Mooners and Shakers: Greed grips crypto market as key sentiment tracker spikes; XRP pumps 24%

Coinhead

Coinhead

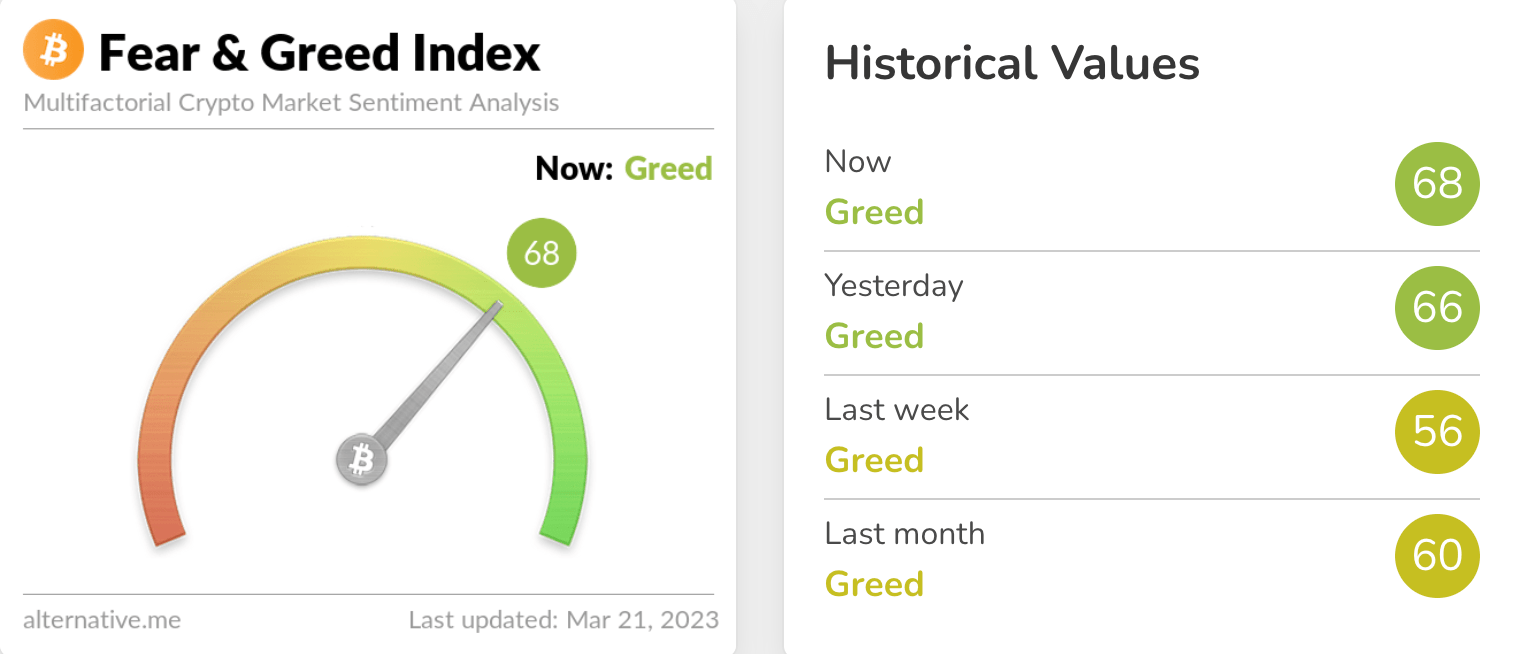

Buckle up, because the end of this week shapes as pivotal. Reflecting that, the Crypto Fear & Greed Index yesterday hit its highest level since mid November 2021 – around Bitcoin’s all-time high. Also… XRP – what the?

We’ll look at possible reasons for why the latter has pumped 24% over the past 24 hours, further below.

But first, let’s examine why the crypto dial flipped to “Greed” just lately. It all has a helluva lot to do with the US banking woes. Probably.

