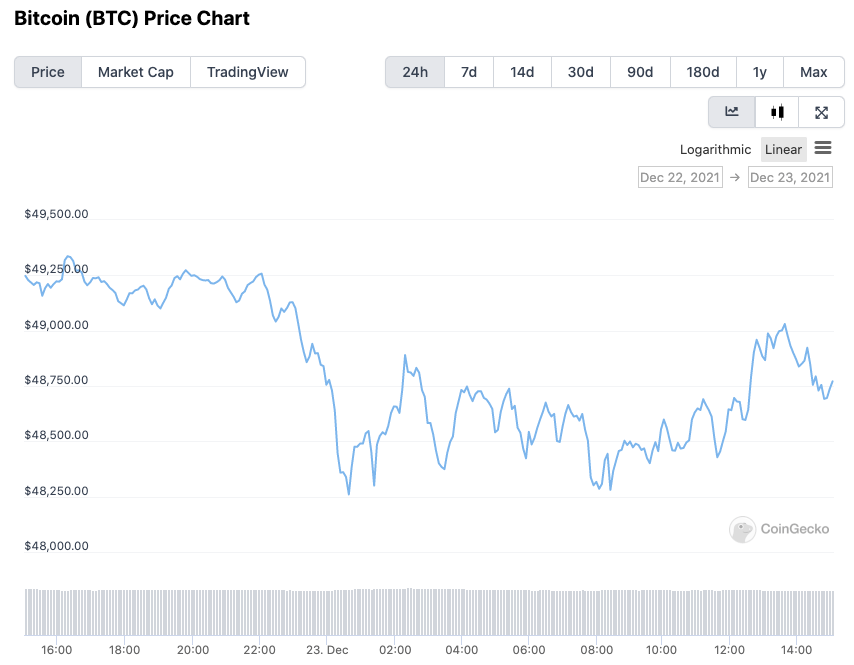

For the moment, Bitcoin has found a healthy level of support around the US$48.3k mark. It’s chopping about just above that at press time, but for further reference, its next potential supportive zone below appears to be about US$47.6k.

With not too much else of significance happening in the top 10 just at the moment, we’ll look further afield…

Sweeping a market-cap range of about US$29 billion to US$1.2 billion in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Near Protocol (NEAR), (market cap: US$8.1b) +20%

• Convex Finance (CVX), (mc: US$1.78b) +17%

• Sushi (SUSHI), (mc: US$1.3b) +15%

• Aave (AAVE), (mc: US$3.3b) +14%

• Uniswap (UNI), (mc: US$7.85b) +11%

Like yesterday, Near Protocol is still the biggest gainer in the top 100 at press time today, and this is on the back of the launch of its Simple Nightshade sharding solution and a partnership with DePocket Finance.

Some prominent advertising for NEAR (and the Aurora bridge + EVM scaling solution) can’t hurt, either.

NEAR @NEARProtocol rides inside, Aurora @auroraisnear is on the second layer pic.twitter.com/bw9cI8XI1e

— zavodil.near (@zavodil_ru) December 22, 2021

Meanwhile, top decentralised crypto-industry developer Daniele Sestagalli has whacked on the Santa suit for the recently embattled Sushi DEX/AMM DeFi system, reiterating his plans to keep the DeFi project thriving, with his help.

Sushi had been experiencing in-fighting woes over the past month or so, resulting in the departure of some of its own top developer talent.

If you want to know what’s my agenda for @SushiSwap than I can tell you this: I cannot accept community owned DeFi project to fail, we need them to thrive and challenge the status quo if not we all failed. $SUSHI must dominate and prove to be the best DEX and team in the world.

— Daniele never asks to DM (@danielesesta) December 23, 2021

DAILY SLUMPERS

There’s not much of note bleeding too heavily in the top 100 right now, nevertheless, here are the five-worst performers at the time of writing.

• Helium (HNT), (market cap: US$3.9b) -7.5%

• Harmony (ONE), (mc: US$2.85b) -6%

• Olympus (OHM), (mc: US$2.8b) -5.3%

• OKB (OKB), (mc: US$8.2b) -5%

• IOTA (MIOTA), (mc: US$3.5b) -4%

Moving below the crypto unicorns (in some cases well below), here’s a selection catching our eye…

DAILY PUMPERS

• Spartan Protocol Token (SPARTA), (market cap: US$43.4m) +74%

• FreeRossDAO (YAM), (mc: US$38m) +48%

• Rome (ROME), (mc: US$65.5m) +31%

• Iost (IOST), (mc: US$847m) +18%

• Rook (ROOK), (mc: US$156m) +17%

DAILY SLUMPERS

• Spartacus (SPA), (market cap: US$24m) -40%

• Raiden (RDN), (mc: US$13.5m) -16%

• Unibright (UBT), (mc: US$204m) -12%

Right then, that’s about it for this column until after Christmas, but we’ll leave you with this, from the lawyer fighting the Ripple Labs/XRP cause in the all-important legal stoush with the US Securities and Exchange Commission.

So, when the money starts to flow from Bitcoin to XRP THAT is what is called "Alt-Coin" season?

And we'll see the XRP to BTC ratio begin to go up?

Asking for a friend… 🙂 pic.twitter.com/O56VSHVAEq

— Jeremy Hogan (@attorneyjeremy1) December 23, 2021

Maybe, just maybe, a Ripple Labs win in the new year will prove to be some sort of moon-mission catalyst – not only for XRP but the broader crypto market.

Bit of Christmas hopium, there? Probably. Pass the eggnog.