Which in turn, ties in with the Bitcoin digital gold safe-haven narrative along with the possibility the US Fed will, on Thursday morning AEDT, pause or even cut its interest-rate hiking while it continues to inject a stupendous amount of freshly minted USD into the system to help bail out said banks.

(Or will the Fed opt for Quantitative Confusion and keep hiking while bank bailing?)

The Fed trying to fight inflation by printing more money

— Bitcoin Magazine (@BitcoinMagazine) March 19, 2023

There are also lingering concerns around the fact the USDC stablecoin depegged recently related to the American government’s supposed “Choke Point 2.0” plan to debank the US crypto industry. This may have caused a rush into certain other top cryptos.

Whether those US gov efforts continue remains to be seen, but one thing is certain for crypto true believers, Bitcoin suddenly looks even more attractive as a store of value when compared with stablecoins pegged to a rapidly devaluing US dollar.

Here, enjoy this stirring montage from crypto analyst Kevin Svenson, set to a Mötley Crüe classic…

Quick News Update 📰#Bitcoin 🍿📽️ pic.twitter.com/pVSEspklgr

— Kevin Svenson (@KevinSvenson_) March 20, 2023

Plenty of crypto heads right now, seemingly.

That level of 68 (above) for the crypto market’s leading sentiment tracker (which, by the way is based on a mix of market momentum, volatility, social media, surveys, trends and more) is the highest level the index has seen since November 16, 2021.

On that day, Bitcoin (BTC) was fidgeting around US$64,000, a few days after its $69k (“dude”) all-time high of November 10.

The market may well be being spurred on by the now-famous/infamous bet by former Coinbase CTO Balaji Srinivasan, who has laid down US$2 million in two separate wagers on his belief BTC will hit… (Dr Evil close-up) $1 MILLION dollars by June 17 due to rapid hyperinflation and the devaluation of the USD.

Meanwhile, here’s Bloomberg Senior Commodity Strategist Mike McGlone tweeting about the possibility of a crypto supercycle, pointing to Bitcoin vastly outperforming gold.

One of Bitcoin’s key advantages over gold, McGlone notes, is its low and rising adoption plus diminishing supply.

Looking for a super cycle? Bitcoin Outperforms #Commodities With Declining Risk – #Bitcoin beating #gold, the top-performing old-guard commodity in 2023 to March 20, by almost 10x may be indicative of a super cycle happening in the #crypto. pic.twitter.com/DGdAL3PW3C

— Mike McGlone (@mikemcglone11) March 21, 2023

McGlone also said earlier this week that he’d be shocked if the US/world does not have a recession, noting:

“Look what gold and bonds and Bitcoin are doing. Those to me are going to be some of the things that people are going to be looking to buy in dips as we tilt in a recession.”

Another prominent analyst and former Wall Street hedge fund manager with Goldman Sachs, Raoul Pal has updated his outlook on BTC, calling an 80% increase within the next year.

That’d put it around US$50k possibly before the end of the year if his prediction proves correct.

One thing, though… the longer the Fear & Greed Index keeps pushing to the right, best just keep in the back of the mind the old Warren Buffett maxim, eh? (“Be fearful when others are greedy, and greedy when others are fearful”.)

Complete financial collapse = Greed pic.twitter.com/CTwj5qu0Bh

— Coin Bureau (@coinbureau) March 21, 2023

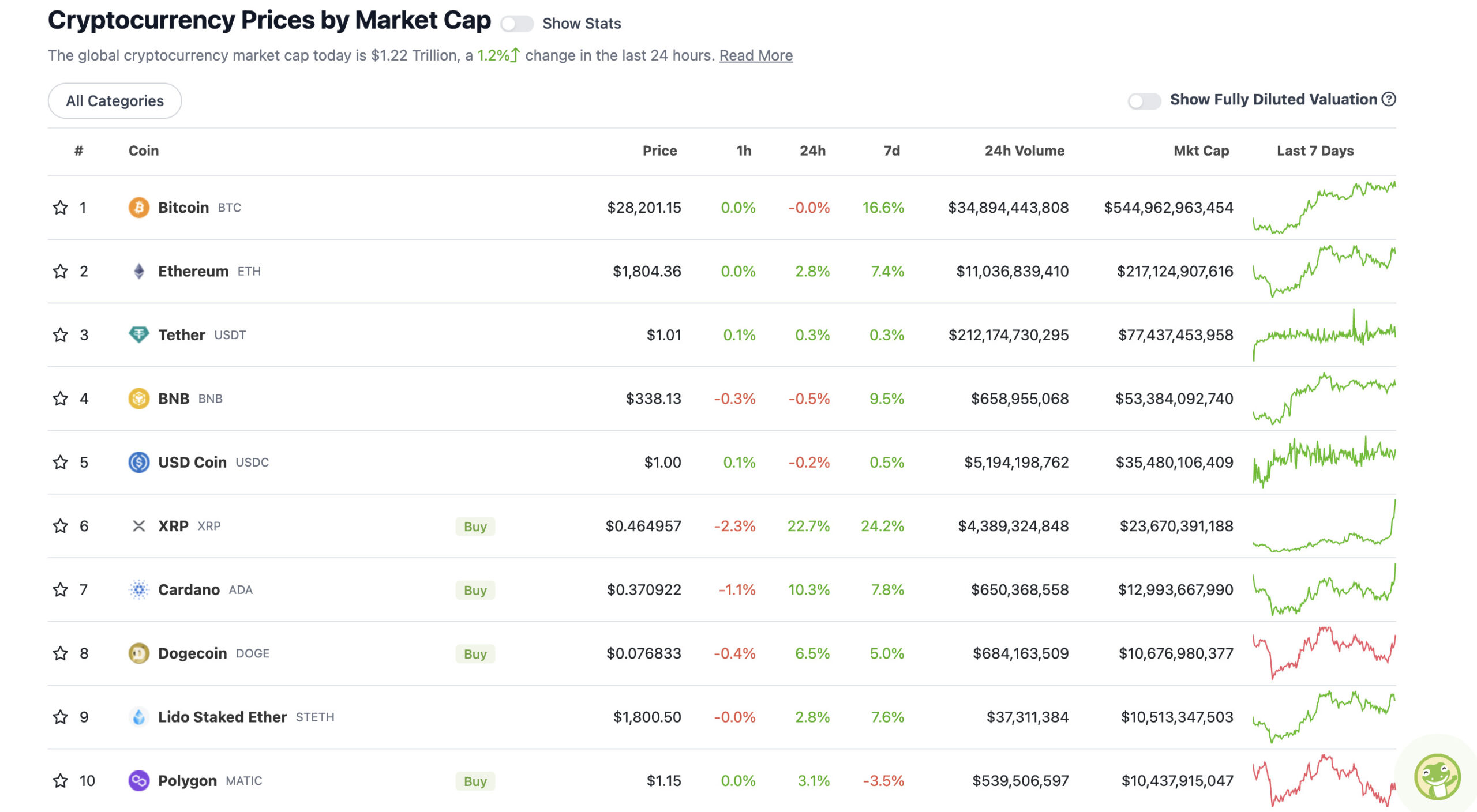

With the overall crypto market cap at US$1.22 trillion, up about 1.2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Yesterday, the altcoins appeared to all be flowing into Bitcoin, the long-term dominant crypto. Today, alts are getting some love as the crypto greed/hopium spreads ahead of the Fed rates announcement – which, incidentally, will hit around 5am on Thursday (AEDT).

#BTC is experiencing some initial consolidation after a tremendous rally and already Altcoins are benefiting from Money Flow and enjoying some gains today$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) March 21, 2023

$BTC H4

I previously stated exhaustion, however, if we continue to see consolidation it will reset those bearish indications and we will continue uptrend.$DXY is failing it’s IHS on 1D which makes me more bullish.$SPX has plenty of room to pump.#bitcoin #cryptocurrency pic.twitter.com/Qz1rp2rEIc

— Roman (@Roman_Trading) March 21, 2023

It’s a green scene across the board in the majors, then but we’d better talk about XRP and its 22.7% rise (24% on the weekly timeframe). What’s going on there?!

Here’s what’s going on there. It’s regarding optimistic sentiment swirling around a positive outcome in the Ripple Labs vs SEC case – the biggest legal event since Jimmy McGill humiliated his sanctimonious elder brother in Better Call Saul.

#xrp pumping! I wonder if we are getting close to a resolution on the SEC case?

— Lark Davis (@TheCryptoLark) March 21, 2023

Recap: In December 2020, the SEC claimed Ripple Labs, along with CEO Brad Garlinghouse and Christian Larsen, the company’s cofounder, had raised more than US$1.3 billion by selling the XRP tokens as an unregistered securities offering to investors.

Ripple Labs said… yeahnah, that’s not right, and more than two years and a stack of legal fees later, it seems like the case might be about to find a conclusion.

John Deaton, a pro-Ripple/XRP lawyer, has predicted that the public will get to see an important piece of evidence in the case – the so-called Hinman emails and speech drafts. These reportedly contain internal SEC deliberations about the former SEC official William Hinman’s stance in 2018 that Bitcoin and Ethereum are not securities.

The documents could show certain biases the SEC might have with regards to picking winners and losers in its attempt to classify crypto assets. The SEC has repeatedly tried to keep the documents out of the courtroom.

Regarding the Hinman emails and speech drafts: the SEC has requested for them to remain sealed, even after Judge Torres’ ruling on summary judgment. I believe the emails and speech drafts will be made public at some point, regardless of Judge Torres’ decision on whether to seal. https://t.co/BcYTuh9QrW

— John E Deaton (@JohnEDeaton1) March 19, 2023

Another reason for the XRP surge is very much due to the fact whales (large holders) have been buying up the asset just lately. This is based on data from on-chain analytics firm Santiment, as pointed out by crypto analyst Ali Martinez, below.

Over the past month, ~50 whales holding 10 million to 100 million $XRP have joined the #Ripple network.

These large investors have purchased around 420 million #XRP, worth $155.4 million, shows data from @santimentfeed. pic.twitter.com/6L3gBwbdiW

— Ali (@ali_charts) March 19, 2023

Sweeping a market-cap range of about US$8.69 billion to about US$424 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS

• Stellar (XLM), (market cap: US$2.56 billion) +10%

• Algorand (ALGO), (mc: US$1.6 billion) +7%

• Ethereum Classic (ETC), (mc: US$2.92 billion) +5%

• Fantom (FTM), (mc: US$1.35 billion) +5%

• Optimism (OP), (mc: US$828 million) +5%

SLUMPERS

• Synthetix Network (SNX), (market cap: US$898 million) -6%

• MultiverX (EGLD), (mc: US$1.11 billion) -6%

• Stacks (STX), (mc: US$1.57 billion) -4%

• Render (RNDR), (mc: US$485 million) -1%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Even if we consolidate for a bit, $BTC convincingly cleared and closed back above the 200W SMA (yellow) — having that as support again would be beautiful. pic.twitter.com/um2z25XpDi

— Chris Burniske (@cburniske) March 20, 2023

Parabolic Diagram = $60K?! pic.twitter.com/xoaNsd8wEE

— Kevin Svenson (@KevinSvenson_) March 19, 2023

🎯 Custodia Bank CEO @CaitlinLong_ does not mince words on the Signature Bank situation.

“Scandal. Outright scandal.”

🔊 Listen: https://t.co/vD0Rw1kZam pic.twitter.com/WbQNMptJrl

— Laura Shin (@laurashin) March 21, 2023

#Bitcoin pic.twitter.com/sqKvbF2eaF

— naiive (@naiivememe) March 21, 2023